Bitcoin Hits 52 Quintillion Hashes Per Second: So Why The Slump?

Markets are falling, and ETFs are going nowhere, but the Bitcoin network reached a new record: 52 quintillion hashes per second.

Markets are falling, and ETFs are going nowhere fast, but that hasn’t stopped the Bitcoin network from growing. Earlier this week, the global network reached a new record: 52 quintillion hashes per second.

It’s hard to imagine a number with eighteen zeros after it. That’s equivalent to nearly four million of Bitmain’s latest S9i miners working overtime. For those who love zeroes, it really is 52,000,000,000,000,000,000.

In other words, solving a Bitcoin block in one attempt would be like being asked to find a specific grain of sand, somewhere in the world, and guessing correctly on the first try… then sitting down to play poker with Annie Duke and catching four aces on your first hand.

It’s especially impressive considering how recently Bitcoin broke the ceiling of one quintillion hashes per second— only two years ago.

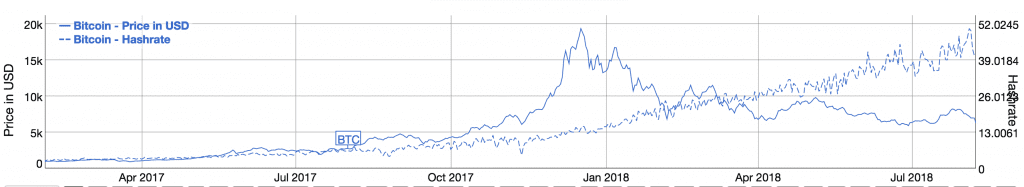

But that raises an interesting question: if mining is increasing why is the price collapsing? It doesn’t take an economist to know that mining should decrease as prices fall.

In a perfectly frictionless market, people would jump into mining when the game was profitable, and leave when profits started to dry up. For Bitcoin that’s only half true–the miners come in, but they don’t go home.

If you were expecting price to correlate with hashrate, you’re not alone. Fundstrat’s Tom Lee entertained the notion of a $25,000 Bitcoin this year based on the historical tendency for prices to settle at around 2.5 times the cost of mining. With four months left in the year, Lee’s prediction is approaching McAfee-level improbability.

Easily In, But Not Easily Out

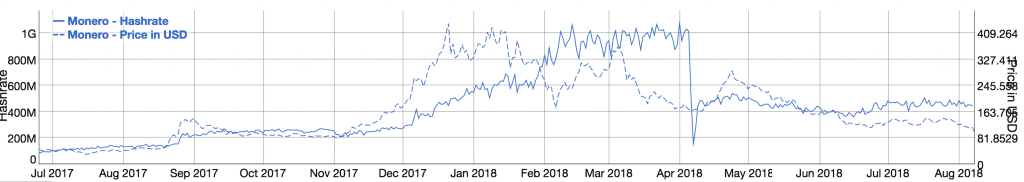

Let’s start by taking a look at a smaller currency. Monero’s developers explicitly tailored their consensus algorithm to prevent industrial-level mining, and launched an emergency fork against rumors of a Bitmain ASIC earlier this year. The relationship between hashrate and price is exactly what you’d expect:

The total hash rate (solid line) increases after prices rise, indicating that new miners are entering the network to take advantage of richer pickings. When profits fall, hashrate follows.

That’s because Monero mining is a fairly open field: anyone with a video card can enter the game and expect to make something close to break-even. When prices fall, you can easily switch your GPU to mine more profitable cryptocurrencies. You could even use it to play video games.

That’s no longer true for Bitcoin mining, which has been outside the reach of home computers since 2013. The only way to break even in Bitcoin is with an ASIC, for which prices start at four digits. Once you buy one, the only alternative use for a Bitcoin miner is as a very expensive paperweight.

That’s why hashrate seems to be a one-way street. Once you’re in mining country, there’s no going back. Everyone wanted a miner when Bitcoins were selling for $20,000. When prices collapsed to $6,000—sorry, no backsies.

But the sunk costs don’t stop sinking there, because ASIC production is only economical at scale. For manufacturers like Bitmain, the most expensive part of the process is Non-recurring Engineering–a technical way of saying “designing a new chip.” With NRE costs starting in the hundreds of thousands, manufacturers have a strong incentive to keep printing and selling chips even after the market slows down.

That trend probably won’t go on forever, especially if prices continue to settle. Cheap electricity will get less cheap, and mining difficulty will increase far beyond 52 quintillion hashes per second, until it’s no longer lucrative to buy ASICs—or to make them.

On the other hand, if prices recover, don’t go looking for miners in your local garage sale.

The author is invested in Bitcoin and Monero.

Earn with Nexo

Earn with Nexo