Did Bitcoin Hit Bottom Last Week?

Bitcoin rallies while the stock market continues to tumble, suggesting that last week could have been the bottom.

Key Takeaways

- Bitcoin rallied while S&P 500 fell, showing that Bitcoin may have decoupled from the broader market

- Most assets experienced sell-offs during the historic market drop on Mar. 12 last week

- Bitcoin prices rose because they were oversold during the panic, according to one crypto fund and several indicators

- BTC's case as a safe haven asset is still untested. However, the recent move supports the possibility

Share this article

Bitcoin decoupled with the stock market after it rallied 15% over the last 48-hours. The stock market, meanwhile, continued to take a beating. Did Bitcoin recover from a bottom?

Bitcoin Leaves Stock Market Behind

In another surprising move, Bitcoin regained its footing after two weeks of unprecedented correlation with the stock market. Beginning on Mar. 19 at 12:00 AM, Bitcoin prices surged 19% over 12 hours, rising from $5,300 to $6,300.

Over the same period, the S&P 500 posted gains over 5%. That rise, however, was erased in a 4.2% fall today, putting the stock market back on its downward trajectory. Meanwhile, BTC held on to its gains, trading at $6,200 at press time.

Assets Become Correlated in Liquidity Crunch

On Mar. 12, freefalling equity prices stemming from COVID-19 and shocks in the oil supply triggered a global liquidity crunch. The growing possibility of a global recession led investors to flee from risky assets into cash. The sell-off was indiscriminate. Major indices, oil, gold, and Bitcoin all suffered startling losses.

However, Bitcoin was especially hard-hit, suffering a 40% drop as liquidity evaporated. Derivative exchanges like BitMEX and Deribit further exacerbated the sell-off. Rapidly falling prices appear to have triggered a tsunami of liquidations, creating a feedback loop that drove prices even lower.

It took BitMEX going offline for three hours, reportedly because of “hardware issues,” to stop the cascade of liquidations. Had the derivatives exchange remained online it’s possible that Bitcoin’s price would have dropped even further than $3,900.

That said, the move may have been a normal correction, especially given that it’s the first time Bitcoin has existed in a bear stock market. As Diana Pires, VP of Institutional Sales at Crypto.com explained:

“Bitcoin has performed as it should given the current economic climate—we have seen gold do just that [and fall in price], an asset we often liken to Bitcoin. Assets suffer during crises, it’s to be expected.”

Bitcoin Correlation with S&P Hits All-Time High

During this period of volatility, correlation measures between stocks and Bitcoin an hit all-time high.

Bitcoin prices even reacted favorably when the Federal Reserve announced it would print more money to stabilize the economy. That day, the Fed revealed it would restart quantitative easing to the tune of $700 billion while cutting the federal funds rate by a full percentage point, bringing rates close to zero.

Bitcoin popped over 14% following the news before dropping off alongside the S&P after the stimulus failed to calm the stock market’s jitters.

Why Did Bitcoin Prices Go Up Today?

According to one theory, Bitcoin was oversold relative to the S&P 500 during the panic, meaning the correction to current prices represents “normal.” As said by QCP Capital, a digital asset fund:

“Last week’s BTC sell-off was overextended relative to the equity risk-off (probably due to severe liquidity dislocation in the perp/futures markets), but with last night’s BTC rally we have now realigned with the S&P Futures correlation implied levels.”

Other indicators also suggest that Bitcoin was oversold during the panic. The Crypto Fear & Greed Index, a measure of market sentiment, reported record levels of fear during the sell-off.

Another measure showing the bottom is in is “Realized Price,” which estimates the average purchase price of a Bitcoin based on its transaction history.

For the majority of Bitcoin’s history, coins have traded above this minimum value, representing a gain for the holder. When prices fall below Realized Prices, it has, thus far, predicted market bottoms.

And, as prices dropped below $5,600, the average holder would have sold at a loss, suggesting that the market hit such a bottom on Mar. 12.

Will Bitcoin Decouple from Stocks?

And the billion-satoshi question remains: will Bitcoin decouple from stocks during a global bear market?

The answer isn’t clear. Satoshi Nakamoto launched Bitcoin at the beginning of the longest bull market in history. As a result, there is no data showing how the digital asset will behave in a bear market.

The worst-case scenario is that Bitcoin is correlated with the stock market. Given the risk profile of the crypto-asset, this would mean that prices would fall, in terms of percent, even faster than the S&P 500, according to the capital asset pricing model. However, the data supporting long-term correlation is difficult to sniff out given BTC’s volatility.

A middle scenario is that Bitcoin is mostly uncorrelated, or only correlated with the stock market during economic contractions that spur the need for liquidity. This would suggest that the factors driving Bitcoin’s growth, adoption, and price are mostly independent of the global economy.

The best-case scenario is that Bitcoin performs like a nascent safe haven asset. Its newness means it could grow rapidly, independent of the economy, while its status as a safe haven protects it from cyclical downturns.

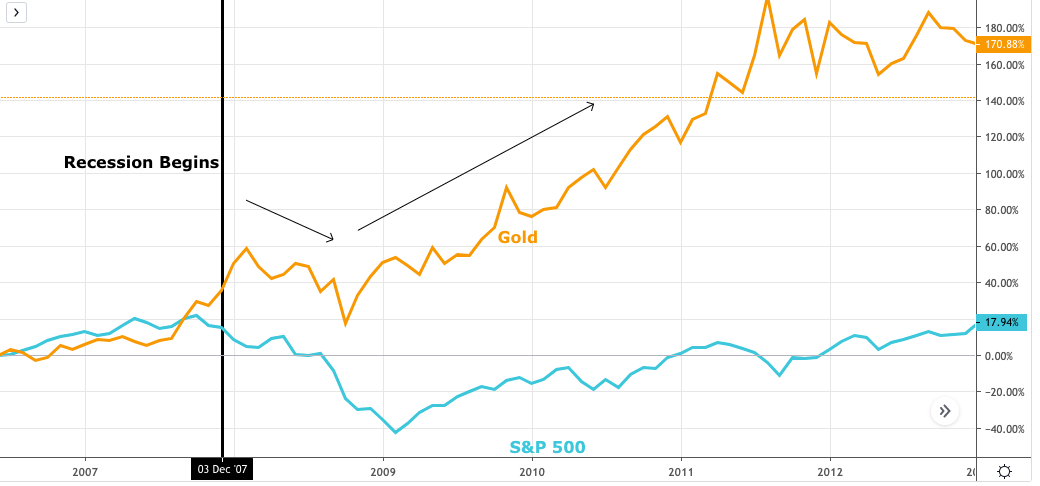

If so, Bitcoin could be behaving like gold did in 2008. First dropping in line with the market to satisfy demands for liquidity and then recovering much faster than the market.

Where BTC is Headed

Fundamentally, Bitcoin hasn’t changed since its atmospheric drop last week. The sentiment now is similar to the crypto bear market triggered by uncertainty around Mt. Gox in 2012. But, unlike 2012:

“We have not only seen crypto being used for trading and investing, we have now seen adoption; crypto being used to pay for goods and services. The market has matured significantly, and with that our overall outlook,” said Pires.

Bitcoin’s value proposition remains the same—money that doesn’t need justification or authorization. In any scenario, Bitcoin is an exceptional investment adjusted for risk, advocates argue. The downside is limited. Meanwhile, it’s not outside the realm of possibility that Bitcoin reaches $100,000 on the upside.

In any scenario there is one thing that is guaranteed—investors are in for a wild ride.

If you liked this article, take a look at SIMETRI for more in-depth analysis and crypto-asset research.

Share this article