Bring Back The ICO: A Contrarian View

Share this article

It pays to be a contrarian. Social media, news outlets, and industry experts create a herding effect. Optimism and despondence build steam equally fast and trap crowds in a carousel of buy high, sell low cycles. Many have been caught in the hype-driven run-up of the fall and winter in 2017, when bitcoin topped $20,000 and was going to the moon. Then, just as quickly, the sentiment turned sour and billions were wiped out in a matter of months.

A similar trend can now be observed in the ICO market. The crowdfunding instrument was hailed as the savior of entrepreneurs and killer of VCs. In 2017, ICOs were going to change the game. Now, three quarters through 2018 teams are turning back to private placements in fear of the volatility of the crypto market.

This follow-the-insecure-leader behavior is disadvantageous for startups. After all, entrepreneurship is supposed to be about finding your own path. So, in the words of Ryan Gosling’s character from Crazy Stupid Love: “Be better than the Gap!”

Listen to the fearmongers and do the opposite

The talk around the watercooler is that now is the worst time for an ICO. The conventional reasoning goes as follows: marketing costs are enormous, crypto-assets are way down, and liquidity is drying up. The naysayers are not lying. The cost of launching of an ICO can easily top $500,000 precluding the cost of listing the token on a decent exchange.

The market prices have obviously retreated from last winter’s highs and the growing dominance of bitcoin shows just how much harder altcoins have been hit by this correction. Liquidity, based on growing concerns about volume manipulations on exchanges, is clearly an issue.

While on the face of it, the logic appears solid, in actuality, this line of thinking incentivizes entering the market when it is overheated and leaving it when there is value to be had. That is not a sound strategy.

Consider this, even with the market down, ICOs have been pulling in a staggering amount of money. Projects that have closed in 2018 have already procured north of $20 billion versus $6.2 in 2017. The number of ICOs has also more than doubled to 786. Even in August and now September, when the market has really been battered, 90 ICOs have closed on over $2.2 billion in funding.

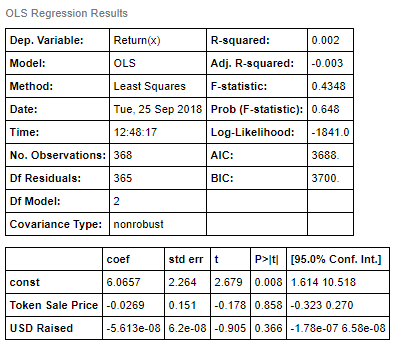

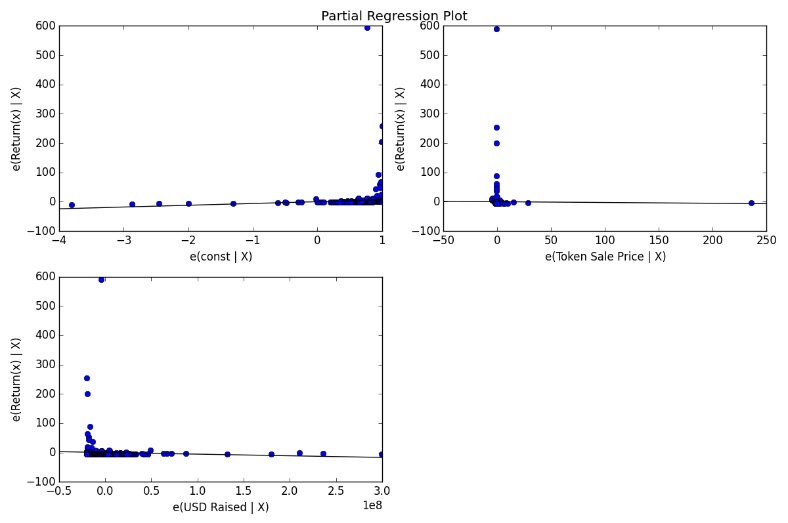

Many are worried about attracting lower figures and about having to offer tokens at a very low price. However, an analysis of ICO token prices and the overall size of the ICO rounds relative to the overall market performance of those assets, reveals no meaningful statistical connection.

(Source: https://www.icodata.io/ICO)

So, as long as a project attracts enough capital to get the job done, the team should not worry about the funding numbers. A solid VC seed round can yield a startup $200,000-$1,000,000 and cost 20-30% in equity. Even in the current market, this would be considered an extremely weak ICO.

Moreover, with the hype levels down, the market has once again shown a preference for dry, tech-heavy projects over the glossy Lamborghini fundraisers, which means that a team can get away with lower costs on the marketing side and just focus on their deliverables.

An ICO is more than just a procurement instrument

At the end of an ICO, teams are left with two capital resources – a pool of ETH and BTC and a reserve of the project’s tokens that have been set aside. Before, when the market was supposedly favorable, teams were accumulating capital at peak prices. Then, when the market started to correct, projects saw their balance sheets diminish and their runways shrink. They bought in at the top, which would be akin to a publicly traded company doing a share buyback when the stock prices are at an all-time high.

An ICO that would be launching now could look forward to future market catalysts boosting their market cap as opposed to the other way around. So, while the crowd is starting to panic, and scream stay away, the fundamentals reveal a different narrative.

There is more to life than infrastructure

The conventional wisdom dictates as long as there is no stable infrastructure, there is no sense in building applications. The market has echoed this, by featuring the infrastructure sector as the number one fund getter in both 2017 and 2018, increasing its share of the ICO pie year over year.

However, it’s the CryptoKitties dApp that, arguably, grabbed some of the biggest headlines and determined the direction of the industry’s development by exposing flaws in the infrastructure. Adoption depends on finding practical, commercial use cases for blockchain technology. DApps are much more important in this aspect because, ultimately, users don’t care about the underlying technology, just the stuff that runs on it.

Look back at the early days of the iPhone; iOS had many issues, and the updates were often so wrought with flaws, it became common practice to skip installing the first update after a new release and wait for the second. However, users chose to overlook these problems, largely because they wanted to use the apps, even if they periodically crashed.

So, if you have an idea for a game, why not develop a game? The infrastructure projects will grow with you and adapt to your needs. Have you noticed how many recent blockchain projects are compatible with Solidity, even when they offer their own languages and compilers. It’s because they have to accommodate the existing dApp developers.

So, while experts might look down upon the dApp ICOs, it’s these projects that will determine the winners of the infrastructure competition. As the industry matures, more traditional companies will enter the space, making it more difficult for a no-brand team to gather funds. Now is the time to have a dApp ICO.

Resist the temptation of going private

With the bear market in full force, projects have started to look to private investors for support. Teams have been offering generous discounts in private rounds that promise healthy returns despite the overall decline in the market. Additionally, the introduction of SAFT has enabled more of the traditional investor capital to move in. Setting aside the fact this dynamic corrupts the fundamental principles of the ICO, which was introduced to free startups from the stranglehold of VC funds, the trend is dangerous for the long-term commercial success of the projects.

First of all, if a significant amount of a project’s tokens is held by a select number of investors, the team can kiss its independence goodbye. Decentralization goes out the window when a utility token, essential to the platform’s operation, is held by only a few entities. They, essentially, can suffocate the platform if they wanted to and thus hold all of the real governance power.

Secondly, going private stunts community growth. Unless the team is building a B2B platform, it makes little sense to provide the retail buyers with only a small portion of the necessary instrument. Not to mention that it might unsettle them to find out that while they were losing thousands, a few players who might never even use the platform made a nice chunk of change.

Sure, given the challenging market, it might make sense to do a small private placement and allocate 10-20% for the effort, but the vast majority should be set aside for public use and reserves. Again, if nothing else, this allows the project team to bet on itself. Instead of selling tokens when prices are down, it can get a small capital injection and then wait for prices to climb on the strength of positive development news from the project.

In summary: things look rough, but maybe that is good

The crypto market has experienced a significant correction trend in 2018. Many have seen this as a signal to lay low and stay away from the ICO markets. Project teams are delaying public placements and are also increasingly looking to traditional investment channels for help.

While it can be easy to succumb to the mounting pessimism, a contrarian approach would suggest that now is the right time to enter the market, especially in the dApp segment. Depressed prices and growing skepticism give startups an opportunity to procure the capital necessary for development while also investing in themselves.

This strategy could prove incredibly profitable for the teams that dare to brave the current storms.

The author is not currently invested in digital assets.

Share this article