Bitcoin And Copper: Two Assets Ringing Recession Alarms

Are copper and bitcoin becoming divergent bellwethers of economic growth?

Share this article

If gold is the flag for an oncoming recession, copper is the opposite. With applications spanning construction, manufacturing, and electrical equipment, the industrial metal has long been considered a bellwether of economic growth.

After falling to two-year lows early this month on fears of a global slowdown, copper futures are now bearing the brunt of uncertainties stemming from trade tensions between the U.S. and China.

Meanwhile, CME Bitcoin futures are up 17 percent since the end of May. With positive sentiment in the original cryptocurrency correlating strongly with the negative sentiment in copper futures, this relationship could be one worth watching. Given the divergent price action between bitcoin and the metal, is bitcoin predicting difficult times ahead?

Bitcoin and Copper: From One Bellwether to Another

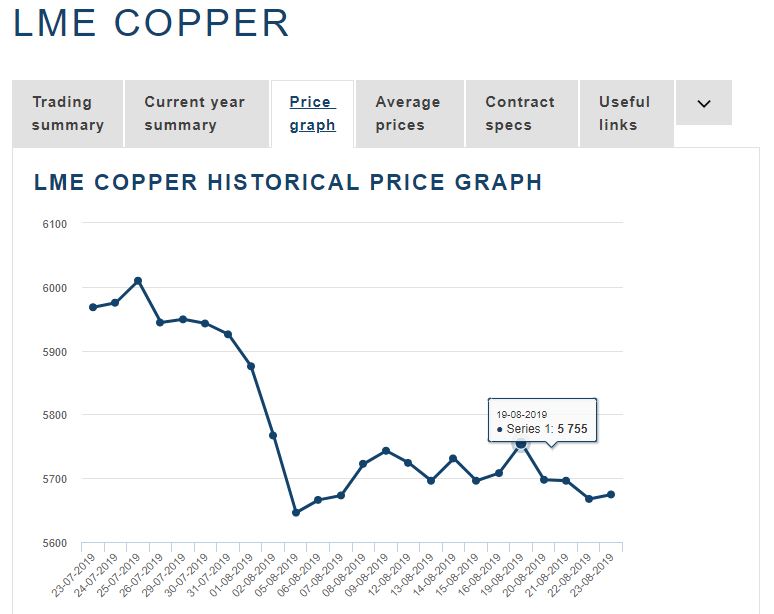

China accounts for 40 percent of global demand for copper. GDP growth in China continues to suffer from a multiyear sag, with growth down to 6.2 percent in the second quarter of the year. That represents a 27-year low. The decline in copper prices at the London Metal Exchange (LME) amid escalating trade tensions and tariffs is telling:

At the same time, China’s bitcoin demand surged 50 percent from around the 5th to the 15th of August, according to Hong Kong-based Babel Finance. Those figures are thought to be linked to the falling value of the yuan and a sluggish domestic economy. Based on these figures, Bitcoin is likely regarded as a safe haven asset by Chinese investors.

Bitcoin Futures Rise as Copper Falls

CME Bitcoin futures contract prices have risen in lock-step with sagging copper futures prices. According to Yahoo! Finance, BTC futures are up 7.8 percent for the month. Copper futures are down 5.5 percent.

The corresponding figures for the last three months show copper futures down three percent, with bitcoin futures prices up by 17 percent.

Falling spot prices in copper are closely related to Chinese demand, with the resulting futures prices suggesting bearish sentiment and investor fears of a global recession.

The metal’s history as a trendsetter for economic activity is well established, but Bitcoin’s well-known price fluctuations make it difficult to identify any single cause for a price movement. All the same, given its similarities with gold, it’s hard to distance bitcoins’ latest price rise from the rising fears of a global recession.

A New Barometer of Economic Sentiment?

The clear divergence between Bitcoin and copper is revealing. As investors appear braced for a prolonged period of uncertainty, concerns are mounting that the Sino-U.S. spat will spill over into the global economy.

Traditional indicators, such as inverted yield curves and negative interest rates also point to flagging investor sentiment. As bitcoin’s price trajectory diverges from those indicators, we may be seeing an emerging risk-off asset class in the digital currency and an alternative barometer of the economy’s trajectory.

Bitcoin as a hedge might be an unusual twist to its historical narrative, but it is an intuitively logical development in the face of negative interest rates and struggling fiat currencies.

Needless to say, the price of bitcoin is also affected by a complex interface between multiple factors. But in the larger macroeconomic environment, the relationship between copper and bitcoin could be a sign of things to come.