Big Finance Tried to Discredit Bitcoin, Here's Why They're Wrong

Some institutions are dwelling on an incoherent thesis in an attempt to discredit Bitcoin.

Key Takeaways

- Critics believe Bitcoin is a bad investment because of its lack of yield and use in money laundering.

- The argument that Bitcoin's volatility is the main reason for hedge fund interest is a coherent argument, but could be discarded in the years to come.

- Bitcoin is a monetary asset, not a claim on ownership of a company; a lack of cash flows is not detrimental to its investment thesis

- Systemic financial institutions using dollars have been charged with more serious fraud than any criminals using BTC have.

Share this article

Bitcoin’s institutional detractors often harp on the digital asset’s lack of cash flows and use in facilitating illicit activity as reasons to steer clear. Here’s why they’re wrong.

Evaluating Criticism of Bitcoin

Institutional critics love to highlight Bitcoin’s lack of cash flows and its role in money laundering and use in darknet markets. According to a recent investor call, Goldman Sach’s wealth management division holds a similar view.

The bank said Bitcoin has no viable investment thesis, and hedge funds are merely taking advantage of the digital asset’s infamous volatility.

Several legendary investors agree with Goldman’s assessment.

Warren Buffett’s stance is that it “doesn’t produce anything,” and investors “can’t do anything with it except sell it to somebody else.” Bridgewater Associates founder Ray Dalio also sees nothing of interest in Bitcoin despite advocating for alternative investments like gold amid rising debt levels.

What is it that these investors are missing? After all, Buffett and Dalio are two of the most successful investors in the last century.

To quote Buffett himself, “never invest in something you cannot understand.”

Hitting Back at Critics

Bitcoin is a Monetary Asset, Not an Equity Share

Although institutional adoption of cryptocurrency is underway, several traditional financial institutions are still opposed to investing in Bitcoin. This opposition is, however, rooted in the very system that Bitcoin seeks to upend. They are not unlike the horse owners living in the rise of the automobile.

ARK Invest lays the groundwork for a coherent argument against these critics.

The primary criticism of Bitcoin is that cash flows or a real-world asset don’t back it – but neither are fiat currencies and gold. Investors tend to group Bitcoin with equities, which is a false equivalency.

Other than the two asset class’ correlation over the last three months, there are no similarities. BTC is not a claim of ownership over a corporate entity.

Bitcoin is a non-productive monetary asset, much like gold is. It was designed to resemble a form of gold with a capped supply. It can be argued that Bitcoin is better than gold. The digital asset boasts better transferability, portability, and divisibility – three aspects that allow Bitcoin to be both a medium of exchange and store of value against gold’s pure store of value narrative.

Gold beats out Bitcoin simply because it has been used and trusted for millennia.

And as BTC fights to find its place in the world of finance, it’s fair to say that hedge funds have been eager to trade the resulting volatility. These effects have been overstated, however.

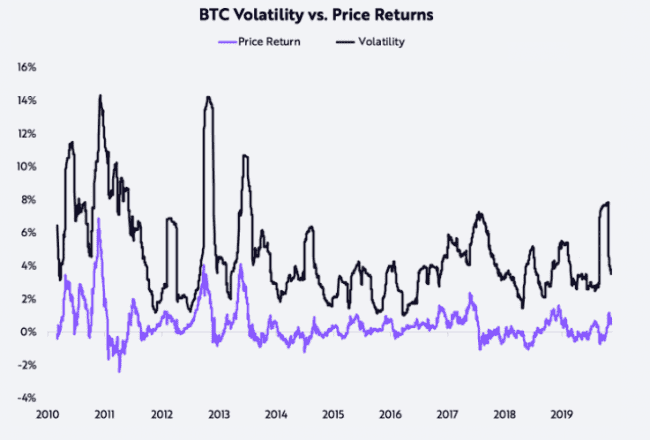

Bitcoin’s realized volatility hit its all-time high in 2011, only to be tested once in 2013 and never seen again. The digital asset’s volatility has since been in a state of constant reduction.

Still, BTC is far more volatile than most other traditional financial assets.

Even RenTech’s esteemed Medallion Fund added Bitcoin futures, not spot markets, to the fund’s investment mandate.

Though valid, criticizing the premier crypto for its volatility may soon lose favor as BTC settles down.

Bitcoin’s Illicit Activity Is Just 7% of J.P. Morgan’s

Bitcoin’s role in online darknet markets is diminishing. The advent of blockchain analytics companies like Chainalysis and Elliptic has put a dent in black markets by allowing authorities to track the flow of BTC like never before.

Black markets, however, will always exist, just as they did before Bitcoin.

Indeed, cash is used to facilitate more illegal activity than cryptocurrencies ever could.

In fact, the very investment bank that offered this as a critique of Bitcoin’s investment thesis, Goldman Sachs, is in the process of weaseling their way out of a $2 billion fine for their role in looting a sovereign wealth fund of close to $2.7 billion.

Additional comparisons with legacy finance show the same conclusions.

Chainanlysis’s Crypto Crime Report, released in January 2020, noted that $600 million of darknet trade was done in BTC during Q4 2019.

Annualizing this figure, BTC facilitated $2.4 billion of illicit activity – just 7% of the $35.24 billion in penalties J.P. Morgan paid over three years for misleading investors with falsified information after the 2008 financial crisis.

Concluding, financial spokespeople have failed to categorize Bitcoin accurately. It is nothing like an equity share, and thus demands a different framework. Once understood as a currency or commodity, it becomes clear that legacy systems are inferior.

Share this article