Today's Crypto Theory: Assange Arrest Sparks Rage Crash

It's not the craziest theory in crypto. Just one of them.

Share this article

The arrest of Wikileaks founder, Julian Assange, could have prompted the crypto market slump today.

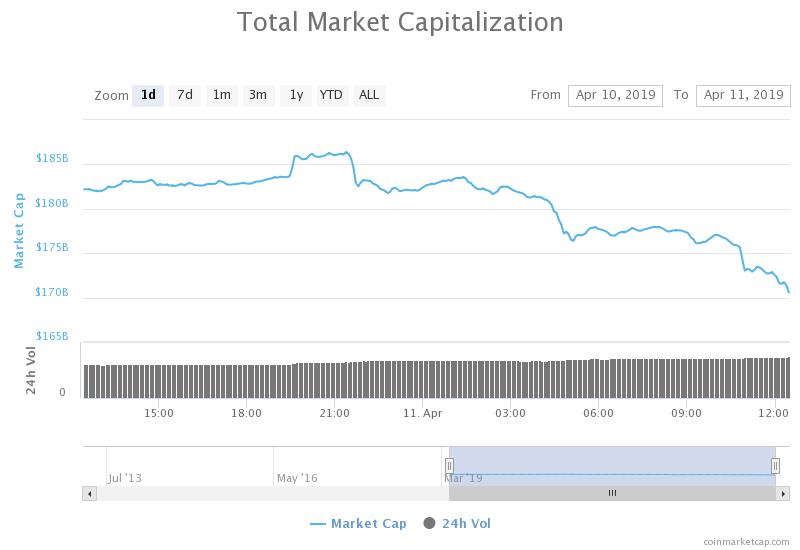

At least that’s one of the theories for today’s $16bn drop in the overall value of the market. Beginning in the early hours of this morning, crypto prices across the board have so far fallen by 7.1%. While that may sound like a stretch, it’s not even the craziest theory we’ve heard this month.

At the time of writing, Bitcoin (BTC) was still holding itself above the $5,000 mark, but many coins in the top-30 are experiencing double-digit drops. The downward trend could continue as the American trading day begins.

Did Assange Arrest Affect Markets?

One industry figure suggested that the arrest of Wikileaks founder Julian Assange may have sparked the sell-off, due to growing concerns of increasing government surveillance. The source, who works in a senior position at a blockchain identity verification company, declined to be named in this article.

“Assange is a bit of a hero in the crypto community,” they said over the phone, “now he’s been taken in [to custody], people are worried about their privacy.”

The source explained that Assange is a widely-respected figure, especially among some of the older figures within cryptocurrency. Wikileaks had been one of the first businesses to accept bitcoin after Visa and Mastercard blocked payments to it in 2010.

The market began sinking hours before Ecuador withdrew Assange’s asylum, and stabilized at the $178bn mark. The arrest was followed by another major sell-off, which caused the market to lose another $10bn in value.

Now that Bitcoin can be tracked just as easily as fiat payments, the source reasoned, Assange’s arrest might be the watershed moment for governments to “show off some new [surveillance] tools.”

Other figures in the cryptocurrency world expressed doubts that most believed the two events were unlinked. One argued that it was “highly unlikely” that Assange’s arrest would have any correlation to the state of the crypto market.

Humans trying to understand situations sometimes fall into the trap of linking two completely unrelated events together, they said. Much like the tenuous connection with a certain April Fools’ prank, the market movement may have been a mere coincidence.

Other theories

The drop was a surprise as market sentiment appeared to be improving. Dave Hodgson, Director and Co-founder of NEM Ventures, told Crypto Briefing that the sector may have been “too early” in predicting the end of the bear market.

Sentiment could have turned sour yesterday after New York regulators rejected a Bitlicense application from Bittrex. The exchange now has 30 days to shut down its operations in the state.

Mati Greenspan, the senior market analyst at eToro, hypothesized out the market slump could have been a reaction to the U.S. Federal Reserve, which suggested yesterday that low-interest rates over a long period of time could cause financial instability.

“[C]orrelation does not necessarily mean causation, but what we can say is that in the 30 minutes following the announcement Bitcoin experienced more volatility than gold, the Dow Jones, and the US Dollar combined,” Greenspan wrote in an email.

Bitcoin in the last six months has gone through long periods of relative stability, followed by short and highly volatile price movements. Following last week’s boom, what might be happening is price determination, as Crypto Briefing has previously reported.

Hodgson highlighted that a steady increase in trading volume, as seen in the crypto market over the past month, is usually a promising sign of investor confidence. The 7% contraction today might actually be “consolidation at a new stable level.”

Share this article