Binance Coin / USD Technical Analysis: Course Correction

Share this article

- Binance Coin is bullish in the short-term, with cryptocurrency touching levels not seen since June of 2018

- The BNB / USD pair’s medium-term picture remains bullish, with the cryptocurrency continuing to rally above its 200-day moving average

- Bearish MACD price divergence is building on the daily time frame

Binance Coin / USD Short-term price analysis

Binance Coin has a bullish short-term trading bias, with the cryptocurrency advancing towards levels not seen since June of last year. Price is also making bullish higher highs and lower lows.

The four-hour time frame shows that buyers have recently invalidated a bearish head and shoulders pattern, with the March 17th trading high now a key support on any moves lower.

Technical indicators on the four-hour time frame are starting to appear overstretched, which may signal that a technical correction could occur in the near-term.

BNB / USD H4 Chart (Source: TradingView)

Pattern Watch

The strong short-term bullish bias in the BNB / USD pair will likely continue while price continues to trade above the head of the invalidated head and shoulders pattern.

MACD

The MACD indicator remains bullish on the four-hour time frame, with the MACD signal line generating a buy signal.

Relative Strength Index

The RSI Indicator is also bullish, although it is starting to correct from overbought conditions on the four-hour time frame.

Fundamental Analysis

The recent price surge can be attributed to the announcement of the update to the Binance Launchpad token sale format. IEO will be conducted as a lottery. Users will have to hold BNB over a 20-day period and will be able to claim up to 5 lottery tickets, depending on the BNB balance. This directly incentivizes holding, therefore the price is growing.

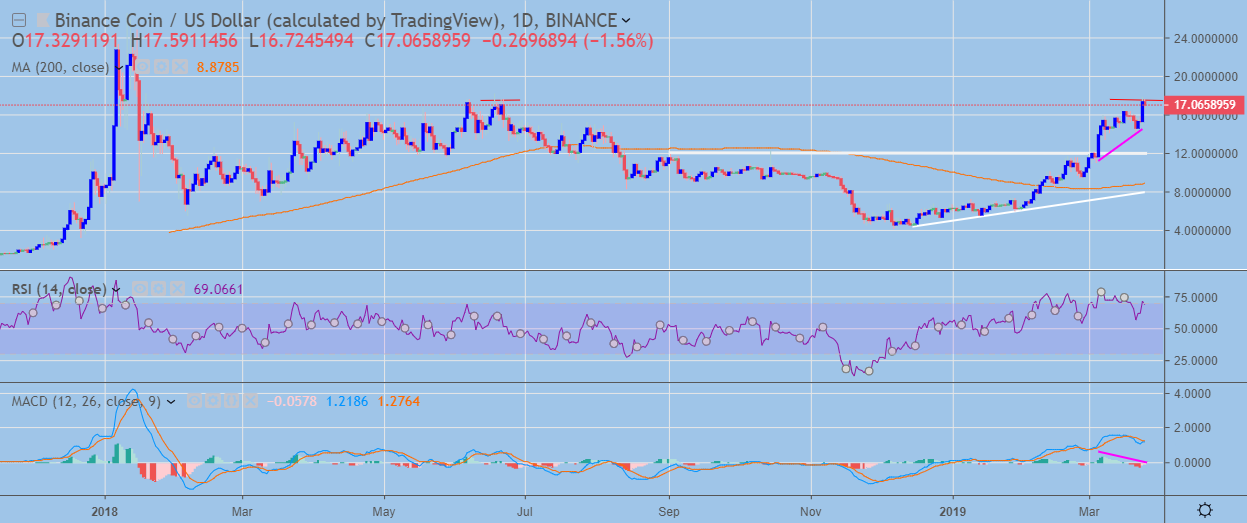

Binance Coin / USD Medium-term price analysis

Binance Coin retains a bullish bias over the medium-term, with the cryptocurrency advancing for five-consecutive trading week.

The daily time frame shows that the breakout from the ascending triangle pattern is close to completion, with price approaching the upside objective of the pattern.

Bearish MACD price divergence is also seen on the daily time frame, which could signal a technical correction back towards the upper trendline of the ascending triangle pattern.

BNB / USD Daily Chart (Source: TradingView)

Pattern Watch

Traders should note that a large inverted head and shoulders pattern with a sizeable upside projection can now be seen on the daily time frame.

MACD Indicator

The MACD indicator on the daily time frame time is showing bearish price divergence, while the MACD signal line has crossed lower.

Relative Strength Index

The RSI indicator remains bullish on the mentioned time frame, with the indicator testing back towards its peak.

Fundamental Analysis

In the medium term, the token remains attractive. The new format of the Launchpad token sales and the upcoming launch of the DEX and Binance Chain mainnet should support the price of the coin.

Conclusion

Binance coin remains bullish over both time horizons, with the cryptocurrency enjoying five-straight weeks of gains whilst also making its strongest monthly advance since December 2017.

Both time frames are showing possible signs of upside price exhaustion, with the presence of bearish MACD divergence on the daily time frame offering a strong warning that a technical correction could occur at any time.

For a refresher course on the project please see our coin guide for Binance Coin here.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.

Share this article