Lebanese Turn to Bitcoin During Economic Crisis

Bitcoin is quickly gaining popularity in Lebanon as the country's banks impose tight capital controls to mitigate economic fallout

Bitcoin has seen a massive rise in popularity among the Lebanese this year, especially after the country’s banks imposed rigid capital controls to contain economic fallout.

Trust in Lebanese Banks at its Lowest

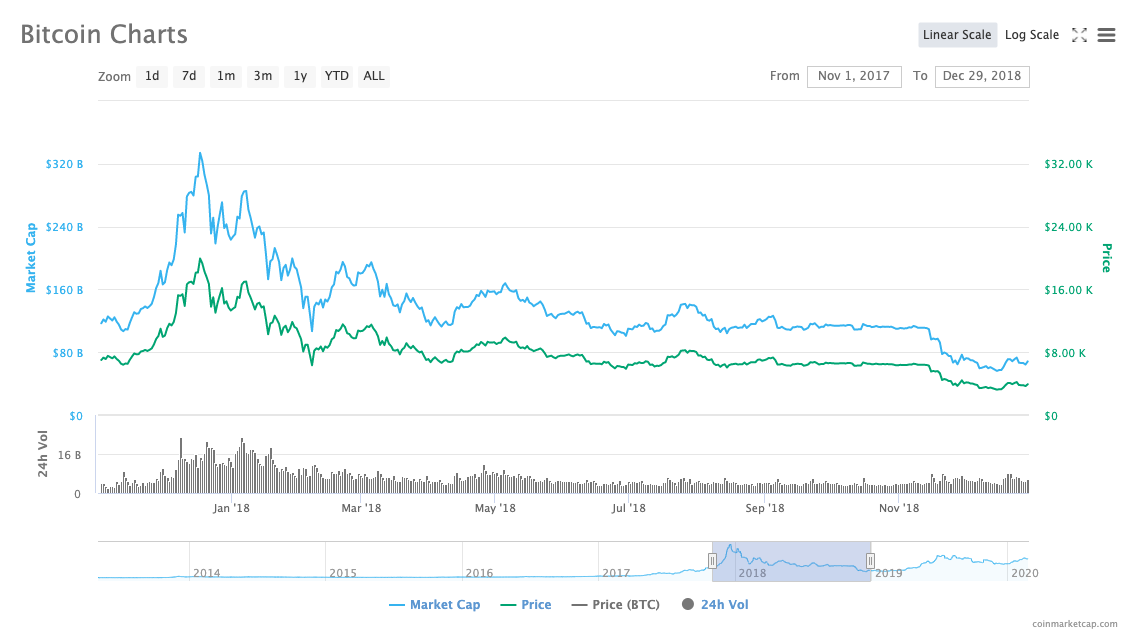

Despite being one of the best performing investments of the past decade, Bitcoin’s utility as a safe-haven asset has long been debated. Bitcoin has seen violent price swings in its 10 years of existence, losing more than 80% of its value in 2018.

However, zooming out shows that despite its instability, Bitcoin is still regarded as one of the best ways to hedge against war and financial crisis.

The people of Lebanon have been turning to Bitcoin en masse to fight tight restrictions imposed by the country’s struggling banks, according to an Al Jazeera report. The country has been rife with protests since last October, when its disgruntled people rose up against increasingly sectarian rule and government corruption.

In response to civil unrest, the country’s banks have imposed restrictions on foreign currency movements and cash withdrawals, causing its people to turn to other instruments for financial freedom. Foreign currency withdrawals are now limited to between $50 and just a few hundred dollars a month, while transfers abroad are capped at $50,000 a year, the report said.

With trust in the heavily indebted state and its crumbling banks at its lowest, Lebanon’s disgruntled people have turned to digital assets. “If you want to go around the banking system, Bitcoin is a solution,” a local Bitcoin trader told Al Jazeera.

Bitcoin as a Hedge in Crumbling Economy

However, buying Bitcoin through exchanges isn’t an option. The country’s central bank has imposed restrictions on purchasing cryptocurrencies with credit cards, which forced people to get creative.

Simon Tadros, the CTO of a web development firm said that most trades happen through referrals, with many buyers and sellers meeting through WhatsApp groups. Most sales, he explains, happen in person and involve exchanging physical cash for a Bitcoin transfer.

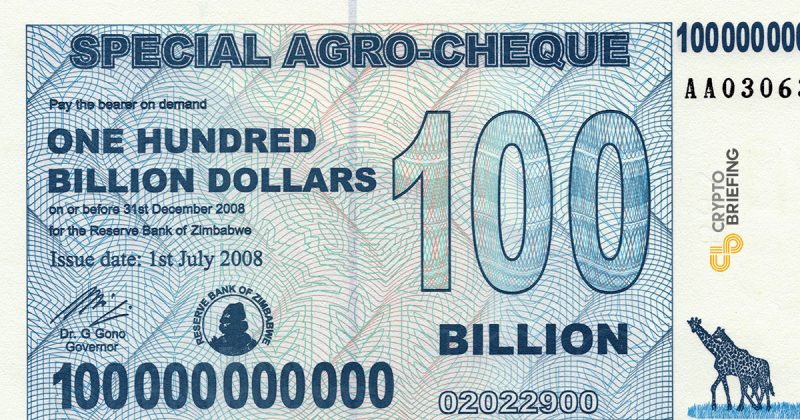

A second, less popular but more widely used method, is buying Bitcoin with physical banker’s cheques. The cheques are verified by the country’s central bank and can only be deposited into other Lebanese banks.

Sellers charge a steep commission for this type of trade as a collapse of the country’s banks seems almost inevitable. While sellers trading Bitcoin for cash usually charge a commission between 1% and 5%, those selling it for banker’s cheques charge a commission of up to 40%.

This is often the only option for buyers who want to move money out of Lebanon, Al Jazeera reported. With the official exchange rate valuing the Lebanese pound at 40% less than the parallel exchange rate—many are still willing to take the risk.

The increased demand has led to the surge in Bitcoin price in Lebanon, with the average price of 1 BTC on LocalBitcoins being 22.9 million Lebanese pounds, or $15,150, at a time when BTC is trading at $9,340 in international markets.

Lebanon isn’t the only country where people have turned to Bitcoin to protect their assets. Demand for the world’s largest cryptocurrency soared both in China and Argentina as the countries saw their national currencies plummet in value last year.

The escalating conflict between the U.S. and Iran also showed Bitcoin’s power as a safe haven asset during wartime, as it saw its value rise by more than 20% while the conflict between the two countries unfolded earlier this year.