MakerDAO's Vote to Enrich Investors, Puts DAI Stability at Risk

Maker voters' decisions to bring back stability fees is good for their pockets, but endangers DAI.

Key Takeaways

- DAI perpetually trades at a premium, which isn't a good thing for a stablecoin.

- Maker voted to re-introduce stability fees, which causes a supply side crisis for DAI and forces the token to consistently trade above $1.

- Voters have kicked back into action with new proposals that aim to bring DAI closer to its peg without reducing stability fees again.

Share this article

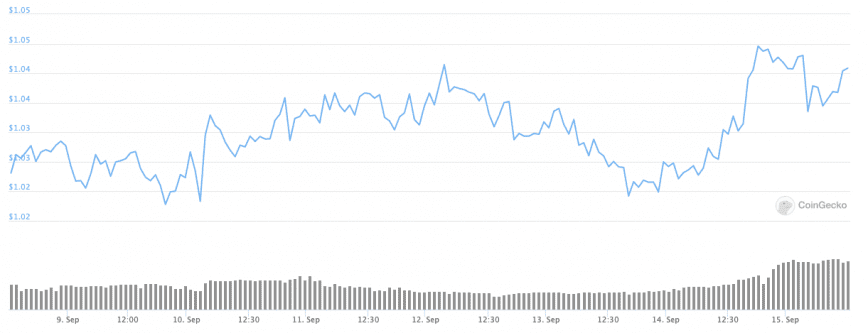

DAI is once again trading well above its desired $1 peg as MakerDAO governance voted to increase stability fees, forcing buyers to compete for DAI already in existence.

Do or DAI Scenario

MakerDAO’s native stablecoin DAI is trading at a stark premium, making life difficult for its users. All stablecoins diverge from their peg from time to time, but DAI is notorious for failing to rebound quickly.

The stablecoin held its peg for a few weeks, but that quickly changed when the MakerDAO voted to raise the stability fee for all collateral assets.

The decision sought to provide MKR holders, the protocol’s native governance token, with a source of value capture as stability fees are used to buy and burn MKR. Stability fees had been nil for months until MKR investors decided it was time to bring back the value capture mechanism.

Increasing the stability fee reduces the demand to mint new DAI. However, the token is an active element in some of the largest yield farms at the moment, which creates sustained buy pressure for the stablecoin.

With little new DAI coming in and demand remaining constant, basic economics dictates that the price will increase until it reaches a level where nobody wants to buy it anymore.

Interesting. So this isn't just an increase in stability fees. It appears to be a new philosophy to Maker monetary policy, one in which peg adherence falls in priority, and Maker shareholders get a bit more of the pie than Maker vault owners.

— John Paul Koning (@jp_koning) September 8, 2020

Further, the only way to rescue DAI’s peg is by minting DAI (at $1) and selling it for an immediate profit. With a stability fee in place, the incentive to do this is minimized because the fee eats into the profit margins of arbitrageurs.

The decision to raise the stability fee, knowing that DAI already struggles with its peg, reflects voter sentiment that value capture is more important than the token’s stability.

However, ancillary measures are being put in place to counteract this.

Maker governance voted to reduce liquidation ratios for USDC and PAX, while also increasing the debt ceiling for both assets. The desired effect is for existing vault/CDP owners to squeeze more DAI out of their USDC and PAX with the confidence that their collateral is safe thanks to the lower liquidation threshold.

🚨 Attention @MakerDAO $MKR holders 🚨

🗳️ There is an expedited executive vote today to:

1⃣ lower the $USDC and $PAX liquidation ratios to 103%

2⃣ raise their respective debt ceilings, and

3⃣ adjust the `box` parameter to limit auction throughput1/

— monetsupply.eth (@MonetSupply) September 14, 2020

All that matters is whether these actions translate to DAI coming closer to its peg. If it does, this will be a win-win scenario for Maker as MKR value capture is re-embedded without causing long-term damage to the stablecoin.

Share this article