Bitcoin’s Growing Hodl Culture

'Holding on for dear life' through the highs and lows.

Data shows people are buying and holding Bitcoin in ever larger numbers, suggesting that hodl culture prevails.

Bitcoin’s Hodl Culture

Bitcoin has its detractors in terms of its scaleability as a currency that can be used in daily transactions. The average block time for Bitcoin transactions over 2019 was just under 10 minutes, meaning that a transaction would take 20 minutes to over an hour to confirm. Most cryptocurrencies transact a lot faster.

The duality of Bitcoin’s value as a speculative asset and its relative sloth, by cryptocurrency standards, as a transaction currency, has led to a “hodl culture” among BTC users.

Bitcoin addresses holding increasingly higher amounts of Bitcoin are on the rise. In January of 2011, there were 34 whale addresses: those with balances over 10,000 BTC. By the end of 2019, that number had climbed to 130.

At the retail level, Bitcoin addresses with over 10 BTC rose from 51,000 to over 152,000. That suggests that, notwithstanding the tripling of whales in the ecosystem, retail level buyers are buying and holding Bitcoin in larger numbers over time. Indeed, the number of wallets with between 0 and under 10 BTC has fallen since the end of 2017 from 28 to 21 million. Small holders have either cashed out or are buying more.

Address and Transaction Growth

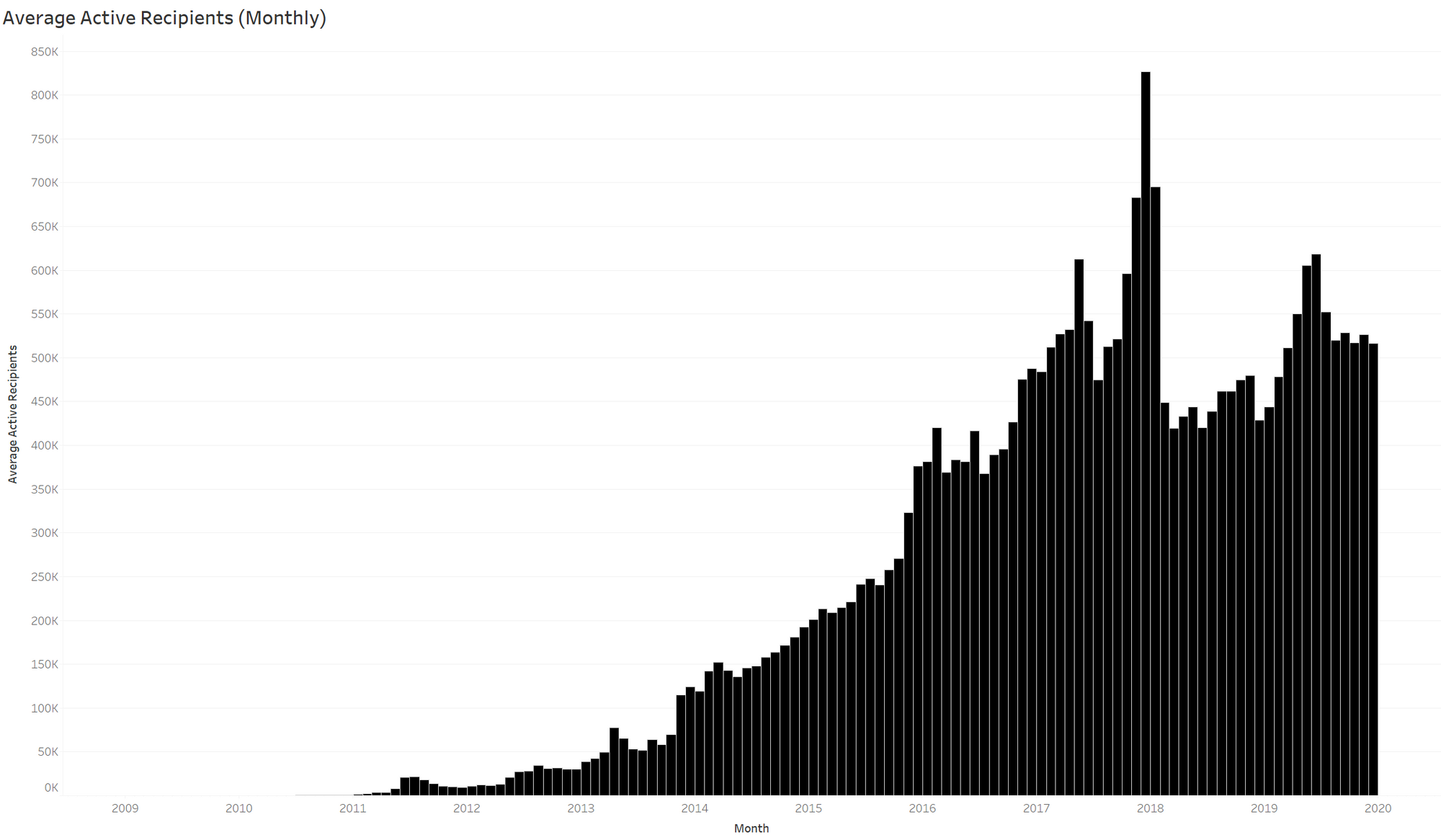

If we look at average active BTC addresses, Bitcoin’s rise, particularly since 2011, has been rapid and, except for the fall following the 2017 period of hype, constant.

Every day, over half a million addresses engage with the Bitcoin blockchain as a recipient or sender of funds. That represents a growth rate of over 40,000 percent for the past decade. Only 5,000 daily transactions were recorded to the network in 2011. The figure was highest on Dec. 14, 2017, when over a million wallets interacted with Bitcoin’s blockchain.

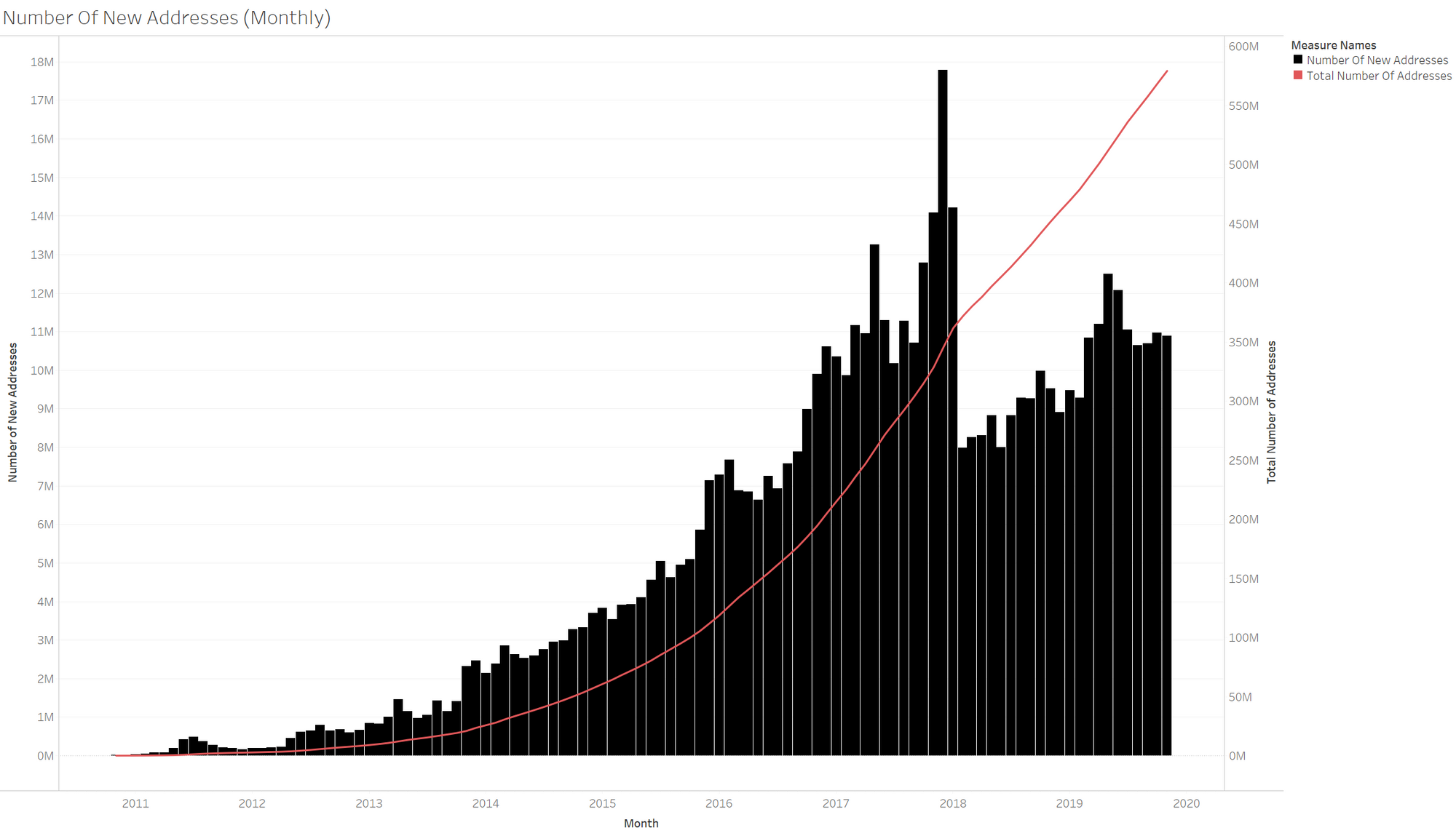

Examining new addresses created over time, the growth of Bitcoin is undeniable. In 2011, there were 7,100 new addresses created each day, on average. That figure has soared to over 350,000 new addresses created on a daily basis.

Annual transactions have risen year-on-year since Bitcoin was created, with the exception of 2018, when the currency saw a 21.7 percent drop in activity from 2017 levels. That suggests that either or both 2017 and 2018 were exceptional, rather than normal, years.

That translates into a new address creation count of around 11 million per month. There are now over half a billion Bitcoin addresses. Interestingly, of the one million transactions that took place on Dec. 14 of 2017, over 800,000 of them were performed by new addresses.

These figures are stark reminders that Bitcoin has become a hodler’s asset. Less of it is changing hands, in value terms, despite the consistent growth in transactions. With more wallets holding more BTC, the market appears to be sitting and waiting for a new round of price appreciation.