ETH 2.0 Won’t Fix Ethereum’s Scalability Problems, Analyst Argues

ETH 2.0 might not solve Ethereum’s high gas fee problem, according to one analyst.

The average transaction fee on Ethereum costs $7.5, three times that of Bitcoin. Setting up a wallet on MakerDAO costs over $40, while the fees to lend on Compound amount to $10. These ludicrous fees are not sustainable.

With new yield farming incentives on DeFi platforms being launched every other day, the space continues to expand despite alarming signals around network congestion and high fees.

DeFi users are eagerly awaiting the eventual launch of ETH 2.0, which promises to scale the blockchain, but that too might not be enough to support the existing number of crypto users.

The Realistic Take on ETH 2.0

The number of unique DeFi addresses is rising quickly with the addition of 350,000 addresses since the beginning of the year . While DeFi platforms like Uniswap surpassed Coinbase in terms of trading volume, its user base is still tiny compared to Coinbase’s 32 million customers.

Assuming network gas fees have peaked, it is a good time to realistically assess how much of a difference Ethereum 2.0 will make on fees.

It starts with 64 shards at first so it should be able to handle at least 64x more usage (potentially even more if we get some L2 adoption as well).

— David Iach (@davidiach) September 18, 2020

Ethereum 2.0 is initially set to begin with 64 shards, each shard could potentially operate as a separate chain with its own transaction history. Under such a scenario, the network would increase its transaction capacity by 64-fold.

Kruger’s estimate is based on the assumption that each DeFi user has four addresses. Following that logic, that equates to about 114,000 unique users. Under the optimistic assumption that each DeFi user only uses two addresses, that’s closer to 220,000 users. With 64 shards this equates to about 14 million users—still short of what Coinbase can handle. To make matters worse, Coinbase is just one of several large exchanges.

Following this analyst’s logic, sharding on Ethereum 2.0 won’t fully solve its congestion problems alone.

Effectiveness of Ethereum’s Layer-2 Proposal

This is where layer-2 applications come into the picture. Ethereum co-founder Vitalik Buterin endorses the use of existing layer-2 scaling solutions like Zk-sync, OMG, and Loopring for ordinary transactions. According to Buterin’s estimates, it has the potential to scale the number of transactions from 12-15 transactions per second (TPS) to over 2,500 TPS.

High gas fees are starting to affect exchange profits. As a result, exchanges are increasing their transfer fees, pushing users to find other alternatives for moving their crypto. While Tether’s implementation of Zk-roll ups is significant, there has been minimal adoption among other exchanges.

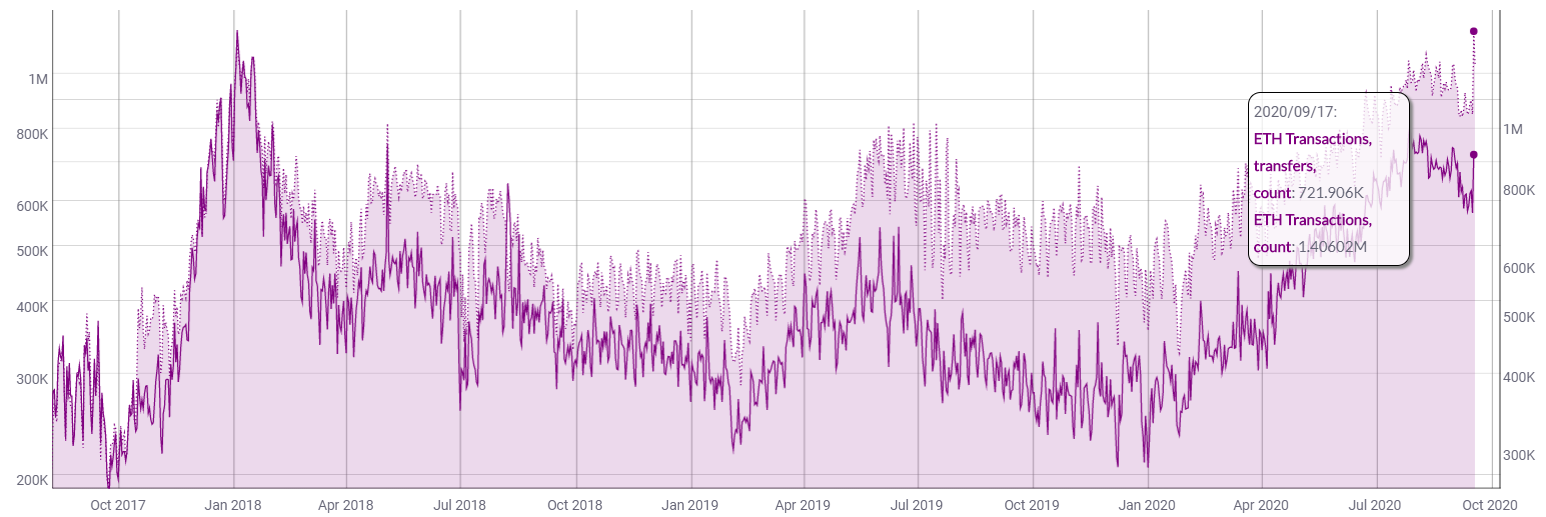

On Sept. 17, Ethereum’s transaction count crossed an all-time high of 1.34 million for the first time since its 2018 peak. Moreover, during the 2017 bubble, non-value based transactions like smart contract execution on Ethereum was less than 2% of the network’s total transactions, which has risen to an extraordinary 50% as of Friday.

Given that layer-2 solutions are proposed only for simple transfers of Ether, its effect on the total gas fees will be minimal. As such, a combination of changes is necessary to scale Ethereum to the needs of DeFi.

The road ahead of scaling Ethereum is still long and arduous, despite the promise of ETH 2.0.