Criminals Love Crypto A Lot Less Than Cash

Share this article

Every time someone holds up an example of a *bad thing* associated with Bitcoin, shaking their head sadly at my life choices and telling me that criminals love crypto, I feel like giving them a good wake-up slap.

It’s justified for people to express concerns about an emerging technology. Its healthy to be skeptical. But it’s unreasonable, unwarranted, and downright Luddite to complain that cryptocurrencies are only fit for the criminal class.

Even prominent Microsoft founder Bill Gates suggested that “right now cryptocurrencies are used for buying fentanyl and other drugs…it is a rare technology that has caused deaths in a fairly direct way.”

While cryptocurrencies are still being used to facilitate anonymous trades on dark web markets, the belief that digital currencies are dangerous because they’re being used by criminals is irrational, and fails to take into account the pace of innovation and the core advantages of the technology.

Not to mention, if 80% of all U.S. dollars in circulation carry traces of cocaine, isn’t it reasonable to assume that cash – not crypto – is the true friend of the ‘drug dealers’ that Jamie Dimon insists are Bitcoin users?

In this article, I’m going to challenge the argument put forth by the media, Bill Gates, and other prominent Bitcoin fearmongers – not in the satirical way that my colleague Adam Selene did yesterday, but with a serious eye on the harm these falsehoods create.

I’m going to first explain the nature of innovation, and why safety tends to lag behind when it comes to disruptive technologies. I will also explore the economic components that define the market when it comes to emerging technologies and security solutions, and end the argument with a concept that the media rarely discusses; while cryptocurrencies are difficult for law enforcement today, they could be a nightmare for criminals in the future.

Innovation and risk are different sides of the same coin

It’s important to acknowledge that cryptocurrencies, like many technologies, have an intimate history with crime. Danger and risk are two of the costs of any new disruptive technology.

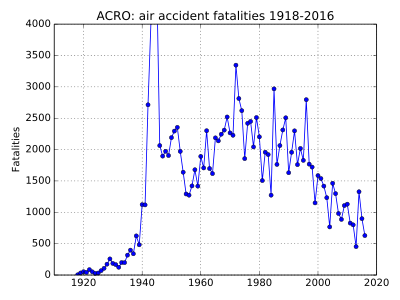

The early days of flight were notoriously dangerous. Flights went down constantly. As you can see from the chart below, deaths peaked at the point of widespread adoption, and have been steadily declining as the technology behind flying became safer. (Bear in mind that actual hours flow has increased dramatically in concert with this decline in the actual numbers of deaths, so the “deaths per miles flown” has dropped much more than the actual number of fatalities.)

However, in 2017, there were zero reported deaths on commercial flights, anywhere in the world. Any innovation therefore comes with some level of risk, and when risks are addressed properly, they can be gradually minimized. Compared to horse riding, driving a car, or even walking, airplane travel is now the safest way to get between two places. Assuming they both have airports.

Safety First? Not With Disruptive Technologies

Unfortunately, safety always comes after innovation. While it sounds pretty obvious that there can be no safety measures implemented on a product or service that does not yet exist, the media tends to point out the flaws and shortcomings of new technologies.

Furthermore, entrepreneurs, engineers, innovators are humans, and despite their incredible achievements, innovators can only focus on one thing at a time; which is often the technology and innovation itself.

If you look at the personalities of innovators, they also tend to have a ‘do-it-now and worry about the problems later approach’. First generation cryptocurrencies like Bitcoin are essentially the Minimum Viable Products of the blockchain world. They can perform the primary function of transferring or mining Bitcoin… however, when it comes scalability, or security, there are many problems to improve. That’s the price of non-incremental, disruptive innovation.

Once innovations achieve proof of concept, they are gradually debugged and optimized. In the cryptocurrency world, once digital currencies are deemed useful by the larger crowd, markets move to capitalize on solving the problems. These problems quickly become opportunities for startups to fix and monetize. Innovations and safety tend to follow this pattern because it doesn’t make sense from a financial perspective to hire a large team of security engineers to solve problems for a technology that many people don’t use.

The Human Economic System

In every industry, security measures and systems are built according to the fundamental economic principle of supply and demand. Unfortunately there is very little data to suggest the idea that security and justice is self-evident, or the will of God.

Implementing security measures and evoking justice is simply a natural part of the human economic system. Although Bitcoin and cryptocurrencies are used for illegal purposes, as the general public begins to adopt the technology, it’s only natural that greater security measures and systems will follow.

Diminishing Returns And Acceptable Losses

Let’s look at an example. Say there is a village that loses $1 million to theft every year, which equates to almost 50 percent of their earnings. The villagers are sick of the bandits stealing from their homes and so they install a $2 lock on each window and door, with a total cost of $10,000 for the village.

At the end of the year, the mayor announces that only $500,000 in theft was lost compared to the $1 million the year before. While it’s an improvement, losing a quarter of their income to theft still doesn’t sit right. The villagers install a security camera system that costs $2,000 per unit, costing the village $100,000 in security costs.

The new system works like a charm, and the mayor announces only $50,000 of theft was recorded that year. The villagers look to reduce theft even further: however most simple solutions have been implemented. The only option available is autonomous police drones that cost the village a total of $200,000 – but the villagers wisely prefer to accept a loss of $50,000 in theft over spending $200,000 in security.

In the parable above, the villagers invest their money to stop theft, but only to the point where the investment provides a positive return. The concept above is called acceptable loss, and every security and justice system has an unspoken acceptable loss rate. Below is a graph that demonstrates the cost of security in relation to percentage or risk removed.

Growth Begets Security

As the cryptocurrency industry matures, the market size grows larger. The growth will naturally attract many competent security companies to service the industry. As users integrate cryptocurrencies into their daily lives, people will also be more open to paying a small fee to grant security and peace of mind.

These increasing layers of security are being implemented today. An example is the Know Your Customer (KYC) requirement that is being widely implemented on cryptocurrency exchanges. Although KYC doesn’t solve the issue of illegal activity on the blockchain entirely, it’s a small domino that can set forth a chain of reactions that may lead to reduced crime on the blockchain network.

Governments and corporations are also actively implementing systems to remove unlawful activities from the blockchain. A noteworthy example is the private company Chainalysis.

Chainalysis was responsible for the arrest of the culprits behind the 2014 Mt Gox heist. The company analyses public ledgers on the blockchain to track the movement of funds. They’ve worked in collaboration with government law enforcement firms such as the FBI and Europol. The company’s latest solutions allow authorities and enterprises to investigate public ledgers as well as provide autonomous compliance tools.

Criminals Love Crypto (Except When It’s More Dangerous Than Cash)

Unlike physical cash, the technology behind cryptocurrency records every single transaction ever conducted. The Bitcoin blockchain also contains details like the address of the wallet, time of transaction, amount transacted and so on. Any illegal transactions occurring today can therefore be investigated with breakthrough technology next tax season, or 10 years from now (provided that the token is still in circulation).

Every day, there seem to be fewer options for converting the digital currency to fiat cash. One of the last anonymous peer-to-peer exchanges Local Bitcoins, now requires KYC for users to move large sums. If you’re in possession of illegal funds, it’s even harder to purchase goods, book flights, or pay for services without revealing your identity. The funds have very limited options to get them out of the system. And if you can’t cash out, what’s the point in using crypto for crime?

Although Bitcoin was briefly popular with Bad Guys during the days of the Silk Road, many in the blockchain world believe that increasing levels of security, decreasing anonymity, and the fundamental immutability of digital assets will deter criminals more than regulation ever could.

At the end of the day, there will always be criminal activity in a new exchange system if there is a window of opportunity. New systems by their nature will always have weaknesses and loopholes that criminals can target.

We should not be discouraged to develop cryptocurrencies further because of its use by criminals. While we often hear from the media that cryptocurrencies are fostering and furthering cime, it’s important to to be critical and assess the larger situation at hand.

Cryptocurrencies have significant advantages over traditional money systems. While there are a lot of problems and flaws with the technology, these are massive opportunities for the market to fix them.

If we continue to assert that criminals love crypto, and will continue to plague the cryptocurrency economy, we’re failing to take into account the supply and demand economics that have almost always resulted in decreasing risk from disruptive technologies.

Share this article

Trending News