Consensus Bump n' Slump: Hungover Market Takes $15bn Correction

Market sentiment has dropped following the end of New York Blockchain Week.

Share this article

Today’s crypto markets demonstrate that Consensus, the biggest event in the industry, is well and truly over. Following CoinDesk’s flagship jamboree, crypto is a sea of red today, reflecting a more cautious investor sentiment compared to last week’s strong euphoria that drove an already bullish market up $30bn.

Losses have so far remained within the relatively generous confines of ‘cryptocurrency normal’: the mean average 24-hour price change in the top-ten (excluding Tether) is roughly -3%, but altogether the market’s total value has drooped by more than ten billion dollars.

Bitcoin (BTC), which yesterday managed to regain its position above the all-important $8,000 market, has since corrected back down to $7,750.

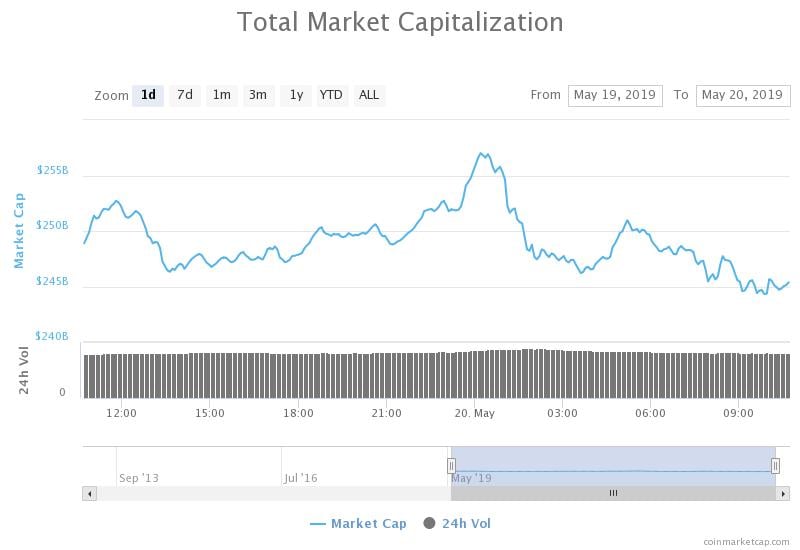

The gains accounted from yesterday’s surprise pump have not been reversed, but the market fell from its high of $256bn at the start of Monday to approximately $241bn at the time of writing.

The timing suggests that the downward trend began during the Asian trading day. Although it hadn’t continued as Europe gets underway, that might well change as America goes online.

What does a Consensus Hangover look like?

Demoralizing to look at: as we enter the week following Blockchain Week New York, the market could well be experiencing a ‘Consensus Hangover’: a decline in investor euphoria detectable through a reduction in prices.

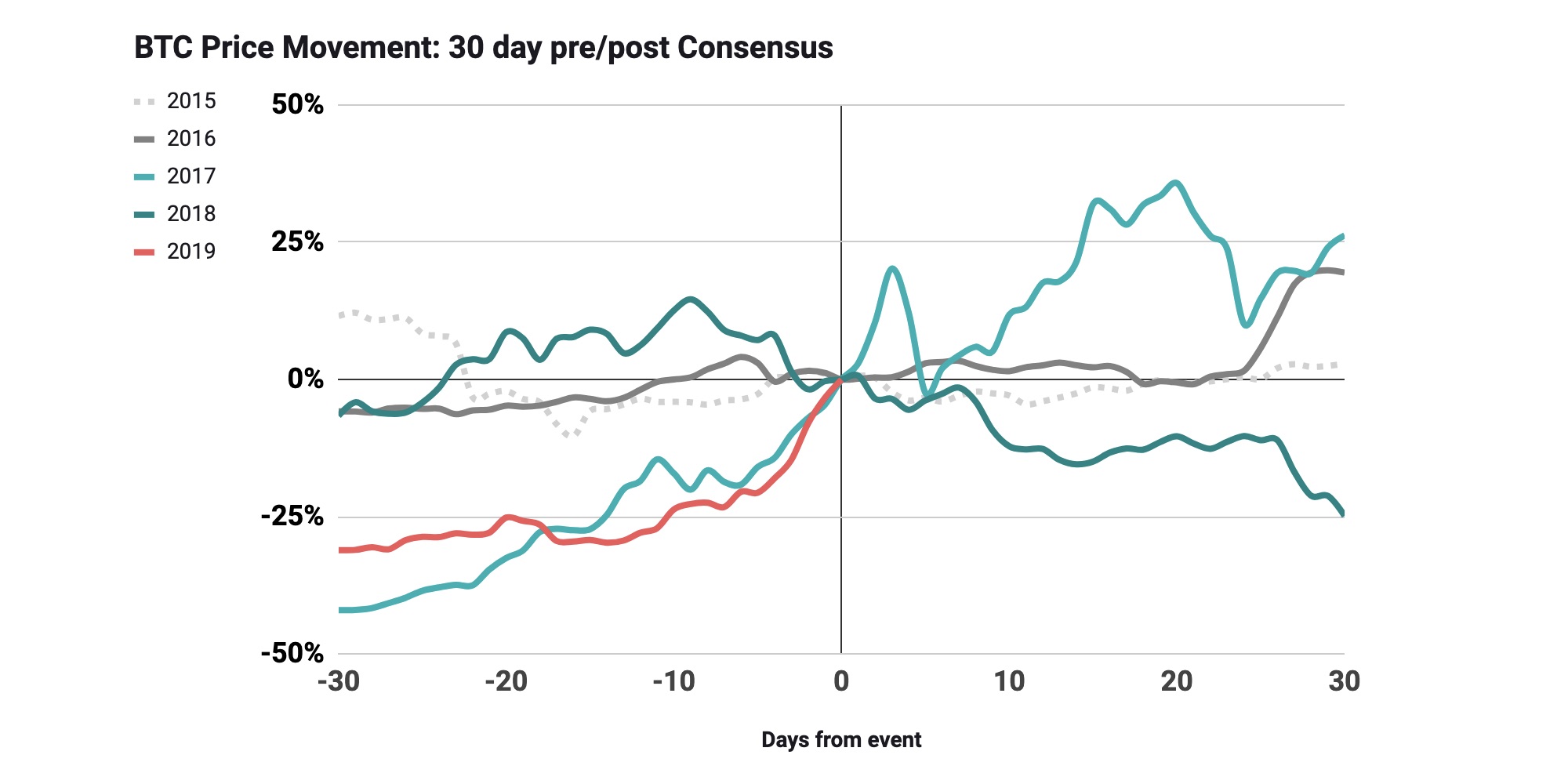

The market usually becomes bullish in the run-up to Consensus, and has done so since CoinDesk held its first event way back in 2015. The only time it didn’t happen was in 2018, when the tail-end of the ICO boom negated any possible boost that the event may otherwise have caused.

Poloniex analysts found this bullish effect begins 30 days before the event and usually continues for a month afterwards. “In four out of the last five years (including 2019), the daily average price of BTC and ETH has increased in the 30 days leading up to Consensus,” reads the blog post.

Notwithstanding the increase, every year has seen some sort of a lull or correction in the days immediately following the event: Consensus 2019 is no exception.

The total value of the market fell by 7% on the Monday following the inaugural Consensus 2015 – proportionally double the price decline in 2019. Consensus 2016 saw a very slight $100M drop before a strong rise a few days later; after reaching a high of nearly $90bn following the close of Consensus 2017, the market plunged back down to $57bn before recouping its losses a week or so later.

Crypto was already on a downward trend when Consensus 2018 got underway. Even so in the first couple of days after the event, the market dropped by around $20bn as the failure to capitalize on the ‘Consensus Bump’ demoralized investors; not to mention the media focus on rented Lamborghinis.

Inconsequential in the long-term

Correlation does not necessarily mean causation. As market reactions from previous Consensus events attest, contemporary macro effects – ICO boom and bust in 2017, 2018 respectively – have a far greater influence on the scale of the correction than the event itself.

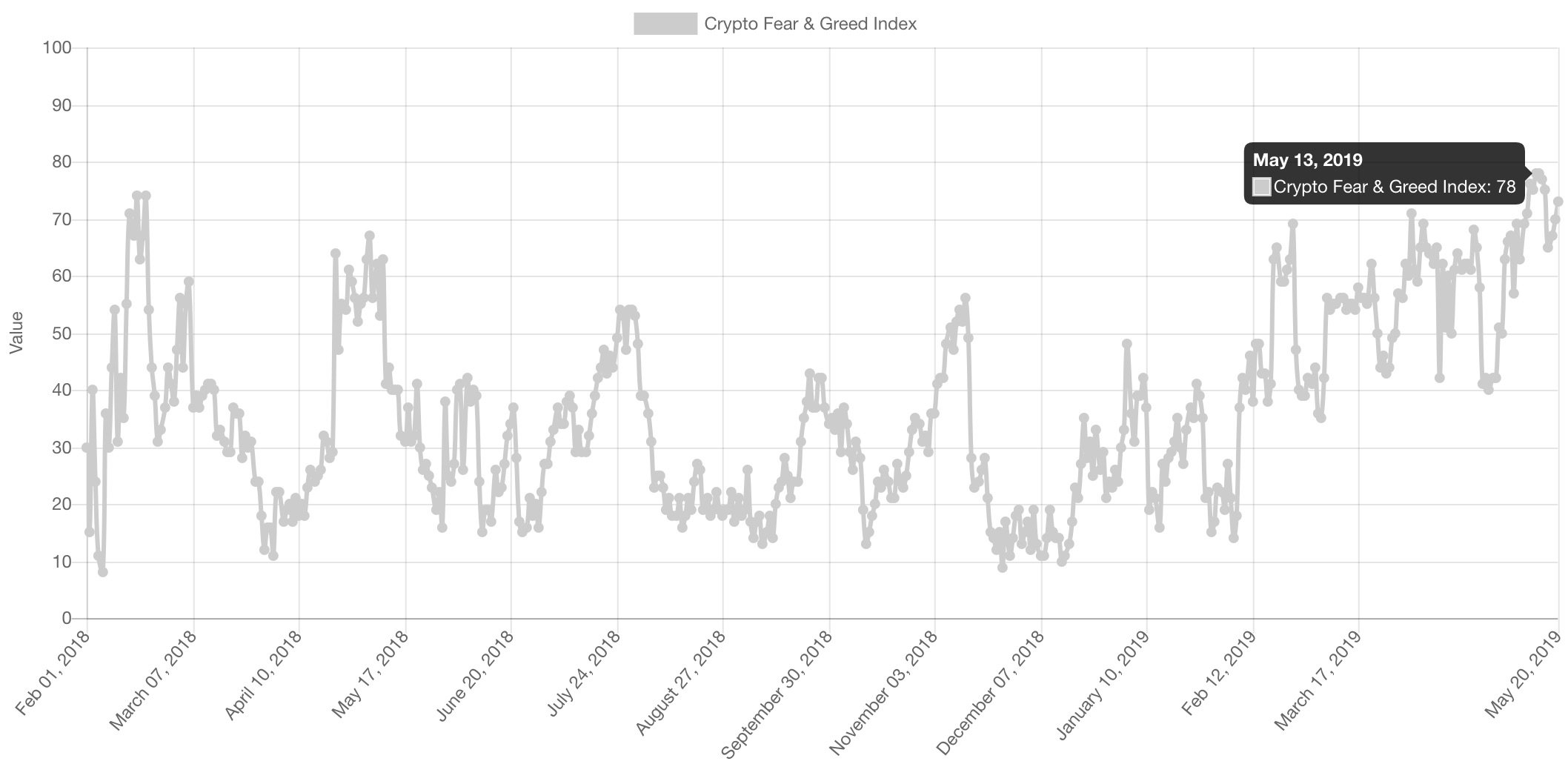

Nonetheless, a ‘Consensus hangover’ effect is discernible. The Crypto Fear and Greed Index, a measure of market sentiment, rose to an all-year-high of ’78’ the day before Consensus, suggesting it spurred investors on to buying digital assets to the point of becoming ‘greedy’ – inflating prices beyond their market value.

Unsurprisingly, the index dropped back down as soon as Consensus finished. It was ’73’ at the beginning of Monday, corresponding well with the current price drop: investor appetite has decreased slightly, leading to a slight demand decline and a corresponding slide in the market.

But as Crypto Briefing has already argued, volatility is attractive for speculators because it provides additional profit opportunities, creating a positive cyclical effect as more volume enters the market.

The Consensus hangover will be a headache for those investors getting over last week’s festivities. But since there’s still a lot more bump than slump, we’re prepared to suck up the throbbing in our temples for now.

Share this article