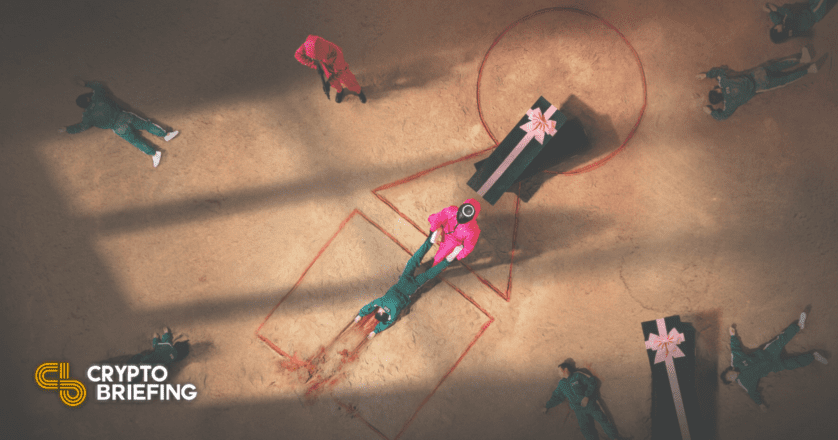

How a BSC Project Used Netflix's Squid Game to Scam Investors

The hyped Binance Smart Chain project inspired by Squid Game has been abandoned after its team sold off the token supply.

Key Takeaways

- The Squid Game project's SQUID token has lost 99.99% of its value after a rug pull.

- The crypto project gained popularity after leveraging the name of this year's most popular Netflix series.

- The team has deleted its official website and made off with just under $12 million.

Share this article

The Binance Smart Chain project has plummeted to almost zero in the latest DeFi rug pull on investors.

Investors Scammed by Squid Game Token

Squid Game, a Binance Smart Chain project inspired by the hit Netflix show of the same name, has crashed. The project’s own team caused the crash by removing almost all of the liquidity from its pools on decentralized exchanges.

The project launched only last week and gained traction by leveraging the popularity of the Netflix show Squid Game. The project’s founders, whose identities are unknown, launched a token called SQUID on Binance Smart Chain. The token was available to buy on the decentralized marketplaces PancakeSwap and DODO. It rallied over 300,000% in less than a week, but several signs hinted that it could be a scam.

Squid Game launched a period of mania for so-called “meme coins,” with several dog-themed tokens like Shiba Inu and Floki Inu also rallying in the same week. Though the project had no official connection to the Netflix series, it caught the attention of many mainstream media outlets due to its theme, which likely acted as a catalyst for the token’s rise.

According to data from CoinMarketCap, SQUID traded at $0.012 on Oct. 26 and briefly hit an all-time high of $2,856 today.

The extreme boom in SQUID’s price was helped in no small part by the project’s “anti-dump mechanism,” which was attached to the SQUID token’s smart contract. This mechanism allowed investors to buy tokens but prevented them from selling.

Earlier today, the team sold the circulating supply of SQUID tokens through PancakeSwap and DODO, leading the price to decline by more than 99.99%. Following the incident, the project’s official website went down, while Twitter restricted its account due to “unusual activity.”

In a Telegram update, the team claimed that someone was “trying to hack” their Twitter account as well as their token’s smart contract. It then announced its departure from the project. A message read:

“Squid Game Dev does not want to continue running the project as we are depressed from the scammers and are overwhelmed with stress.”

Onlookers in the crypto community have reached the conclusion that the team executed a rug pull, duping investors into buying the token then removing all of the liquidity by selling it on the open market. The team made just under $12 million from the sale.

The incident sheds light on how hype can drive users to invest in dubious cryptocurrency projects without exercising caution or due diligence. This particular project used Squid Game’s success to dupe investors, and many overlooked its “anti-dump mechanism” even though it was disclosed in the whitepaper.

Squid Game joins a long list of other notable exit scams on Binance Smart Chain and other blockchains. TurtleDex, Luna Yield, and PolyWhale are just some examples of crypto projects that have met a similar fate in recent months.

Share this article