Ethereum Options Hit All-Time High as Investors Prepare for Volatility

As options prices fall, market neutral strategies have low risk and high reward.

Key Takeaways

- Ether options hit an all-time high in open interest and all-time low in implied volatility.

- Market neutral options plays are in favor as traders ready for a burst of volatility in either direction.

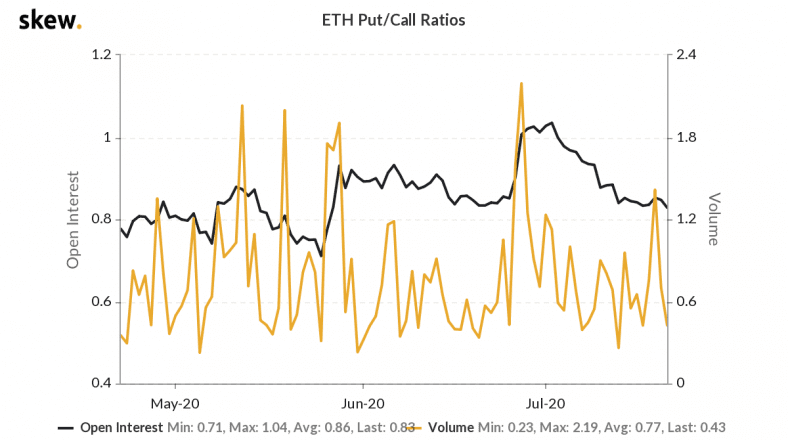

- A declining put/call ratio indicates that a majority of traders believe ETH is due for a rally.

Share this article

Ethereum options hit an all-time high in open interest as volatility in the market hit record lows. Market data further indicates that longing volatility with a bias to the upside is the current play.

Ethereum Options and Betting on Volatility

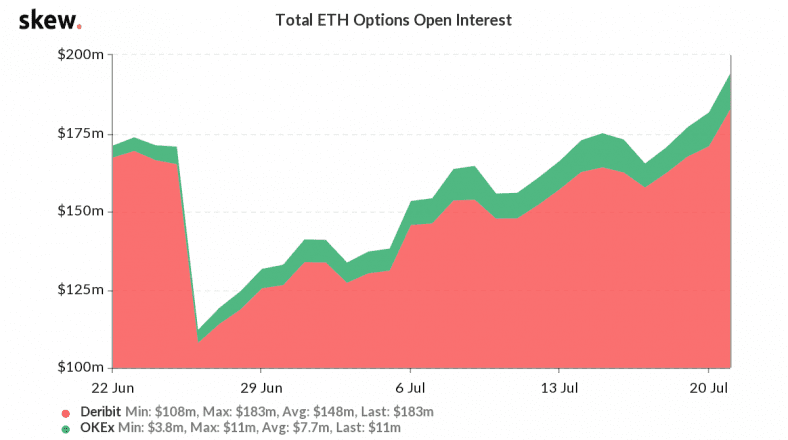

Open interest for ETH options has made a fresh all-time high of nearly $200 million. Just two months ago, ETH options broke their previous highs for open interest.

This time around, however, buying options are one of the most favorable trades.

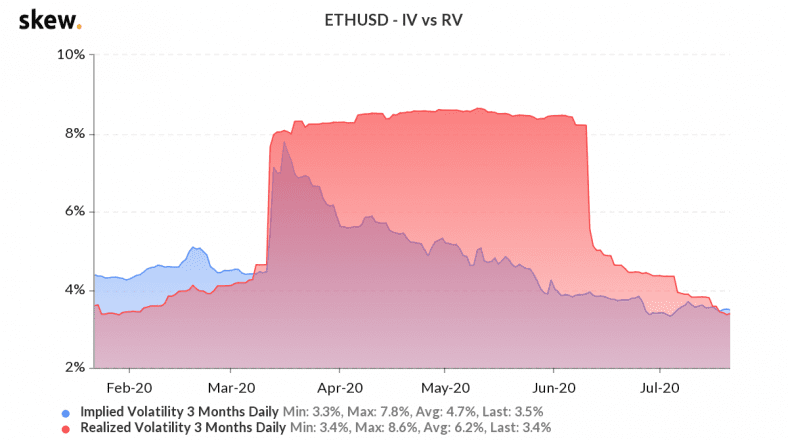

ETH implied volatility is at an all-time low, while realized volatility hovers around it’s yearly low. Implied volatility is a variable determined by the Black Scholes option pricing formula, and realized volatility is actual historical volatility.

Low implied volatility is a sign that options are cheaply priced. Traders take advantage of this by entering a dual-legged option trade known as a straddle or a strangle.

These two strategies involve a trader simultaneously purchasing a call and a put option with the same expiration date. A straddle is when the call and put have the same strike price; a strangle is when the two strike prices are different.

Both of these strategies are market neutral, meaning they profit if the price of the underlying assets breaks to the upside or downside. The end-game of these strategies is to gain long exposure to volatility.

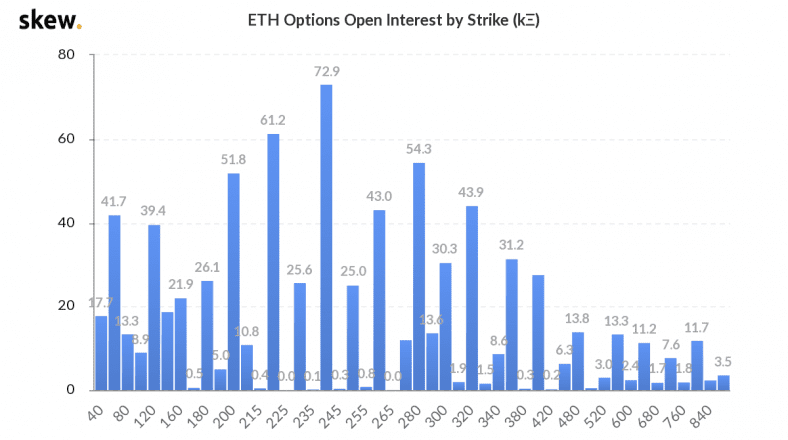

Ethereum options are concentrated in options expiring on Jul. 31, 2020, and Dec. 25, 2020. The most concentrated individual strike prices are $200, $220, $240, and $280.

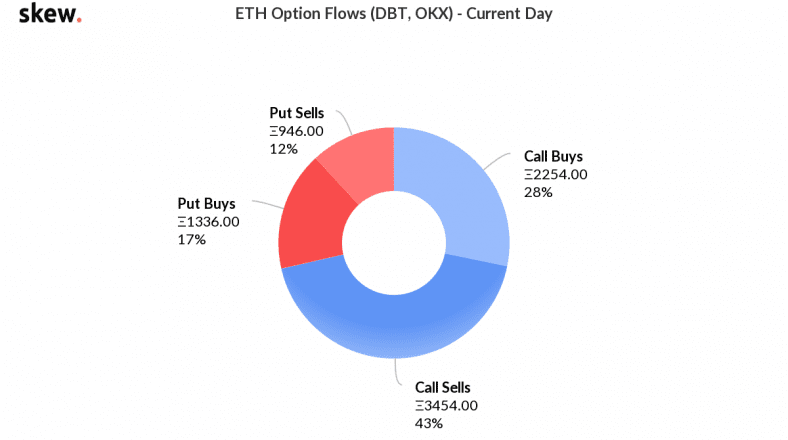

Capital flow has been steadily moving further into calls, rather than puts, as evidenced by the declining put/call ratio since the end of June. This is a sign that options traders believe there is a higher chance for upside than downside.

Predicting which direction ETH will move in is futile at this moment. However, with implied volatility at record lows, longing volatility is the consensus trade.

There is still room to take advantage of low volatility as Ethereum options data shows more capital flowing into selling options rather than buying options.

Share this article