Can Terra's UST Stablecoin Hold Its Peg?

Learn about the mechanisms and factors influencing UST’s peg and the threats to its stability.

Key Takeaways

- UST is an algorithmic stablecoin on Terra. It's pegged to the value of the U.S dollar.

- Because UST is unbacked, it can potentially de-peg from the dollar during periods of extreme market volatility.

- Issues with UST demand and reduced involvement from UST creator Terraform Labs could threaten the stablecoin's peg in the future.

Share this article

Recent market conditions have put pressure on the TerraUSD peg, leaving many market participants fearful of another major de-pegging event. Join Crypto Briefing as we explore UST’s meteoric rise and whether it’s likely to break its dollar peg again in the future.

The Rise of Terra and UST

UST has grown fast over the last year, but some fear that the coin may not be stable.

TerraUSD, otherwise known as UST, is an algorithmic stablecoin on the Terra network. UST is pegged to the value of the U.S. dollar and is currently the biggest algorithmic stablecoin by market capitalization, with over 11.2 billion UST in circulation.

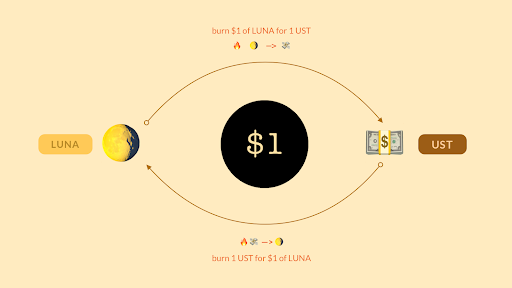

Because UST holds its peg algorithmically, it is not backed by real dollar reserves like the USDT and USDC stablecoins issued by Tether and Circle claim to be. Instead, UST uses Terra’s governance and staking token, LUNA, to maintain its peg through an algorithmic incentive mechanism. At any time, users on Terra can burn $1 of LUNA to mint 1 UST, or burn 1 UST to redeem $1 worth of LUNA.

Because LUNA and UST are tied together, whenever there are inefficiencies in the ratio between the two, arbitrageurs can jump in and profit off the difference while simultaneously helping UST hold its peg. For example, if the UST value drops below $1, an arbitrageur can burn 1 UST to mint $1 of LUNA, then sell the LUNA for profit. Likewise, if demand for UST climbs, more LUNA tokens will be burned to create UST, decreasing the overall LUNA supply.

In recent months, demand for UST has surged thanks to the growing interest in Terraform Labs’ Anchor Protocol. On Anchor, users can deposit UST to earn a stable 19.5% yield, which is among the highest rates paid on a stable asset in the entire crypto ecosystem.

Several DeFi protocols utilize Anchor’s lucrative yields, with Abracadabra Money’s degenbox strategy being the biggest. Degenbox lets users leverage up their Anchor yields by depositing UST to borrow 90% of the value as Abracadabra’s MIM stablecoin, trading that MIM for more UST to deposit, then repeating the process. With this strategy, users can earn up to 100% APY on UST—but with one caveat. If the price of UST deviates significantly from its $1 peg, leveraged degenbox positions can face liquidation, as the amount of MIM borrowed surpasses 90% of the value of the UST collateral.

Why the TerraUSD Peg Might be Durable

For DeFi users to feel secure keeping their money in TerraUSD, it needs to hold its peg, even during periods of extreme market volatility. All stablecoins see their value fluctuate daily; but when the value moves by more than one or two percent, the stablecoin peg is considered to have broken.

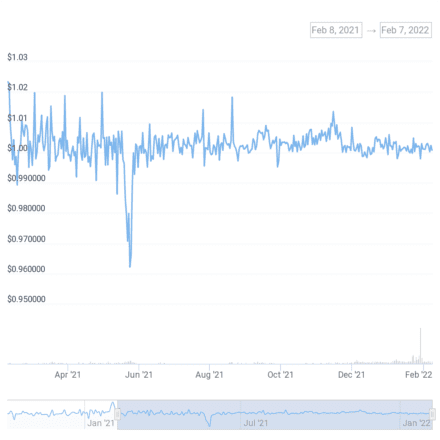

UST’s most recent major de-pegging event occurred during the May 2021 market crash. As LUNA tanked along with the wider crypto market, those who were borrowing UST against LUNA on Anchor had their positions liquidated, resulting in large amounts of LUNA entering the market. Those who performed the liquidations used UST’s algorithm to burn the LUNA for UST to secure their profit from executing the liquidation. The volume of UST created in a short space of time exceeded $80 million on multiple occasions, forcing the stablecoin to trade at a discount for several days.

However, while UST dropped to $0.96 in May, it hasn’t broken its peg to the downside since. Over the last year, the volatility of UST shows a marked decrease that coincides with increased liquidity.

UST now has much deeper liquidity and more arbitrageurs that ensure its peg is kept stable. The peg’s most recent test occurred when fears surrounding the integrity of Abracadabra founder Daniele Sestagalli caused panic among users, resulting in approximately $500 million worth of UST positions being unwound from Abracadabra’s degenbox strategy.

According to a Delphi Digital report, over the initial period of contagion, UST’s price never dropped below $0.995. While the the UST peg briefly broke on Curve Finance’s wUST-3Crv pool, this was primarily due to low UST liquidity on Ethereum rather than any fundamental problem with the stablecoin itself. On the Terra network and centralized exchanges such as Binance and Kucoin, the UST held strong, showing how deeper liquidity and more arbitrageurs have strengthened the peg compared to its performance in May.

Fundamentally, as long as LUNA can maintain a non-zero value and ample liquidity, the peg should hold. As interest in the Terra network grows and Anchor’s attractive yields continue, there’s no reason to believe that another de-pegging event similar to May 2021 should occur. However, this isn’t to say other factors in the Terra ecosystem won’t affect UST.

Concerns Over the Sustainability of the TerraUSD Peg

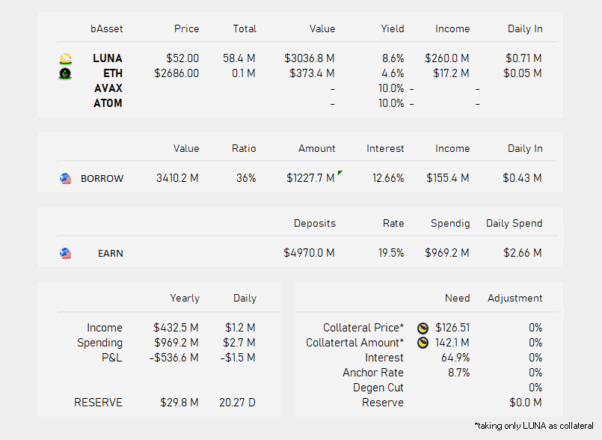

In Terra’s DeFi ecosystem today, demand for TerraUSD primarily comes from Anchor. The protocol pays out a consistent 19.5% yield and has been instrumental in the growth of the Terra ecosystem. But how exactly is Anchor facilitating such high yields on UST?

Anchor’s biggest source of revenue comes from user-deposited LUNA. Currently, 58.4 million LUNA tokens are locked up as collateral on Anchor, earning the protocol a yearly yield of $260 million by staking the deposited tokens to help validate the network. As Anchor also accepts Ethereum deposits as collateral, it earns some income from staking deposited ETH on Lido, too. The final source of income comes from users borrowing UST from the protocol. The current borrow rate stands at 12.66% and generates $155.4 million yearly.

When calculating Anchor’s expenditures and incomes, the protocol unsurprisingly pays out much more than it generates. Anchor’s high yields are dependent on subsidies from its creator, Terraform Labs. The company’s CEO Do Kwon recently hinted that it could replenish Anchor’s coffers with an additional $300 million to extend the period Anchor can continue paying out its 19.5% yield. When the current subsidies run out, it’s estimated that Anchor’s yield will drop to approximately 9%.

A drop in Anchor’s yields could potentially impact liquidity as users move away from UST toward other more profitable, stable asset yield farming methods. With less demand, UST’s liquidity could drop back to previous levels, leaving the stablecoin at risk of another liquidity crisis and de-pegging event. Additionally, with the advent of leveraged strategies such as Abracadabra’s degenbox, a mass unwinding of positions could cause a liquidation cascade that sends UST below its peg. While unlikely, such as situation must be considered as it is still a very real risk.

Another issue with UST is that the mechanisms governing its peg are not as decentralized as some may believe. Terraform Labs uses a single oracle to update the prices for LUNA and UST across all its products and protocols. In December, discrepancies between the price of LUNA according to Terraform Labs’ oracles and Binance’s Chainlink oracle resulted in a $37.2 million liquidation event across 239 accounts.

In addition to confusion over liquidation levels and a lack of decentralization causing a single point of failure, Terraform Labs’ control of the oracle price feeds gives it additional opportunities to regulate UST. As Terraform Labs is the first to see updated price feeds, it can front-run liquidations before other parties have the chance. When Terraform Labs liquidates large amounts of LUNA or UST, it can absorb the assets without selling them on the open market. This reduces the stress of liquidations on the market and thus the likelihood of UST de-pegging during times of high market volatility.

While conducting liquidations helps maintain stability in the Terra ecosystem, it is not organic and increases centralization. UST proponents often discuss how it is more decentralized than the world’s biggest two stablecoins, USDT and USDC, which rely solely on the companies that issue them to maintain their pegs. However, in reality, Terraform Labs plays a significant role in helping UST maintain its peg, meaning UST is not as decentralized as many DeFi enthusiasts think it is. Without Terraform Labs stepping in to conduct liquidations, the UST peg would likely be a lot more unstable than it currently is.

UST has provided a significant amount of utility, both in the Terra ecosystem and across multiple partner ecosystems such as Ethereum, Solana, and Avalanche, among others. While UST’s algorithm offers a new and innovative way to create a stable value asset, it has several issues it needs to overcome to ensure it keeps its peg without centralized intervention.

The recent stress tests caused by Abracadabra users and the wider crypto market downturn have shown that TerraUSD’s peg is much more resilient than it was in the past. However, given that Anchor currently has no way to ensure continued high demand for UST and Terraform Labs’ involvement in the Terra ecosystem, another de-pegging event is not out of the question in the future.

Disclosure: At the time of writing this feature, the author owned LUNA, ETH, SOL, and several other cryptocurrencies.

Share this article