Bitcoin’s Biggest Difficulty Drop for 2019: Simply Coincidence?

Mining remains highly random.

Share this article

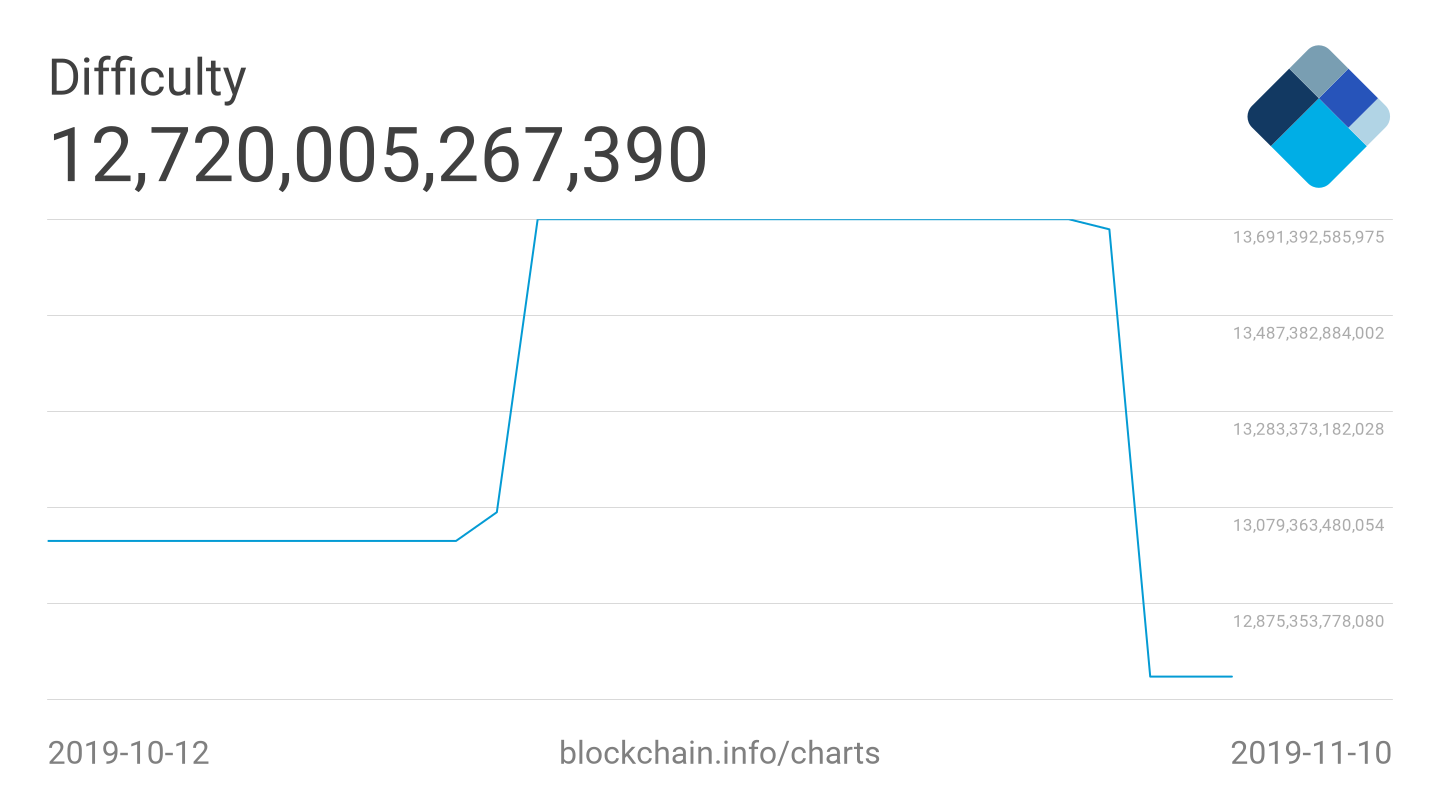

A few days ago, Bitcoin saw one of the largest single miner difficulty drops since late 2018. Multiple culprits have been proposed, but data shows that this may have been a random coincidence.

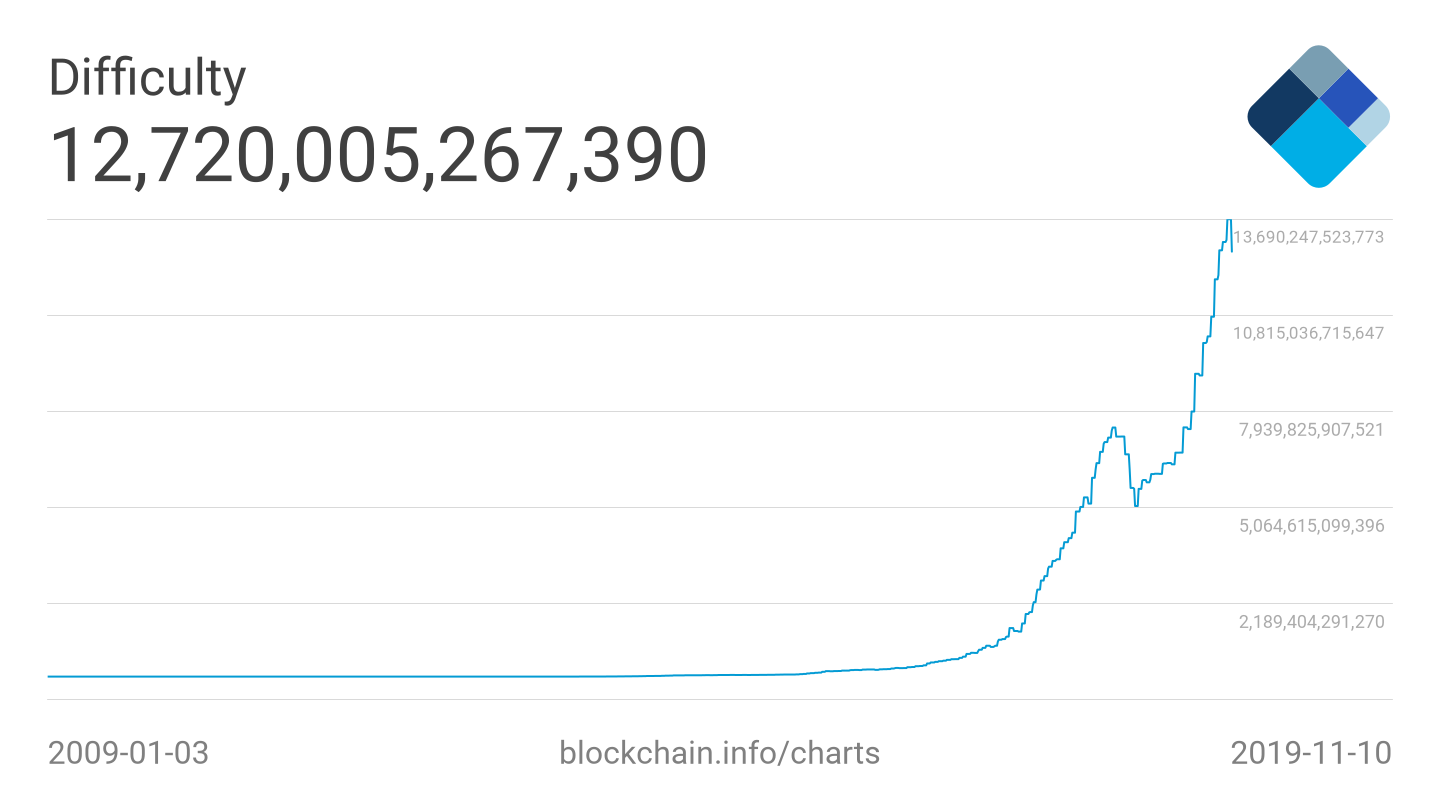

Miner difficulty is a measure aimed at balancing the block production. Bitcoin should ideally produce a block every 10 minutes, but the amount of hashing power dedicated to mining directly affects the average. Therefore, Bitcoin corrects the complexity of the mining calculations every 2016 blocks – ideally equivalent to two weeks’ time. If it took more than 14 days to produce that amount, the difficulty is lowered. If it took less, it’s increased.

This interval is comparatively large — Litecoin also uses 2016 blocks, but has a block time of 2.5 minutes — which allows for significant deviations from the ideal to occur.

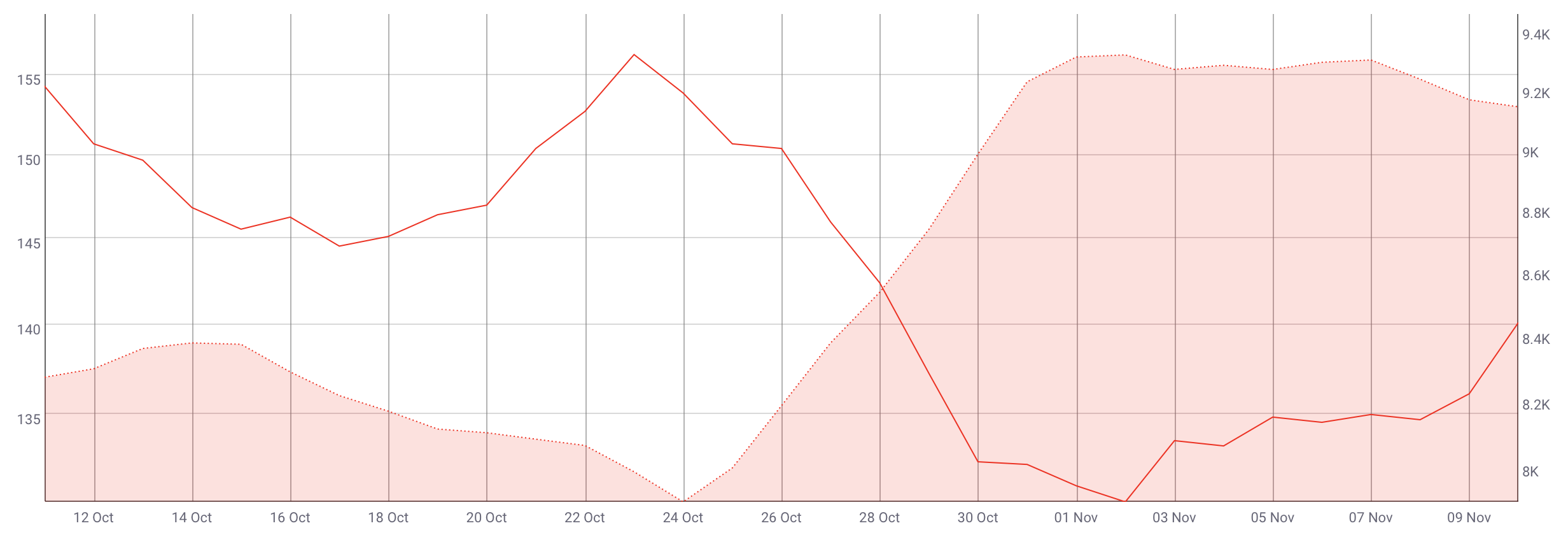

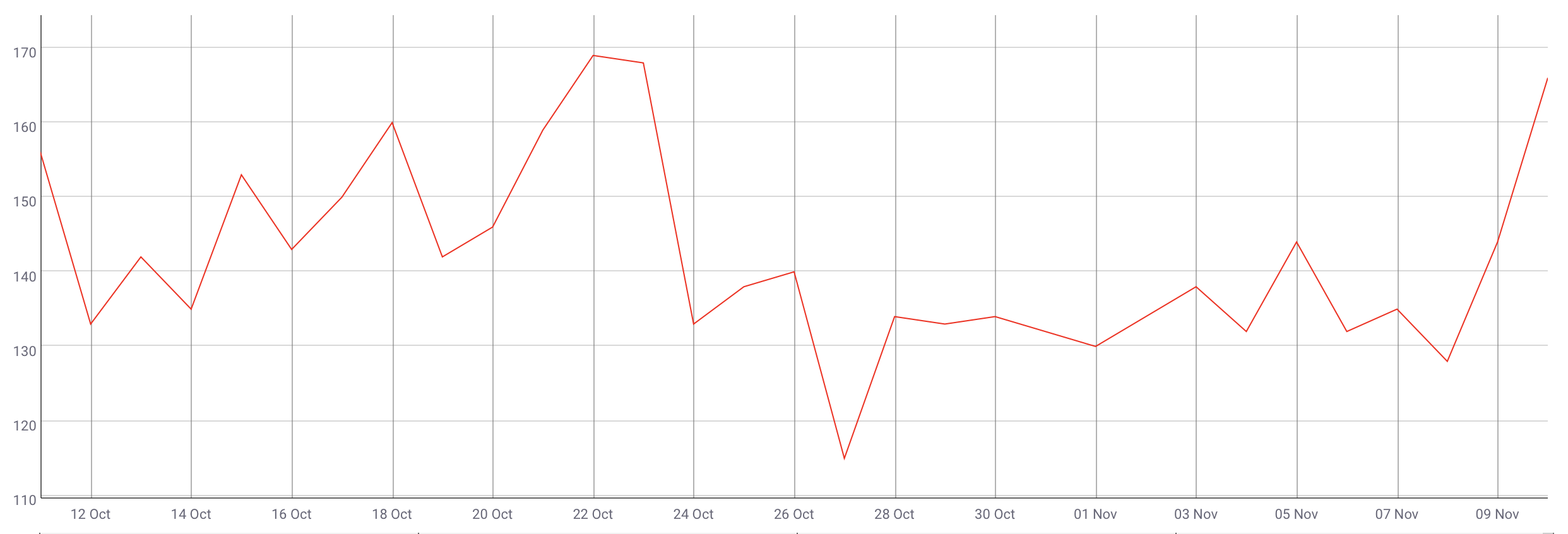

That was the case in late October. The daily production of blocks fell significantly below the average of 144 in a clearly observable trend. This normally indicates a falling hashrate – and is indeed the primary measure used by most websites to estimate the current hashrate.

Some have identified miners disconnecting unprofitable machines and weather issues as possible causes. However, the drop coincided with a significant increase in Bitcoin’s price – miners had no reason to turn off their equipment at this specific moment.

Random Fluctuations as The Cause?

There were two difficulty changes in the past 30 days: one on Oct. 24 and another on Nov. 8.

Using more granular data from Coin Metrics shows that the daily block production spiked just before the first retargeting. Fewer blocks than the theoretical average were mined in the next period – with Oct. 27 as a particularly slow day.

Effective hashrate losses could have contributed to the overall slowness. But the immediate and continuous nature of the dip in production, as price was growing, indicates that it was likely a minor factor.

Mining is by its nature highly random. The most likely explanation is a perfect storm of coincidences – a random fluctuation caused too many blocks to be produced in the previous period. Hence, the subsequent two weeks were made “too difficult” while randomness and other causes exacerbated the trend.

The apparently large drop seems to be an over-correction. With low difficulty and the recent increase in BTC’s price, miners are likely to jump at the opportunity and continue devoting more machines to securing the network.

Share this article