Market Commentary: Altcoin Correlation To BTC Decreases, ETH And XRP Rise.

XRP rises on generic news.

Share this article

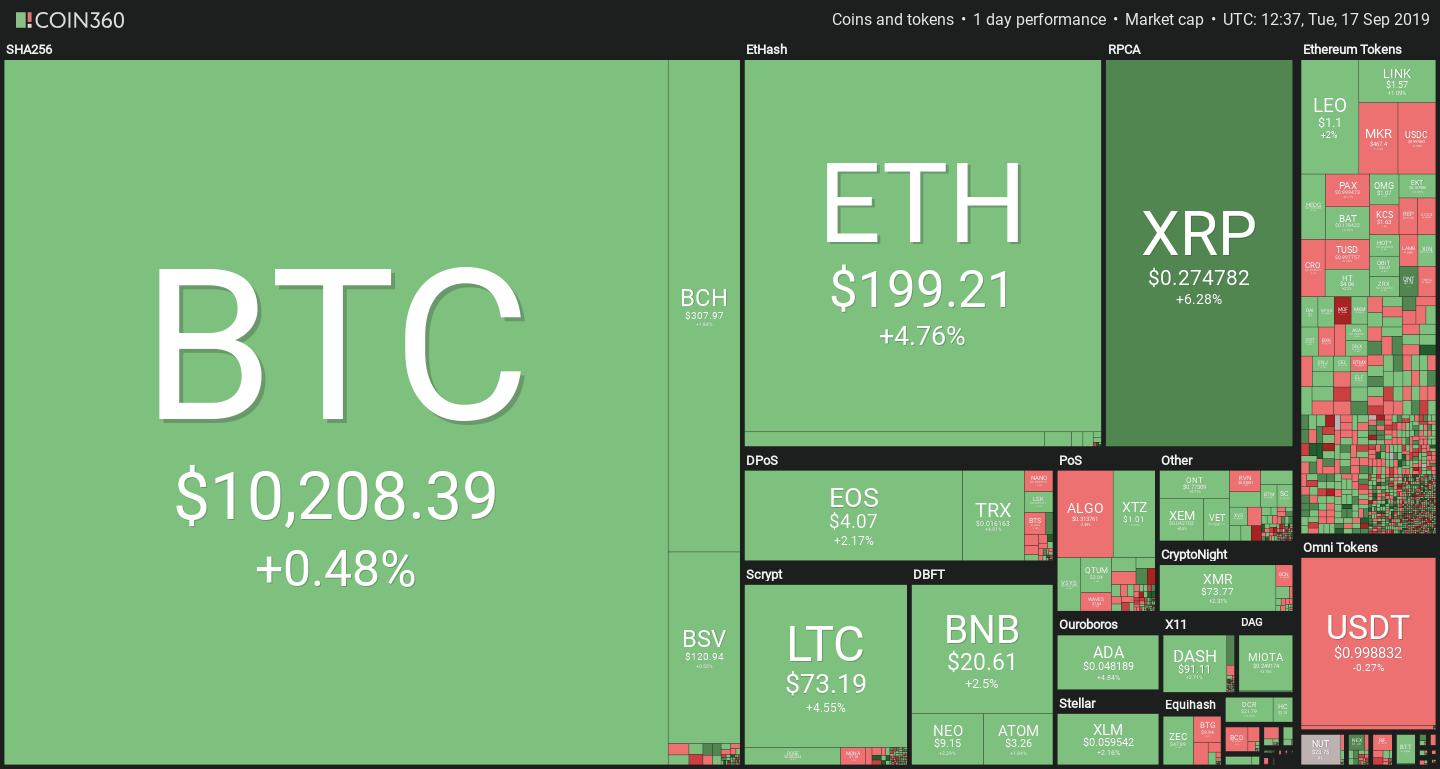

Bitcoin and the rest of the market is surprisingly linear today, with many altcoins registering modest gains as BTC remains range-bound. Ethereum and XRP in particular are showing strong gains.

How correlated is the crypto market?

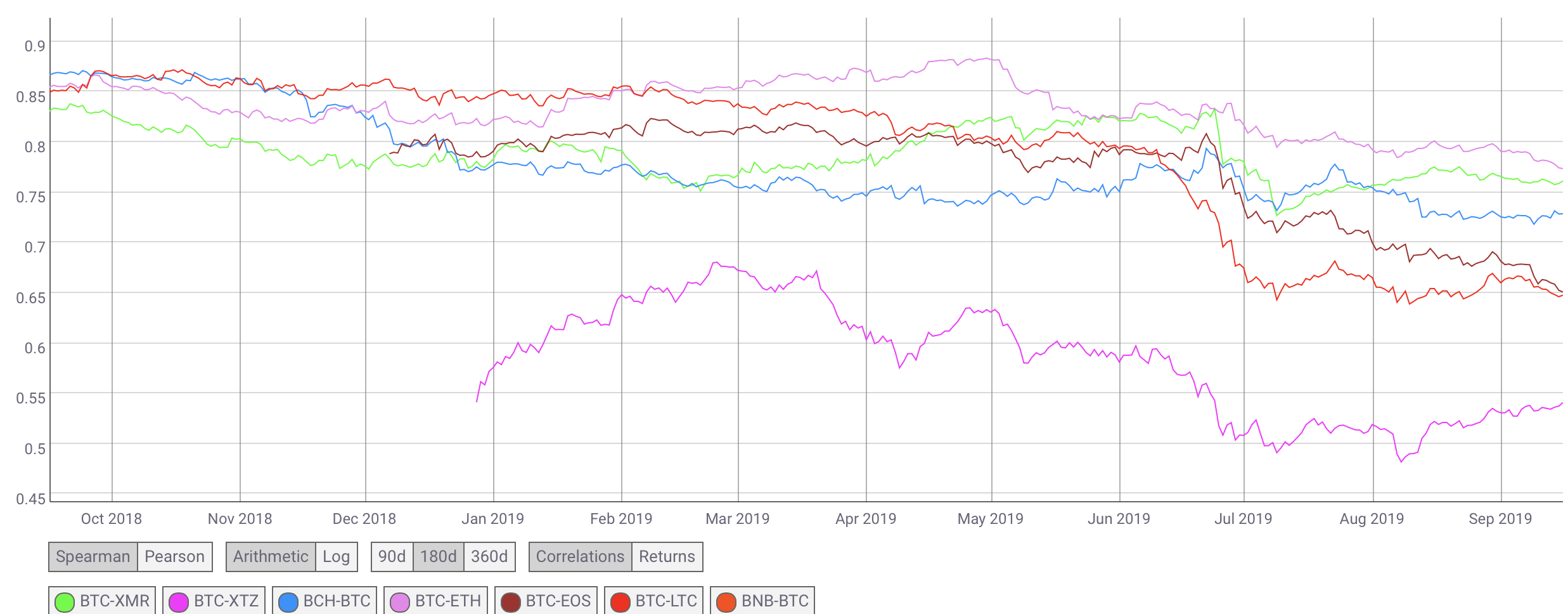

As experts debate the correlations between Bitcoin and gold versus the stock market, it’s interesting to look at the other currencies. Crypto investors are often told to ‘diversify’ their investments into a basket of multiple currencies, but this bit of common wisdom is often criticized due to the fundamentally similar movements of all crypto assets.

Data from Coinmetrics.io allows us to dive deeper into the specific values.

When looking at the chart, it is immediately obvious that most of the correlations are extremely strong. Whereas the Bitcoin-gold correlation is relatively weak at 0.10, most altcoins have a correlation with Bitcoin of at least 0.65 (at 1.0 correlation, the movements are exactly equal).

A few interesting conclusions can be drawn from this graph. For one, overall correlation has been going down over the past few months, as Bitcoin is leaving behind the rest of the cryptocurrency space and searching for a new home in institutional desks.

Correlations of specific coins are also worth noting. Ethereum (lilac line) has the highest strongest correlation with BTC, almost touching 0.9 in May. The second highest comes from XMR (green), which left it on a constant just-on-the-edge of top-10 position.

Litecoin, often called the silver to Bitcoin’s gold, has seen its correlation fall dramatically over the year (red line). It might become a decent asset for diversifying crypto investments, assuming that the trend continues.

Finally, Tezos appears to be the black sheep of crypto. Though it has grown recently, the coin has always had the weakest correlation in the basket (purple). Currently, it’s probably one of the only crypto assets that could pass for ‘putting an egg in a different basket’.

Ethereum maintains momentum

After a fiery weekend where it pushed to within walking distance of the $200 resistance level, the top-two coin is continuing undisturbed with 5% gains.

While the weekend move could best be explained by technical movements, today’s rally seems to be at least partially fueled by a fundamental driver.

BitPay, a payment service that allows merchants to accept crypto in their stores without dealing with it directly, has announced the introduction of ETH for payments. The move marks the first altcoin expansion for the company, which previously only served BTC.

Soon BitPay merchants will be able to accept Ether payments from #Ethereum users around the world: https://t.co/2nXIDhIN6y #ETH pic.twitter.com/IyqHnxpo1F

— BitPay (@BitPay) September 16, 2019

XRP surges on Japan integration

The not-Ripple token has risen by approximately 7% in the last few hours after the launch of the BitMax exchange, developed by leading Japanese messaging provider LINE. The exchange could tap into a potential 81M users in Japan, thanks to the integration with its services.

XRP influencers and some publications are selling it as an XRP-specific news, though the exchange is supporting a variety of currencies including BTC, ETH, LTC and BCH. The news is nevertheless positive for cryptocurrency as a whole due to the increased exposure.

https://twitter.com/XrpCenter/status/1173913265736474626

Bitcoin Commentary By Nathan Batchelor

Bitcoin is probing the downside, after the cryptocurrency was swiftly rejected from just above its weekly pivot point on Monday. The latest move lower appears to put the $10,000 support level back in focus as short-term BTC / USD buying interest is still lacking above the $10,260 level.

This Friday will see Bakkt’s physically-custodied Bitcoin futures launch, which could spur some much-needed volatility in the BTC / USD pair. It still remains to be seen whether the long-awaited launch is baked into the current price of Bitcoin.

Bitcoin has failed to react to a bullish report that shows that the number of transactions using SegWit for Bitcoin payments is surging, as more companies implement it to their payment platform. This is important as Bitcoin is clearly becoming cheaper to use and more adopted, further justifying the BTC / USD pair’s $10,000 price.

With this in mind, Bitcoin is edging closer to a major bullish breakout on the daily time frame, as the large descending triangle pattern has narrowed significantly over the last few weeks.

Technical analysis shows that the top of the triangle is now located around the $10,750 level, while the bottom of the triangle is located around the $9,300 level. Should we see the BTC / USD pair return back above the $10,420 level, it would then bring the cryptocurrency tantalisingly close to the top of the triangle.

The triangle pattern is being watched by many traders , as the upside projection of the bullish breakout would take the BTC / USD pair close to the $15,000 level. The current lack of demand above the $10,420 level still suggests that Bitcoin may need to trade somewhat lower in the short-term before it can trade higher and attempt a long-term breakout above the triangle pattern.

*Continued weakness below the $10,260 level is pointing to yet another test of demand around the $10,000 level.*

SENTIMENT

Intraday bullish sentiment for Bitcoin is tracking lower, at 41.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is also edging down, at 65.80 % positive.

UPSIDE POTENTIAL

Bitcoin has been struggling to move above its 50-day moving average since mid-August. This key technical metric is currently located around the $10,480 and remains a key area that bulls need to hold price above on a multi-day basis.

In the near-term, BTC / USD bulls need to break through the weekly pivot point, around the $10,260 level. Bitcoin’s monthly pivot point is another key technical area the cryptocurrency must surpass, around the $10,420 level.

DOWNSIDE POTENTIAL

The $10,000 level is coming back on the radar as buying interest softens above the $10,260 level. Traders should expect a test of the $9,700 to $9,800 region if the cryptocurrency starts to hold below the $10,000 level.

In the medium-term, the $9,300 level is the most important technical support level to watch prior to the July monthly trading low, around the $9,120 level.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article