Bitcoin Price: More Dependent On The US Economy Than We Thought?

Bitcoin and the U.S. economy: when the enemy of your enemy is your friend.

Share this article

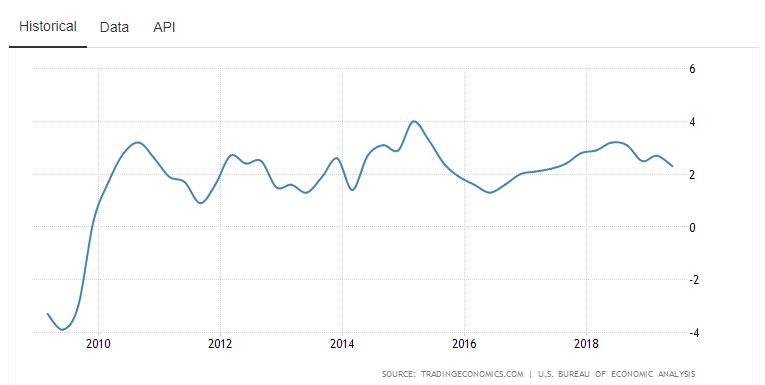

Bitcoin emerged from the ashes of the global financial crisis, with the genesis block created in January, 2009. The American economy emerged from the same ashes around the same time, with GDP soaring immediately following the GFC and continuing to deliver a historically long period of expansion.

Recently, as has been extensively reported, growth in the U.S. has slowed. The world’s largest economy added an average of 223,000 jobs per month last year. This year, that has slipped substantially, with only 136,000 jobs added in September, as reported by the Bureau of Labor Statistics.

After a decade-long period of expansion following the global financial crisis, the economy may be hitting the ceiling of growth for the current cycle. This has been compounded by fears of a Sino-U.S. trade war, the (eventual) slow rise of interest rates over the period, and global economic weakness.

Trump-fueled uncertainty over the past three years hasn’t helped.

Is Bitcoin Flatlining with the American Economy?

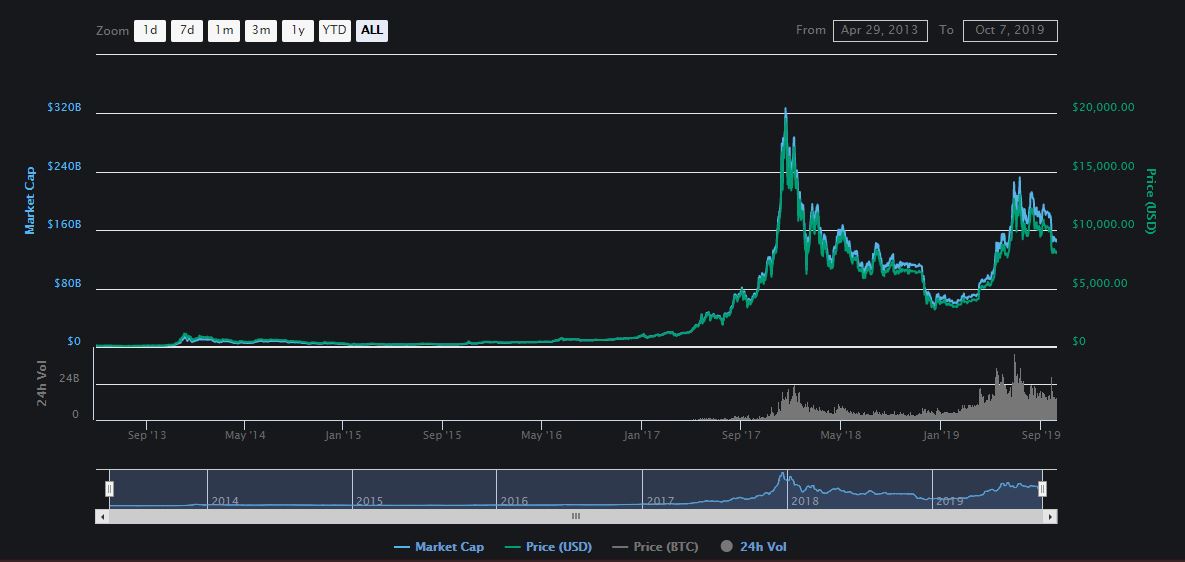

Bitcoin, after a resurgence in the first half of 2019, has stalled, now trading at around $8,180 according to Coinmarketcap.

Recent months have shown signs that the American economy may be slipping toward recessionary territory. Despite a decades-low unemployment rate of 3.5 percent, wage growth fell according to the Bureau of Labor Statistics, to 2.9 percent in September on an annualized basis. That compares with 3.2 percent the month before.

As the economy slows, BTC price action has softened.

With consumer spending and private investment representing around 85 percent of the U.S. economy, falling wage growth and a loosening job market are real threats to the American economy.

As Glassdoor senior economist Daniel Zhao told NBC News:

“The wage growth numbers are the big surprise this month. They were really disappointing. This signals that the labor market is still not as tight as we’d expect at this point, and the result is that workers aren’t seeing as much benefit from the longest economic expansion in history that we’d expect.”

– Glassdoor senior economist Daniel Zhao

Is Bitcoin a Victim of U.S. Economic Woes?

The historical price chart for Bitcoin shows that the OG crypto has risen since its genesis block, though not linearly, to give early investors a return on investment of almost 6,000 percent.

The American economy hasn’t enjoyed anything like those kinds of returns, of course, but its longest-ever period of economic expansion has coincided with bitcoin’s birth and growth.

Recent concerns over the threat of a looming recession could, of course, cause it, as consumers delay purchase decisions until certainty returns. As that places a dent in demand, especially during the important fourth quarter, 2020 could well kick off with a contraction.

With all the talk of the U.S. finally feeling the effects of tariffs on Chinese imports and global weakness, particularly in Europe, there may well be less money to set aside for speculative assets. Like bitcoin.

Bakkt’s underwhelming launch could be a signal that investors are expecting price weakness in assets across the board. A sagging wider economy also takes some wind out of the argument for bitcoin as a safe haven for inflation. Price pressures are only likely to weaken with a dampening economic outlook.

If the market for bitcoin is, indeed, tied closely with the greater state of the economy, the bull run of 2019 may have little steam left on which it could run.

The bitcoin price has never been tested during a recession. We may be closer to finding out how dependent a digital currency is on fiat frailty.

Share this article