Gamers Rejoice as Crypto Winter Tanks GPU Prices

Prices for high-end graphics cards have more than halved over the past six months.

Key Takeaways

- High-end graphics processing units (GPUs) have tanked in value on the secondary market over the past six months.

- The falling price of Ethereum and its upcoming switch away from Proof-of-Work have contributed to the decreased demand.

- Rising energy costs have also hurt miner profitability, resulting in many miners selling their graphics cards to recoup costs.

Share this article

The declining crypto market has caused prices for graphics cards on the secondary market to plummet.

GPUs Come Back Down to Earth

Graphics cards are becoming more affordable for their intended purpose.

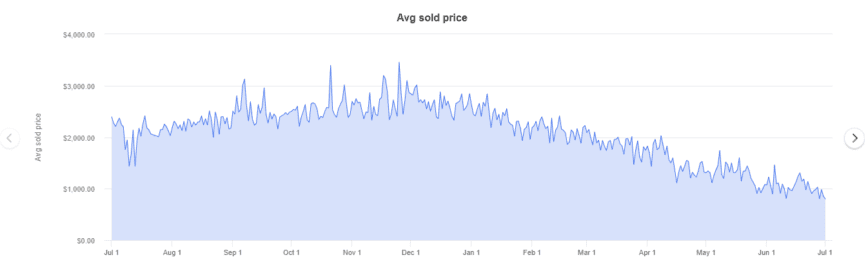

High-end graphics processing units (GPUs), popularly used for mining Proof-of-Work cryptocurrencies such as Ethereum, have plummeted in value on the secondary market over the past six months.

According to completed listings data compiled from eBay, the latest models from Nvidia’s RTX 3000 series and AMD’s 6000 series have seen their prices drop 50% since the start of the year. In January, an RTX 3060ti, one of the most efficient consumer-grade cards for mining Ethereum, typically set buyers back upwards of $1,000. Now, the same card trades hands on eBay for around $492.

Secondary sales of other cards show similar trends. Nvidia RTX 3070s and AMD RX 6800 XTs have also registered over 50% declines in recent months. Additionally, more powerful cards, such as the RTX 3080 and 3090 models, show larger discounts compared to their more mining-efficient counterparts. The RTX 3090, until recently the most powerful card in the RTX series, has seen the most significant price drop, previously selling for up to $2,788 in January, down to an average of $1,106 today.

The higher decline in the prices of the RTX 3080 and 3090 models suggests these cards may have been selling at an additional premium unconnected to their use in crypto mining. While demand from crypto miners has contributed to graphics card price rises over the past two years, scalpers taking advantage of semiconductor supply issues caused by COVID-19 lockdowns are also responsible for less mining-efficient graphics cards trading at exorbitant prices.

Graphics cards are an essential component in personal computers that convert code into images that can be displayed on a monitor. While high-end GPUs let gamers play popular titles in high detail with advanced effects, the processors that render these high quality graphics are also effective in solving the complex equations needed to mine some cryptocurrencies. As the crypto market roared to new highs in late 2020, demand for graphics card soared. At the height of mining profitability in 2021, cards bought at main sale retail price could be paid off after around three months of Ethereum mining.

Now, falling crypto prices, and thus mining profitability, has provided relief to the GPU market. Ethereum, the second-largest cryptocurrency behind Bitcoin, has consistently been the most popular coin to mine using consumer-grade GPUs. Since the start of the year, Ethereum has nosedived from over $3,600 to just over $1,000, representing a drop in value of more than 70%.

Ethereum Merge Slashes GPU Demand

Additionally, Ethereum will soon switch from a Proof-of-Work to a Proof-of-Stake consensus mechanism in a long-awaited upgrade dubbed “the Merge.” This will bring an end to using GPUs to validate the network, replacing energy-hungry computations with a greener coin staking mechanism. The switch to staking is estimated to reduce Ethereum’s carbon footprint 100-fold while reducing coin emissions by around 90%.

With the Merge expected to occur later this year, many Ethereum miners are slowing down their operations in preparation. While some miners have announced plans to switch to other cryptocurrencies such as Ethereum Classic or use their GPUs for on-demand video rendering post-Merge, there’s no guarantee these activities will be as profitable as mining Ethereum—if at all. Those mining today will likely be apprehensive about buying more graphics cards with an uncertain future ahead.

One final issue contributing to falling GPU prices is the increasing cost of energy globally. The World Bank Group’s energy price index shows a 26.3% price increase between January and April 2022, adding to a 50% increase between January 2020 and December 2021. With energy prices surging, more miners will struggle to eke out a profit—especially smaller home miners who pay domestic electricity rates. A combination of rising energy costs and plummeting crypto prices has likely made it uneconomical for many hobbyists to continue mining. As those who decide to unplug their rigs sell their cards to recoup costs, pushing decrease due to the increase in supply.

While GPU prices have dropped from the jacked-up prices consumers have come to expect over the past two years, there could be scope for them to drop further. Semiconductor shortages combined with excessive demand caused GPU makers to up their retail prices to fall more in line with secondary market sales. However, the recent influx of used cards on marketplaces like eBay has brought the going rate down well below main sale retail prices. If manufacturers like Nvidia and AMD want to continue selling new units, they face adjusting their prices to compensate for secondary market supply. This isn’t the first time manufacturers have been hit—in 2019, Nvidia reported disappointing sales of its then-new 2000 series cards, which the company blamed on second-hand GPUs flooding the market after the mining boom during the 2017 crypto bull run.

With Ethereum moving away from Proof-of-Work mining and crypto prices settling into a bear market, graphics card prices are finally returning to normal. Still, if another Proof-of-Work coin takes off in the future, GPUs could once again become a hot commodity.

Disclosure: At the time of writing this piece, the author owned ETH and several other cryptocurrencies.

Share this article