Could DeFi Be the Next Google?

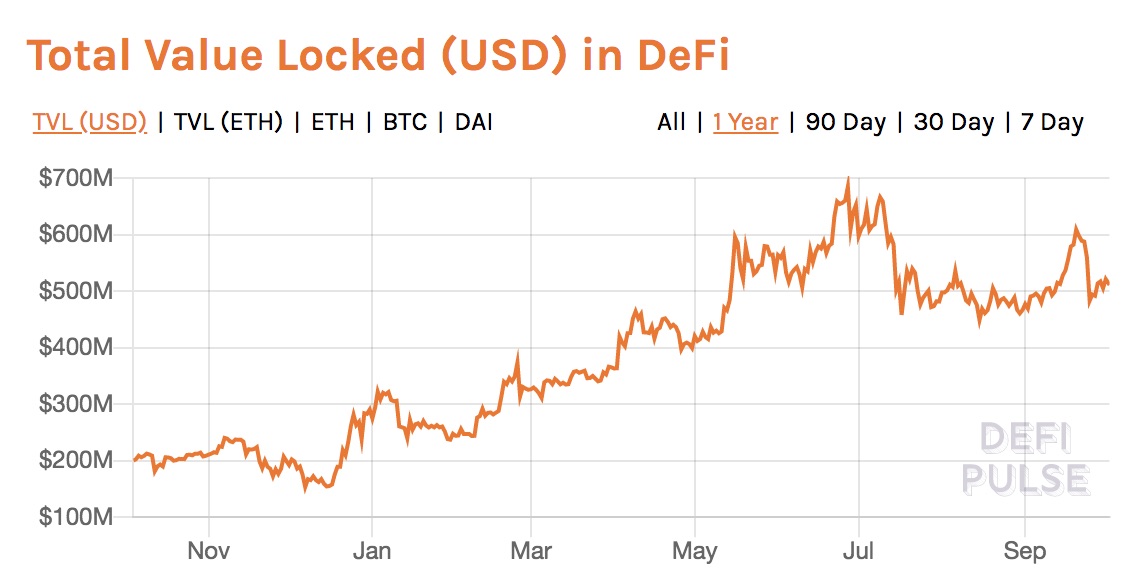

The DeFi sector has doubled this year.

Share this article

In the near future, decentralized finance (DeFi) may provide a whole host of financial services and products, which are currently inaccessible to the vast majority in the world’s population. Much as search engines rapidly made the internet indispensable to modern life, smart contracts could be on their way to becoming a cornerstone of modern finance.

DeFi smart contracts currently hold more than $500M in assets. That’s more than double the amount since the start of the year.

But how many people will actually use DeFi applications? Very few people understand Bitcoin (BTC), let alone the more complicated digital assets.

Technical and financial complexity excludes the vast majority of people, and that takes us back to square one. As Crypto Briefing reported earlier this month, the preponderance of arbitrage and other sophisticated trading strategies shows that DeFi has mostly been the preserve of professional traders.

Perhaps that’s why a DeFi portal based out in India has managed to attract investment from some of the largest, most reputable names in the space. InstaDApp announced earlier this week that they had raised $2.4M in seed capital from the likes of Pantera Capital, Coinbase Ventures as well as Loi Luu, from Kyber Network (KNC).

“DeFi allows anyone to launch a bank,” explained InstaDApp co-founder Sowmay Jain, in a call with Crypto Briefing. It allows innovation, which is currently limited to a handful of tech hubs, to “happen in any corner of the world.”

InstaDApp provides access to a host of interoperable DeFi applications all from the same interface. Based on a smart contract layer, users can make transactions across otherwise separate protocols in a single step. Previously that would have been expensive and time-consuming, involving multiple transactions and hours spent researching differences in data-sets.

The project’s first protocol bridge was between CDP provider Maker and lending platform Compound, allowing users to easily switch debt positions between the two providers. After launching in early July, the value locked into InstaDApp smart contracts has increased ninefold, from $4M to $35M, in a three-month period.

The number of DeFi protocols has exploded in recent months. There are now more than fifty different projects, according to the data site DeFi Pulse. That includes projects offering decentralized financial products, like Maker or Ampleforth, as well as wallet providers and infrastructure projects, like InstaDApp.

The industry is still not established enough to offer services to everyone, says Jain. A lack of fiat onramps restricts DeFi to those who hold cryptocurrencies, although that will change as digital assets begin to integrate with mainstream finance.

As the numbers of users and providers grow, the technical infrastructure underpinning DeFi will become more important. By offering bridges between the different protocols, InstaDApp believes it can make the DeFi space more attractive to users.

Judging by the seed round, that’s what investors think too. While there are still only a handful of dApps, an investment in the plumbing suggests the market is already thinking long-term about the future of DeFi.

It’s hard to judge how successful a sector will become at such an early stage. But when Google and Amazon were obscure startups in the 1990s, they also attracted multi-million dollar investments.

History never repeats itself, but it does rhyme.

Share this article