Is Chainlink Centralized? A Breakdown of Token Distribution

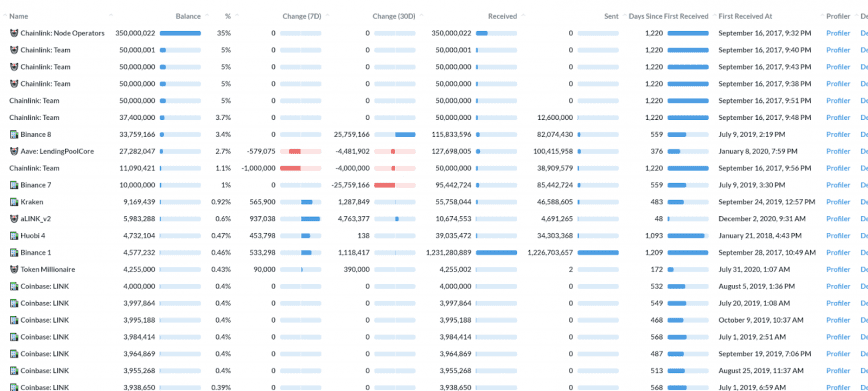

Chainlink recently made headlines when it emerged that 125 wallets held 81% of the total supply. However, there’s more to the distribution than meets the eye.

Key Takeaways

- Chainlink node operators hold 35% of the supply, the team holds almost 25%, and exchanges hold 16%.

- Funds held by the team are aimed towards bootstrapping development.

- No wallet outside of teams, nodes, or exchanges holds over 1% of funds.

Share this article

Alex Svanevik, CEO of the Nansen blockchain AI firm, chastised media today for skirting over important details and spreading “FUD” regarding Chainlink’s token distribution.

Hey @Cointelegraph may I recommend you get a @nansen_ai subscription?

No need to fud $LINK with these headlines.

See full breakdown of top LINK holders below. pic.twitter.com/AZqg6jt8QI

— Alex Svanevik 🐧 (@ASvanevik) January 19, 2021

Speaking to Crypto Briefing, Svanevik stated that “In brief, overly simplistic metrics do a disservice to the space. Reporting that 125 wallets control 80% of LINK supply doesn’t take into consideration what those 125 wallets are exactly.”

Crypto Briefing took a closer look at the data. The author’s findings show that wallets holding more than 1% of the total supply account for 66.6% of the supply.

The distribution for wallets holding over 1% is as follows:

- Smart contract for Chainlink node operators: 35%

- Chainlink team: 24.8% across five different wallets

- Binance: 3.4%

- Aave LendingPoolCore: 2.7%

Exchanges hold 16% of the total supply. 35% of the funds are held in a smart contract that will be paid out to nodes as an incentive and the team holds 24.8%. Chainlink ambassador ChainLinkGod posted a tweet in defense of the project, stating:

The recent @Cointelegraph article about the $LINK supply pushes a false narrative about "whales" designed to mislead readers about distribution

The facts:

40% of supply is circulating

35% is node operaters incentive fund

25% is held by team for development

350k+ total wallets pic.twitter.com/HDik9mFl8A— Zach Rynes | CLG (@ChainLinkGod) January 19, 2021

According to the ambassador, funds held by the team are being used to bootstrap future development.

Is Chainlink Centralized?

While the specific data on which wallets are controlled by which parties are relevant, the fact remains that the majority of circulating tokens are held by a minority of users.

The Nansen chart posted on Twitter shows many exchanges accounting for top net worth wallets.

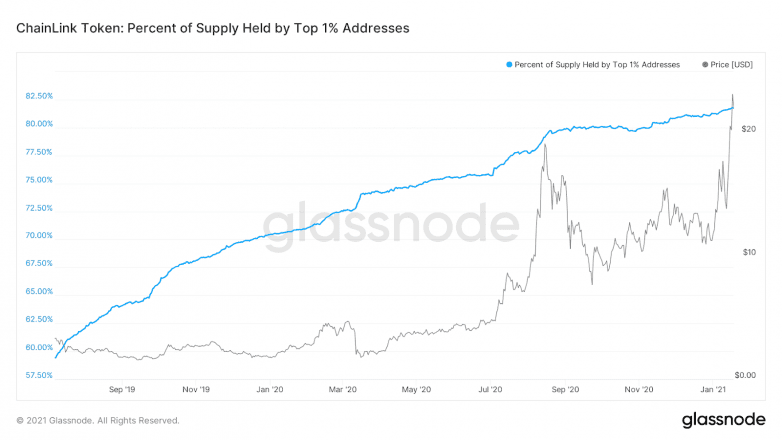

However, the total distribution to exchanges is only 16%. Furthermore, the supply held by the top 1% of addresses has been steadily climbing since 2019.

Scrolling past the first two dozen or so wallets on the Nansen list, many of the wallets have been labeled “Token Millionaire,” signifying whale wallets with $1 million or more worth of LINK tokens.

The main caveat to this point is that none of these whale wallets own a sum equal to or greater than 1%.

Every cryptocurrency has whales and millionaires, and LINK is no different. The issue here comes down to why node operators and team members hold so much of the supply and whether that supply can be used to force governance decisions.

Chainlink Tokenomics

Chainlink is a decentralized oracle service that transmits data to smart contracts between various interconnected blockchains. Chainlink nodes are paid in LINK, an ERC-677 token used to transfer data.

In theory, the tokenomics connect LINK’s value to demand for data in the ecosystem. Users can also stake LINK as collateral value against the Chainlink oracle, and nodes with more LINK staked are seen as more trustworthy.

Users who stake LINK receive LINK rewards over time. The Huobi exchange is one of several that runs its own Chainlink node.

While it’s true that the team holds enough LINK to manipulate price action, they’ve only sold 5% of the total supply over the last 3 years, moving from 30% to 25%.

To many users, this suggests that the funds are being used to further network development. The token is not used for governance, as Chainlink allows different networks to handle governance in their own unique ways. While the sum of tokens held by the top 100 wallets is formidable, it is not related to the governance decisions made by the team.

Originally I hated the team had so much of the supply but given the recent YFI debacle, I’m glad link is not a governance token and I’m glad they reserved a % for development and a % for node incentives. Really shows how forward thinking they were.

— D⬡N Shillingt⬡n (@FriedWatts) January 19, 2021

Ethereum co-founder Vitalik Buterin stated that while he felt the project was a “great solution as one among several,” Chainlink’s “security model is too centralized for me to be satisfied with it being the solution to all oracle problems.” However, projects that begin fully decentralized start off on the back foot when it comes to governance.

Speaking to Crypto Briefing, entrepreneur Max Safarin described the balance between a centralized team and token distribution as a “necessary evil” to start off with.

“This is a multi-billion dollar enterprise being built and token ownership by the team is necessary to make that process work,” he said.

While the project is not fully decentralized in terms of governance, it does not appear that the current token distribution poses a threat to the ecosystem’s health.

As Glassnode commented in a recent report, “The continued concentration of supply suggests that, even with the available supply increasing, LINK’s top holders are still bullish on the token, and are continuing to acquire more. This is a positive sign for LINK, as it demonstrates ongoing support and bullish sentiment from the existing community.”

Share this article