Crypto Scams, And The Scammers Who Scam The Stats

Share this article

Bloomberg Research recently published a study from the Satis Group, an ICO advisory service, purporting to show that crypto is a minefield for bad investments. But not only was the reporting selective to the point of being misleading, some of the research itself was clearly gleaned from a cursory Google search – and it was dead wrong.

The biggest takeaway, that “80% of ICOs are scams,” was repeated by dozens of media outlets, along with a study from Boston College, which found that “half of all ICOs die within four months.”

We can’t put all the blame on Bloomberg. The story was uncritically reproduced and shared from Bitcoin.com to Ethereum World News. Even in the crypto sphere, nothing gets clicks like a good scandal.

There’s no denying that crypto is risky. But there’s a lot more to those studies, especially if you take the time to read them.

Unnoticed Fact No. 1. Most ICO Money Went Into Successful Projects.

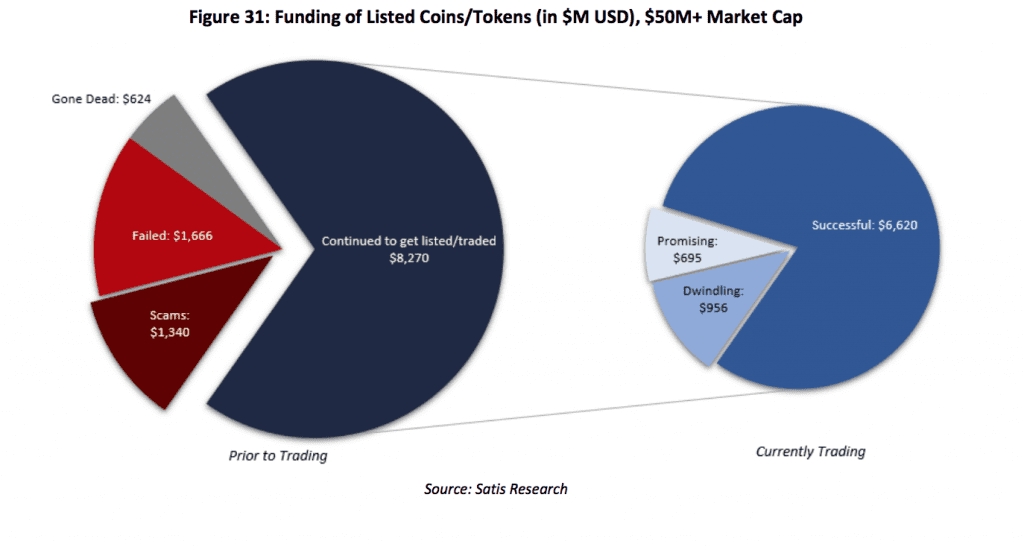

Somewhere in the story was the unnoticed fact that very few of the so-called scams earned significant funding. “Looking at our classifications as a percentage of the US dollars raised to-date (~$12B) we found that only ~$1.3B (~11%) of ICO funding went to Identified Scams, and that number becomes even smaller when you exclude three very large scams,” wrote the authors of the original report.

The three “large scams” were Pincoin, Arisebank and Savedroid.

Savedroid was not a scam. It was possibly the worst publicity stunt since Balloon Boy, but the project is still going on, however shamefacedly – and it was well-documented throughout the crypto media and the mainstream business press.

Arisebank appears to have been an earnest project with naive founders; no money was stolen and all funds are now in receivership.

Pincoin, which defrauded Vietnamese investors of $660 Mln, is the only one which really qualifies as malicious, intentional fraud.

To erroneously declare one ICO a scam might be unfortunate… to declare two, smacks of carelessness.

“Outside these three projects, Identified Scams got away with just $30M in fundraising (or ~0.3% of all time ICO fundraising),” the study says, which the authors attribute to investors who are “relatively adept at discovering scams and adding them to lists.”

Leaving aside the semantics of the word “scam,” $8.2 Bn went to “Successful” offerings, which went on to trade on exchanges and have continuous GitHub Activity.

“This is a very positive story and a direct contrast to the outcome when you look at the percentage of Successful and Scam projects on a per numbers basis,” the authors state. Somehow, this part of the story got omitted from the mainstream narrative.

Neglected Fact No. 2. Most Coin Offerings Did Pretty Well

If your portfolio’s full of ERC-20’s, you probably missed out on a lot of potential gains. According to the Statis study, most of the market cap is in coins.

It’s a tough distinction, considering how often the phrase “ICO” actually refers to tokens. “Coins” refer to independent blockchains, like Bitcoin or Ethereum. Tokens are the one-off projects that rely on them. Considering the fact that it takes under an hour to make an ERC-20 token and start trading, it’s no surprise that the token economy has a lower bar to entry–and thus, more competition.

“Although half of all cryptoassets are classified as tokens (built on other platform networks), nearly 90% of the value resides in coins,” the authors report. Moreover, “the median platform network [e.g. blockchain] trades at ~4x the total value of the overlying tokens built on it.”

Neglected Fact No. 3. There’s A Reason Crypto Has High Payouts

Returning to the Boston College study, there are good reasons why ICOs pay out so well.

That explanation has to do with risk. While high returns can signify overpricing, the scholars found ICO returns were “consistent with high compensation for risk for investing in unproven pre-revenue platforms through unregulated offering.” If you take on more risk, you chance a higher reward.

Compared to the 90% of tech startups that fail, ICO mortality doesn’t look quite so bad.

One could interpret that to mean that crypto is a giant casino—or it could be that, because crypto is so unregulated, so untested, and so risky, that the only way for legitimate projects to compete for investment is by offering oversized returns.

“Scams, while plentiful in number, are not as important in terms of stolen capital because investors are shrewd enough to spot (and underfund) them,” the Boston College scholars write, concluding that “while regulators should continue to deter fraudulent activities, they need to be careful not to throw out the baby with the bathwater.”

If that conclusion is accurate, it might give is an idea what to expect from a better-regulated—and better enforced—crypto marketplace. If regulation can eliminate the scams, it could also lower the market’s temperature.

And the other conclusion to be drawn from the selective use of statistics to prove a point, as Bloomberg and its cohorts have done again, is that statistics don’t lie. People do.

The author has investments in Bitcoin and Ethereum.

Share this article