Market Commentary: Bitcoin Futures Offer Stability, And What's Happening With EOS?

EOS pumps despite ongoing hack.

Share this article

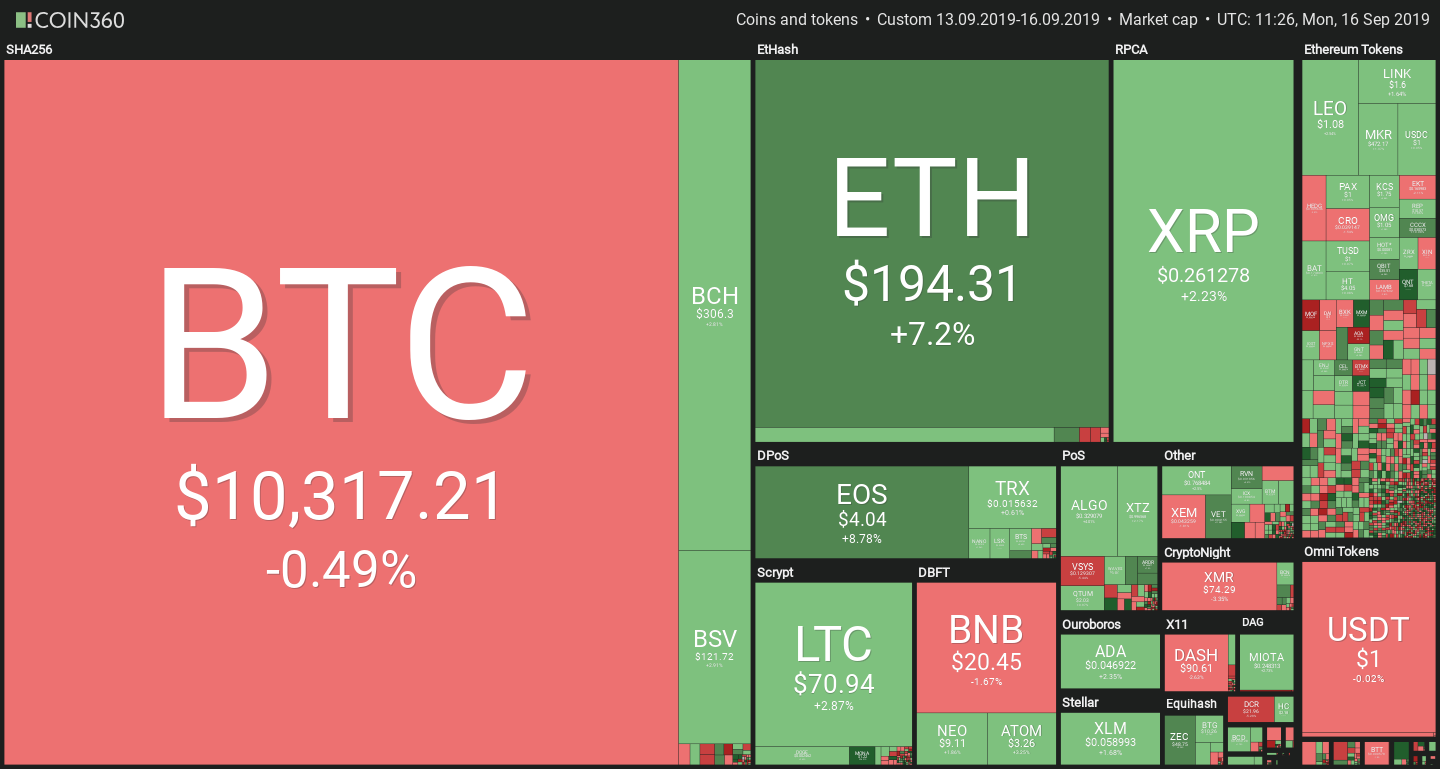

As we pass the middle of September, cryptocurrency markets are still lethargic. Bitcoin’s tunnel trading continues with renewed vigor, though we are seeing a fair amount of action further down the charts. Notable gainers are Ethereum and EOS, which had noticeable upticks over the weekend.

Is Bitcoin’s relative stability a sign of things to come?

The offering of futures and other derivatives is set to expand quite drastically, with Bakkt soon to launch futures trading on September 23, while Binance is currently entering the space previously occupied by BitMEX, OkEX, Digitex and others.

The debate on whether derivatives trading stabilizes or destabilizes the underlying market has been raging for decades, with dozens of papers written on the subject by leading economists. A 1976 paper analyzing the futures market for onions and potatoes concluded that derivatives do in fact tend to price in the various production shocks more gradually, leading to less volatility.

The same issue has been analyzed for Bitcoin: futures markets have been introduced for a while now, allowing researchers to draw initial conclusions on their effect.

As reported by DataDrivenInvestor, a 2019 paper by Kang Kyungwon et al. studied Bitcoin volatility trends before and after the introduction of futures trading on CBOE and CME. The researchers found out that the effect was not linear: while the first trading period actually led to higher volatility, it then gradually went down, establishing a strong causation link for the last period.

Laurent Kssis, Director of CEC Capital, has weighed in on the issue. “From a professional level, market makers prefer to hedge futures contracts using settled ‘physical’ contracts to hugely reduce the risk of potential settlement price manipulation,” he explained. “With cash-settled contracts, the settlement price is never truly efficient upon maturity.”

The distinction between cash-settled and physical delivery futures lies in how the underlying asset is treated: with the former, the transaction is simply a mathematical write-off depending on the reference spot price, while in the latter, the asset is actually exchanged upon maturity.

“As a result, it appears the buyers of these [cash-settled] contracts are simply speculators, capitalising on the use of leverage,” he continued. “Once the long awaited physical contracts come to market, I would expect most cash-settled contracts to lose their appeal and the spot market to stabilise.”

The launch of Bakkt will be crucial to confirming this theory, as the only certified provider of physical delivery contracts.

EOS rises despite hack

The EOS token has seen a solid 8.78% rise over the weekend, likely fueled by anticipation of the upcoming version upgrade, scheduled for September 23.

Yet, the rise is happening in the context of a strong attack on one of its dApps, EOSPlay. As reported by CryptoSlate, the attacker was able to siphon more than 30,000 EOS (~$110,000) with an initial investment of just $1000 to trigger the exploit. While the vulnerability has been confirmed to be exploited with only one application, some are suggesting that the scale of the attack is much larger.

VeChain sees sudden spike

VET has seen a large surge today, topping at at 15% gain in a single four hour period. It has been speculated by the community that this could be another chunk of VeChain’s buy-back program announced in June, where it pledged to purchase $25M worth of tokens on the free market. While the address holding all the tokens still hasn’t seen new inflows, this could be due to a withdrawal delay. There’s little other notable news that could explain the sudden movement.

Bitcoin Commentary By Nathan Batchelor

Bitcoin traded in an incredible tight price range over the weekend, with bulls failing to take charge of the cryptocurrency while the broader market enjoyed a fairly decent rally. As I have previously noted, when Bitcoin trades in a small price band for an extended period of time then a breakout move is likely around the corner.

Ethereum enjoyed a notably strong upside move over the weekend after languishing in depressed territory for most of the month. Looking at the ETH / BTC chart, it certainly appears that the cryptocurrency is breaking out against Bitcoin in the short-term, although the MACD indicator is warning that a bearish correction may soon occur.

The bearish MACD price divergence in the ETH / BTC pair across the lower time frames is interesting as it may be a precursor for a pending breakout in Bitcoin. Employing technical analysis for cross-cryptocurrency pair usually helps decipher potential strength or weakness ahead, particularly if one of the cryptocurrencies is fairly stable against the U.S Dollar.

With this in mind, the negative price divergence in the ETH / BTC pair strongly suggests that a bearish correction is due, which bodes well for Bitcoin if Ethereum pair hold firms against the greenback. Infact, it suggests that Bitcoin may start to play catch-up, once Ethereum reaches its immediate upside objective.

The medium-term outlook for the ETH / BTC pair points to a strong upside recovery, with plenty of two-way trading action ahead, which ultimately bodes well for both cryptocurrencies. In specific reference to Bitcoin, the ETH / BTC charts highlights that Bitcoin is unlikely to trade in tandem with its closest rival over the coming months.

* The short-term technicals suggests that sellers are likely to remain cautious while Bitcoin continues to hold above the $10,000 level. *

SENTIMENT

Intraday bullish sentiment for Bitcoin has moved back to neutral, at 51.00%, according to the latest data from TheTIE.io. Long-term sentiment for the cryptocurrency is slightly lower, at 66.00 % positive.

UPSIDE POTENTIAL

Failure to close the weekly price candle above the $10,600 level has seen the BTC / USD pair open the trading week on the backfoot as expected. BTC / USD bulls desperately need to move price above $10,420 level to encourage new technical buying.

Technical analysis shows the $10,260 level as the likely battle ground for weekly control of the BTC / USD pair. Bitcoin’s key exponential moving averages are converging, pointing to a potential breakout this week. Looking ahead, a break above the $10,960 level remains key, alongside further advancement above the $11,100 technical area.

DOWNSIDE POTENTIAL

The $10,000 level is the key support area that sellers need to breach this week. Weakness under this key technical area is likely to be the trigger for a bearish attack towards the BTC / USD pair’s current monthly trading low.

In the near-term, it is important that sellers force price under the weekly pivot point, around the $10,260 level, to gain back control of price action and encourage a test towards the BTC / USD pair’s former weekly trading low.

A full version of Nathan Batchelor’s Daily Bitcoin Commentary, together with his calls, is available to SIMETRI Research subscribers earlier in the day.

Share this article