Ethereum Shorts Fall To Record Low

Share this article

The number of traders betting against ether (ETH) has dropped to an all-time low, suggesting a dramatic reversal in investor sentiment.

Data from Bitfinex show that the volume of ether short trades has dropped by more than 75%, from approximately $320,000 at the beginning of February to $74,500 today. The fall may represent a significant change in market attitudes from just a few months ago.

Short trading reached an all-time high of $430,000 in early December, as cryptocurrency markets suffered a massive sell-off. Volumes are currently at the lowest levels since Bitfinex started offering the position in August 2017.

Fewer shorts suggest more gains

Traders use short positions to bet against an asset, and profit if the price declines. The volume of short positions is usually negatively correlated with the price of the underlying asset: when one begins to rise, the other starts to fall.

As evident from the graph above, the volume of ether shorts on the exchange nearly quadrupled between November and December, as prices across the digital asset market fell.

Both movements were accompanied by dramatic falls in ether prices. In November, the volume of Bitfinex shorts increased by roughly $150,000 during the contentious BCH fork. Short trading shot up again on December 6th as ETH fell below the $100 mark.

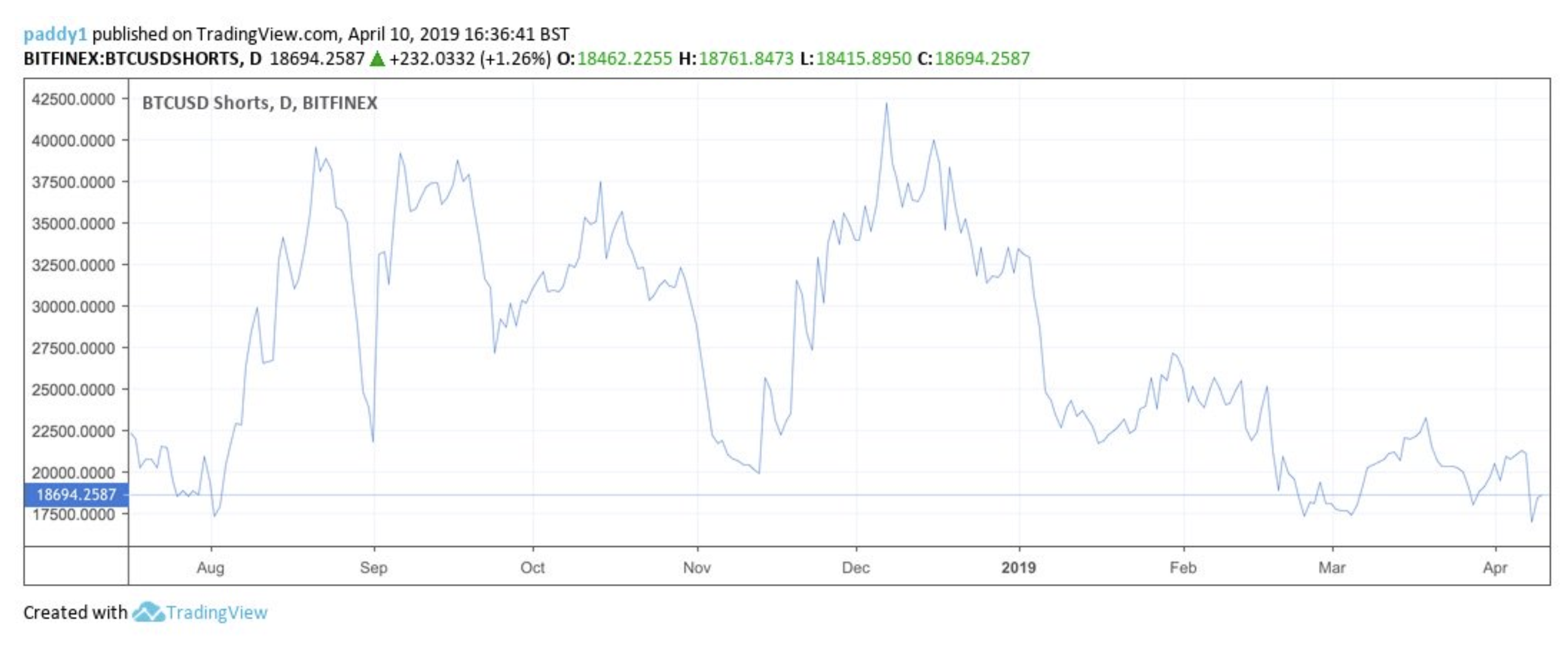

The trend isn’t restricted to ether. The volume of bitcoin (BTC) short positions has also dropped to the lowest levels seen since early August 2018.

This, too, appears to correlate negatively with spot prices. Shorts against bitcoin declined in the run-up to the initial deadline for the VanEck-SolidX ETF application, only to shoot up by more than 120% when the SEC delayed its decision. Short positions dropped again following last week’s ‘bitcoin boom.’

What does it mean for ETH prices?

Bitfinex’s terms of use allow margin traders to leverage up to three times the value of their collateral. Since not all traders use the maximum amount of leverage, the data presented here might well be an exaggerated reflection of the market reality.

Still, declining short volumes suggest that a growing number of traders expect the price of ether, as well as bitcoin, to continue rising in the short-term. The caveat is that sentiment can change at a moment’s notice, as the ETF delay showed.

If the market for leveraged trades is any indication, last week’s surge might just be the warm-up.

Share this article