Boosted by DeFi, DEX Volumes Compete With Binance, Poloniex, and Other Centralized Exchanges

DEXes traded 45% more volume in the last two months than they did in the entire year of 2019.

Share this article

DEXes Scale Liquidity and Trading Volume

In just the last week, Uniswap and Curve created more than $720 million in trading volume. This is more volume than all DEXes combined last quarter.

In fact, it’s almost double the $325 million in trading volume recorded by DEXes in their best month last year.

DEXes are by far DeFi’s most successful products, with several platforms achieving product-market fit. Automated market makers (AMMs) like Uniswap, Curve, and Balancer stand out within this segment.

Yield farming and liquidity mining are a major reason for this boom cycle in DEX usage.

With previous liquidity incentives from protocols like Compound and Balancer continuing alongside newer yield farms like yEarn Finance, diligent users have been earning absurd amounts of money.

These incentives are resulting in unparalleled growth in the DeFi sector

Total DEX volume is en route to hitting $2 billion in July 2020. The rising popularity of permissionless trading will put non-custodial exchanges firmly in competition with their custodial counterparts.

On Jul. 23, 2020, DeFi exchange Uniswap’s 24-hour volume was $78 million. This is more volume than major centralized exchanges such as Poloniex, Gemini, and Binance US, according to CoinGecko’s exchange volume data.

In many cases, Uniswap can compete with centralized exchanges in terms of token liquidity.

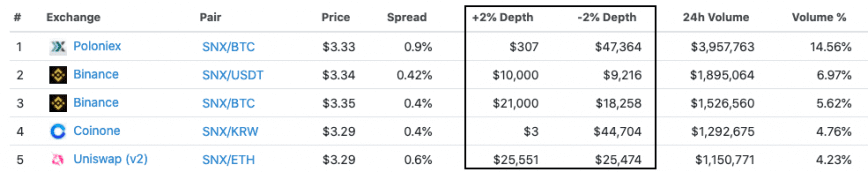

Binance and Poloniex recently listed Synthetix Network (SNX) and a ton of tokens moved into these exchanges. But despite centralized exchanges enjoying higher trading volumes for SNX, the deepest and most even liquidity spread is still on Uniswap.

The DeFi DEX Is the Future of Trading

Since DEXes and ERC-20 tokens both run on the Ethereum blockchain, using a DEX creates a synergy that makes life much easier for users.

For example, an avid Aave user holding the protocol’s native token, LEND, will find it easier to buy or sell tokens through a DEX than a centralized exchange. This is because the same wallet used to interact with Aave can also interact with a DEX.

DeFi DEXes remove one layer of friction from this process.

DEXes, however, still have a long way to go, however. Binance, which is the cream of the crop in terms of volume, exchanges close to $2 billion of value per day. This translates into roughly $60 billion a month, which is 10x the volume DEXes have done in 2020 thus far.

DEXes are yet to hit come anything close to critical mass – they’re an emerging trend within an emerging trend (the broader crypto space ).

At the end of the day, most traders care about ease of access and liquidity. New projects like Matcha by 0x are catering to this crowd by aggregating DEX liquidity on a platform that’s optimized for superior user experience.

Once perfected, DEXes will be able to square up to their centralized counterparts on all fronts.

Share this article