DApps Out, DeFi In: Dapp.com Publishes Q3 Report

Only Ethereum offers more than just gambling.

DApps are only gaining traction slowly – and in some cases losing ground – but DeFi may accelerate the use of blockchain. That’s the TLDR of Dapp.com‘s Decentralized Application Trends Report for Q3 2019, released today.

The report highlights several worrying trends for dApps in the third quarter, which posted significantly lower figures than the previous period. The report analyzed dApps on six platforms it deemed to be mainstream, which included Ethereum, EOS, Steem, TRON, TomoChain and IOST.

Total transaction volume over this period added up to $2.03 billion, which may seem like an impressive number, but is actually a 40% drop compared to Q2.

DApp developers also seem to have taken a few chill pills: while in the first half of the year they averaged creating 164.6 new dApps every month, in the three months of Q3 they released less than 150 in total. Users have likewise cooled off, with only 36% of Q2 dApp users having used them even just once in Q3.

While these are discouraging statistics, it may be a growing pain on the path to something greater. Compared with the 2018 report, we see much less of a dominance for gambling and pyramid schemes – and more of sound Decentralized Finance.

Ethereum Leads the DeFi Race

Where one buzzword falls, another one takes its place. Decentralized Finance has seen huge growth in Q3, and the vast majority was picked up by Ethereum. Over $525M passed through DeFi services this quarter, and Ethereum accounted for 88% of the total volume.

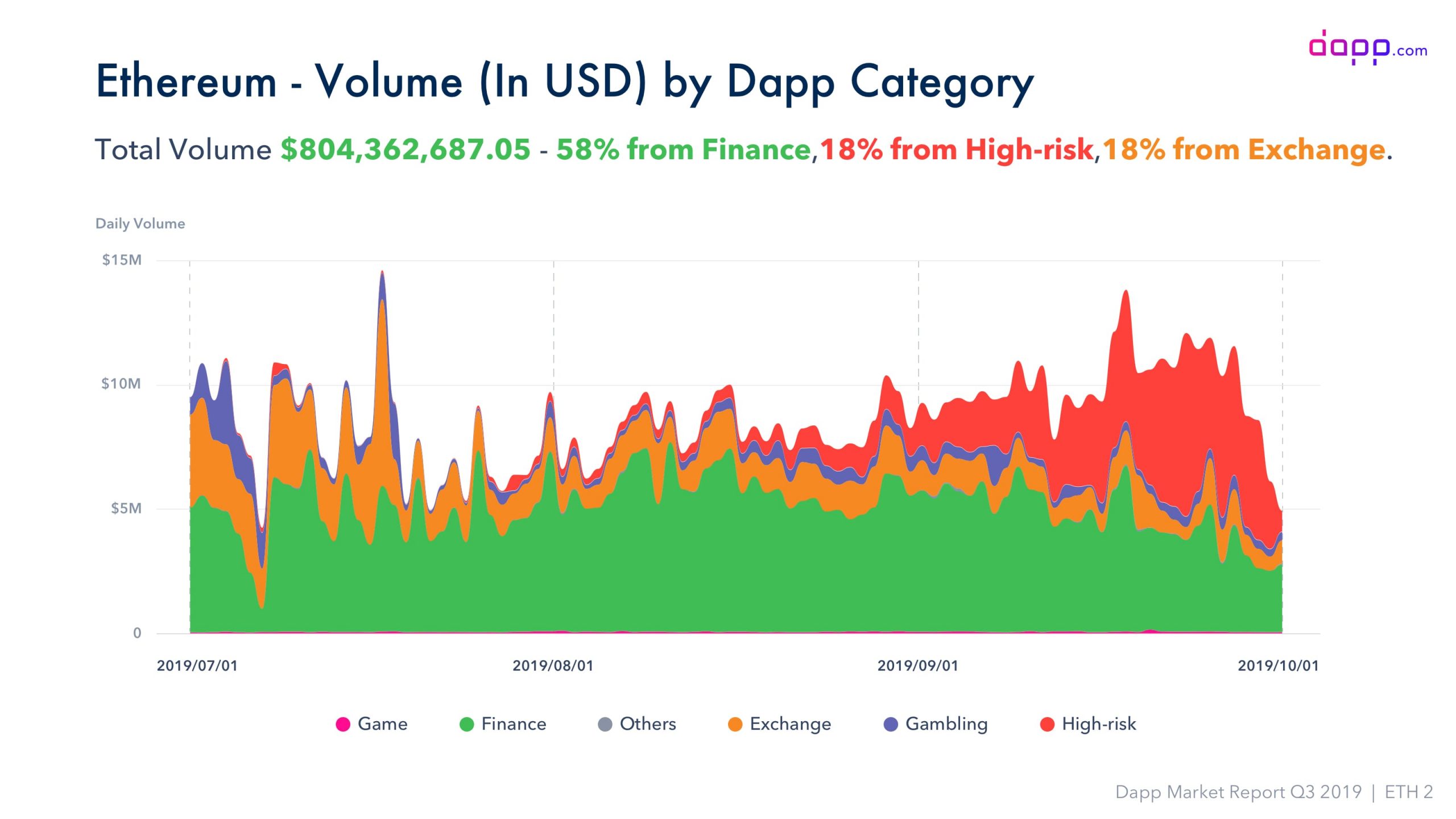

A distinction can be seen even in ETH-only stats, where finance accounts for a much larger proportion of its volume than for other blockchains.

DeFi, exemplified by projects such as Maker, InstaDApp, and Nest, has been largely dominating the volume charts this quarter.

The sharp increase of the High-risk category (a more polite version of scam) is likely attributable to the FairWin Ponzi scheme that played out in September.

Overall, DeFi seems to be gaining traction with new users, 27.6% of whom preferred dApps, compared to 34% for gambling. Speaking of which…

EOS and TRON as the Digital Vegas Strip

The dPoS blockchains produced some mixed accomplishments, with EOS achieving the highest user retention rate from Q2 of 40%, compared with Ethereum’s 5% and TRON’s 15%. Despite this, EOS’ overall growth has been the slowest among the top dApp blockchains, with fewer than 220,000 new accounts.

TRON has performed comparatively well, adding 500,000 new users in Q3 that contributed to making it the largest dApp platform launched after 2017.

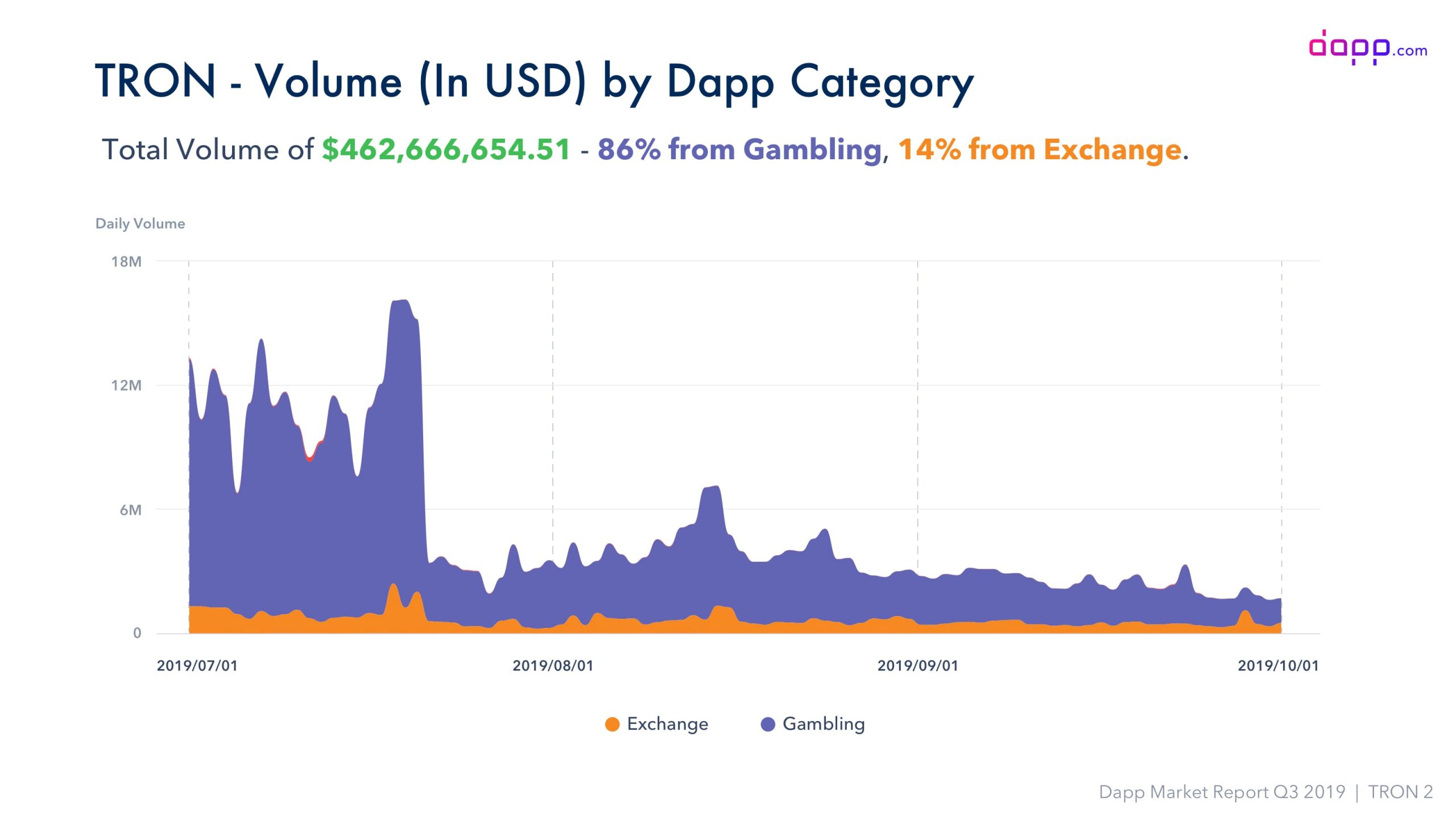

But they are the least diverse in terms of dApp categories, with gambling comprising the majority of the volume: 63% for EOS and 86% for TRON.

Gambling is a relatively niche field. The global market size for gambling stands at around $450 billion, compared to $1.5 trillion for financial services in the U.S. only.

Failing to diversify could leave the gambling platforms far behind their DeFi-friendly competition.

Earn with Nexo

Earn with Nexo