Is BitMEX Costing Bitcoin Users Higher Transaction Fees?

According to new research, BitMEX broadcasts megabytes worth of transactions every day at the same time. This practice slows confirmation times and costs Bitcoin users higher transaction fees.

Key Takeaways

- BitMEX’s handling of Bitcoin transactions raises transaction fees unnecessarily, according to new research.

- Bitcoin fees spike at 1pm UTC every day.

- Coinbase recently introduced batching to reduce its impact on the network.

Share this article

BitMEX’s handling of Bitcoin transactions raises transaction fees unnecessarily, according to new research.

BitMEX Bitcoin Transactions Causing Fee Spikes

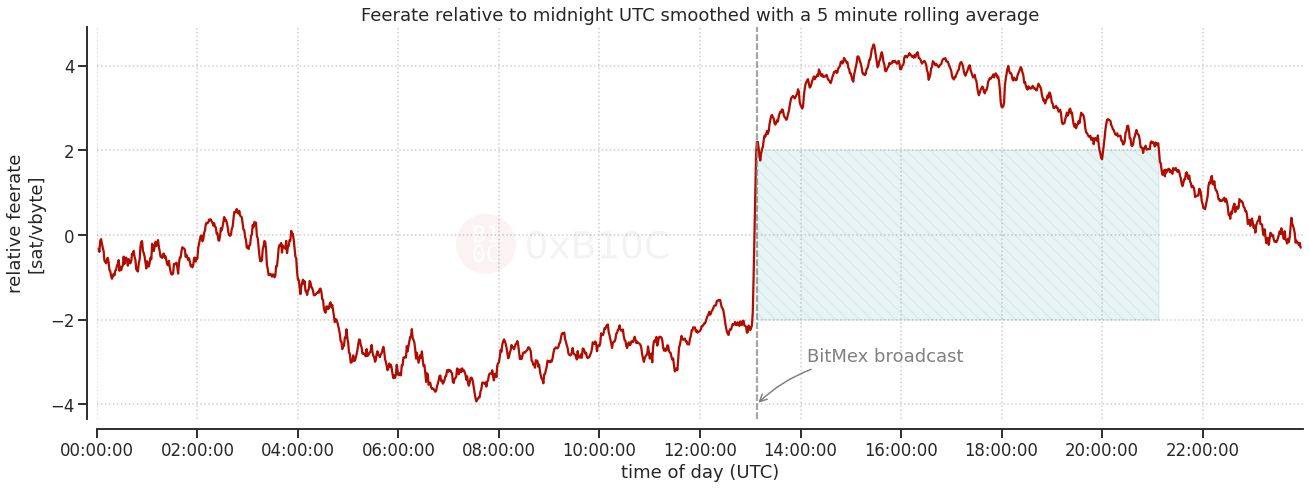

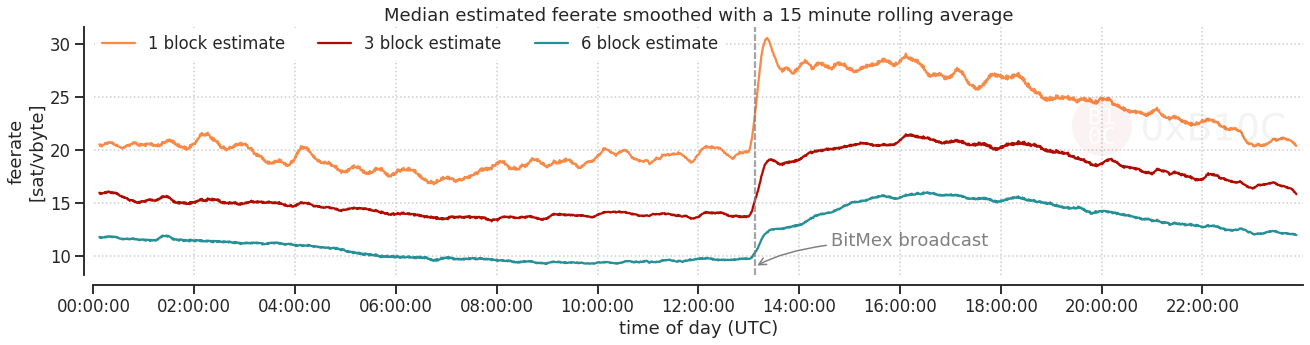

According to findings published by 0xB10C, BitMEX broadcasts many megabytes worth of large transactions to the Bitcoin network at around 1 pm UTC every day.

The transaction sizes cause an immediate temporary spike in transaction fees.

The spike in fees could be offset if the handling of the transactions was conducted using industry-standard management. As 0xB10C argues:

“The transaction size could be greatly reduced by implementing current industry standards in the BitMEX wallet. Once activated, utilizing Schnoor and Taproot combined with output batching seems to be the most promising for improving the transaction count and size.”

The mechanism used by BitMEX means all parties transacting on the Bitcoin network that use fee rate estimators pay the price in both higher fees and longer confirmation times. The impact is lower on weekends when fewer transactions are broadcast.

Coinbase Switched to Batching in March

In a bid to reduce network load and user transaction fees, Coinbase launched Bitcoin transaction batching in March. The exchange now bundles multiple transactions into a single transaction.

That represents up to 50% savings on transaction fees for its users. It also has a positive impact on the network by reducing Coinbase’s own load on it.

The only cost to Coinbase users is a slight delay in transaction broadcast, as it awaits other transactions to be mixed within a single broadcast.

The larger question of the impact of centralized exchanges on the Bitcoin network remains.

Given BitMEX’s and Coinbase’s decisions can have such significant effects on the network, many would feel a new era of decentralized exchanges is not only inevitable but also healthy.

Share this article