MCO Visa Card in Review: The Best Card for Cashback

The MCO Visa Card offers some of the best cashback available anywhere. There’s just one catch: in order to unlock the best rewards it’s necessary to invest in cryptocurrency.

Key Takeaways

- MCO Visa Cards offer some of the best cashback anywhere, with rewards ranging from 1-5% on all transactions

- Unlocking the best rewards requires an investment in Crypto.com's MCO token, but their 1% cashback card is available to everyone

- Card holders can enjoy free subscriptions to Netflix, Spotify, and Amazon Prime, as well as other discounts

- The cards have almost no fees, cash deposits are FDIC insured for up to $250,000, and holders enjoy unauthorized charge protection

Share this article

The MCO Visa Card by Crypto.com advertises 5% cashback, no hidden fees, and a free Spotify and Netflix subscriptions—is this too good to be true? Here’s our comprehensive review.

What Is the MCO Visa Card?

The MCO Visa Card is a prepaid debit card issued by Hong Kong-based Crypto.com, a crypto-powered financial services company. The card is one of the company’s most popular offers.

https://youtu.be/JMiP8JSrvTM

The MCO Visa Card offers some of the best cashback rates—paid in cryptocurrency and redeemable in cash. Crypto.com’s most accessible card tiers offer up to 3% cashback on all transactions, not just for specific shopping categories like comparable rewards cards. This is in addition to other perks, such as free Netflix and Spotify subscriptions.

Compared to most credit cards, which usually offer between 1-2% cashback, the MCO Visa Card is a point more competitive. Plus, users can enjoy convenient access to cryptocurrency through the integration with their mobile app.

The company’s elite cards, meanwhile, offer as much as 5% cashback, as well as other luxury benefits including private jet access and inheritance management services.

Unlike most cards, the MCO card has no interest charges, annual fees, or withdrawal fees. There’s just one catch: in order to unlock the best rewards it’s necessary to invest in cryptocurrency.

How to Get the Card

To unlock the rewards that make the MCO Visa Card competitive, it is necessary to purchase Crypto.com’s “MCO” cryptocurrency.

To apply for the card, the first step is to download the Crypto.com mobile app. The approval process is fast and straightforward through their mobile app. The card is currently available in the United States, United Kingdom, Singapore, and soon, the rest of Europe.

The second step is to unlock one of the card tiers by staking MCO. On approval, everyone can immediately access the lowest tier MCO Visa Card, “Midnight Blue,” without any cryptocurrency staked.

To unlock the premium card tiers, however, it is necessary to “stake” Crypto.com’s native cryptocurrency, MCO.

We’ll take a look at each of the card tiers and unlock requirements a little later. But first, we’ll explain how the cards work.

Staking essentially locks up the required tokens for a set amount of time. These tokens are once again accessible after the staking period lapses. During that time card holders above the 500 MCO tier will receive interest on their stake. This makes the MCO stake similar to a CD or a bond, where holders receive interest and have access to the principal investment after the maturity date.

The staking period for all MCO Visa Cards is six months. Although these tokens aren’t accessible over those six months, the card is actually available immediately after users stake their tokens. Once the card is unlocked, the card is shipped and should arrive within 3-7 days.

In order to keep getting the best benefits, it is necessary to keep these MCO tokens locked up beyond the six month staking period. In that regard, the MCO Visa Card is similar to a secured credit card, which requires people to lock-up a balance to use it. Unlike a secured credit card, however, locked up MCO cannot be used for purchases, meaning the card needs to be topped up with cash on top of the initial token stake.

What Is the MCO Token?

The MCO token is a cryptocurrency issued by Crypto.com on the Ethereum blockchain. MCO provides several benefits on Crypto.com and its mobile app.

The MCO token offers access to better MCO Visa Card tiers, higher interest rates on cryptocurrency deposited on the mobile app, and lower cost crypto-backed loans.

MCO’s value fluctuates between $3 and $7 based on market data over the last year. Given the volatility of MCO, holding the token can be risky for some people. That said, many see it as an investment opportunity given that MCO appears highly correlated with Bitcoin prices.

As a token on the Ethereum blockchain, MCO is compatible with any crypto wallet, including hardware wallets like Trezor and Ledger, as well as online wallets like MetaMask and MyEtherWallet.

To learn more about the MCO token, read our full guide here.

Different MCO Card Tiers

There are five tiers of cards, with each tier offering better rewards than the last. Unlocking each card tier, however, also requires ten-times as much MCO. Below is a diagram showing each tier, their cashback rates, as well as their respective MCO staking requirements.

The cards offer between 1-5% cashback, paid in MCO tokens and redeemable for the equivalent value in cash on the app.

Each of the MCO Card tiers also offer increasingly better perks, most notably rebates (automatic reimbursements) for popular online subscriptions and services:

- Midnight Blue: Cashback—paid out weekly in MCO

- Ruby Steel: Spotify—up to $12.99 per month

- Indigo/Jade: Netflix—up to $12.99 per month

- White/Gold: Amazon Prime—up to $12.99 per month

- White/Gold: Expedia—up to 10% cashback on purchases up to a $50 limit per month

- Black: Airbnb—up to 10% cashback on purchases up to a $100 limit per month

Each of the cards include benefits from all of the previous tiers. For example, the Indigo/Jade cards provide holders with a free Netflix and Spotify subscription, as well as cashback.

The card tiers also do not need to be unlocked sequentially, meaning that someone could immediately get access to the best cards, assuming they’re able to stake the appropriate amount of MCO.

All MCO Visa Cards come with almost no fees. The fees they do have are usually for extraordinary circumstances, like replacement cards, closing a card with a balance, or for allowing more than a year of inactivity to pass.

As an added plus for travelers, the card charges no international transaction fees and settles transactions at the interbank exchange rate—meaning almost no loss on foreign currency conversion.

In the United States, all MCO Visa Cards can be used for mobile payments, including Apple Pay and Google Pay. Support for mobile payments will be rolled out to other countries soon, according to Crypto.com.

To begin using the card for mobile payments, it is first necessary to receive the card in the mail. Once the card is activated, it can be linked on either Apple Pay or Google Pay, much like other credit or debit cards.

Value Loading MCO Cards

All MCO cards, regardless of tier, are loaded in cash. Although the company advertises the cards as “powered by crypto,” the card does not actually transact in crypto outside of its cashback rewards, which are paid out in MCO cryptocurrency.

All MCO Visa Cards need to be topped off either by bank transfer, or by a cryptocurrency deposit that is then traded into fiat on the Crypto.com app.

Supported bank transfer services include ACH, SEPA, wire, or Xfers, depending on the region. For the moment, SWIFT transfers are temporarily unavailable. The process can be cumbersome, in our experience, because it requires that card holders make a transfer through their bank.

Unlike other prepaid cards, like those offered by Revolut or Wirex, it is not possible to link a bank or debit card directly in-app. This means that card holders may have to wait several days for a bank transfer before getting to use their card, which may come with additional transfer fees depending on the bank.

The other option is to send cryptocurrency to the Crypto.com mobile app. From there, it is possible to exchange that crypto into fiat for a nominal fee. For large crypto deposits, this may result in the loss of up to 0.5% of the transferred amount because of the exchange spread, even though Crypto.com itself does not charge exchange fees.

Any cash balances held on the Crypto.com app or on the MCO Visa Card are FDIC-insured up to $250,000. There are other protections as well. Unlike some prepaid cards, MCO Visa Card holders can file chargebacks to dispute transactions, just like a standard credit card.

Review of the Five Card Tiers

As mentioned earlier, unlocking each MCO Visa Card tier requires an exponentially larger MCO stake. Although it is nearly impossible to access the higher-tier cards for most, even the middle-tier cards provide better benefits than even some of the best cashback credit cards.

Midnight Blue

The lowest tier MCO Visa Card tier is not anything to get excited about, but it is the easiest to unlock and does not have any special prerequisites. The Midnight Blue MCO Card offers 1% cashback on all purchases. The card is made of durable plastic.

The Midnight Blue card also provides no-fee ATM withdrawals for up to $200 per month, with a 2% fee thereafter. International transactions using the interbank exchange rate are capped at $2,000 monthly, with a 0.5% fee thereafter.

Even without any special benefits, the card is a solid prepaid option for cashback that’s available to everyone, even those with bad credit.

Ruby Steel

Next up is the MCO Ruby Steel Card, which offers 2% cashback on purchases. The tier is unlocked with a stake of 50 MCO tokens, the equivalent of about $250. Unlike the card tiers beyond Ruby Steel, users will not earn interest on their 50 MCO stake.

Beyond competitive cashback, the Ruby Steel tier provides holders with a free Spotify subscription. Those that elect to automatically pay their Spotify subscription with the card will receive a rebate of up to $12.99 per month.

The Ruby Steel card is made of composite stainless steel with an attractive brushed metal face. It is about three times heavier than a plastic credit card, and has about the same thickness. The card is comparable in terms of its look and feel to other premium metal credit cards.

The card also provides no-fee ATM withdrawals up to $400 per month, with a 2% fee thereafter. International transactions are also made using the interbank exchange rate, capped at $4,000 monthly, and with a 0.5% fee after that.

Royal Indigo / Jade Green

The next tier offers holders a choice of colors between “Royal Indigo” and “Jade Green.” The Royal Indigo and Jade Green MCO cards offer 3% cashback. To unlock the cards, it is necessary to stake 500 MCO tokens, the equivalent of roughly $2,500.

For most, Indigo/Green is the best and most realistic tier people will be able to access. Like other premium MCO cards, both colors are made of composite stainless steel.

Beyond industry-leading cashback, the Indigo/Green cards provide holders with a free Netflix subscription, as well as a free Spotify subscription. Those that elect to automatically pay their subscriptions with the card will receive a rebate of up to $12.99 per month for each subscription, for a total maximum monthly rebate of $25.98.

As an added benefit, holders of the card will get LoungeKey Access, a service that provides holders with free access to more than 1,000 airport lounges worldwide. Some lounges even provide showers and a place to nap. Not only that, there are many airport restaurants that qualify as a “lounge,” providing card holders with around $28 in free food per visit.

Royal Indigo and Jade Green holders also enjoy bonus interest on their deposits. Those who participate in Crypto.com Earn beyond their card stake will also get an additional two-percentage-point bonus on their cryptocurrency deposits.

For U.S. dollar stablecoin deposits, participants can earn 12% interest annually on deposits with a three-month term, instead of 10%. For Bitcoin, participants can earn 6.5% interest annually on deposits with a three-month term, rather than 4.5%.

Those with a Royal Indigo or Jade Green card can also withdraw up to $800 from ATMs with no fees, and at a 2% fee for amounts larger than $800. International transactions use the interbank exchange rate for amounts up to $10,000 per month, with a 0.5% fee thereafter.

The Royal Indigo and Jade Green card tier is an exceptional choice for globetrotters. The lack of international transaction fees, along with interbank exchange rates, make it a good travel companion.

That said, the 500 MCO requirement to unlock the card is not small. We recommend that people try one of the lower tiers first before making the upgrade.

Icy White / Frosted Rose Gold

Next up, the first of the luxury tiers. Holders at this tier are given a choice of colors between “Icy White” and “Frosted Rose Gold.” The Icy White and Frosted Rose Gold provides holders with 4% cashback.

To unlock the cards, it is necessary to stake 5,000 MCO tokens, equivalent to roughly $25,000.

Beyond nearly unbeatable cashback as well as the same subscriptions provided by the previous card tier, White/Gold holders also get a free subscription to Amazon Prime.

The White/Gold cards also give holders 10% cashback on Expedia, with a maximum rebate of up to $50 per month. Between all of these online services, holders can get a maximum of up to $88.97 in rebates per month. Like other premium MCO cards, both colors are made of composite stainless steel.

Like the previous tier, holders of the card will get LoungeKey Access, with the added choice of bringing along up to one guest.

Those who unlock the White/Gold tier will earn another two percentage points on top of what is offered by the previous tier on Crypto.com Earn, paid in MCO tokens. This means 14% and 8.5% interest for stablecoin and Bitcoin deposits with a three-month term, respectively. It also doubles the Crypto Earn deposit limit from $500,000 to one million, allowing card holders to earn interest on even larger sums of cryptocurrency.

Another benefit, the tier comes with access to “Crypto.com Private,” which provides services such as cryptocurrency investing, market research, inheritance services, special event access, and more.

Those with an Icy White or Frosted Rose Gold card can also withdraw up to $1,000 from ATMs with no fees, and at a 2% fee for amounts beyond $1,000. International transactions use the interbank exchange rate for amounts up to $20,000 monthly, with a 0.5% fee thereafter.

Overall, the Icy White or Frosted Rose Gold cards are good for people who want to earn interest on large sums of cryptocurrency, or those who simply want a “premium” experience.

Obsidian Black

The final card is only available to the largest of MCO token holders. It is only available to those who stake 50,000 MCO, equivalent to about $250,000.

The cashback for the Black card is unbeatable, providing an unconditional 5% cashback on all transactions. In addition to the free subscriptions of the previous cards, as well as cashback on Expedia, the Obsidian Black card also gives 10% cashback on Airbnb, up to $100 per month.

Between all of these services, holders can earn up to $188.97 in rebates per month. Like other premium MCO cards, the card is made of composite stainless steel.

Like the previous tier, holders of the card will get LoungeKey Access, with the added choice of bringing along up to two guests.

Those who unlock the Black tier will get the same bonus interest as the White/Gold tier on Crypto.com Earn. However, the deposit limit is again doubled from one to two million dollars, or the local fiat equivalent.

Those with the Black card will also be able to withdraw up to $1,000 from ATMs with no fees, and at a 2% fee for amounts beyond $1,000. There is no limit for international transactions using the interbank exchange rate for the Obsidian Black card.

Like the White/Gold, the Black card comes with access to “Crypto.com Private.” Obsidian Black holders, however, will get priority over Icy White or Frost Rose Gold for some of these perks.

The Obsidian Black card is good for high-net-worth individuals and those who run well-established businesses in the cryptocurrency industry.

Cost Benefit Analysis of Different Tiers

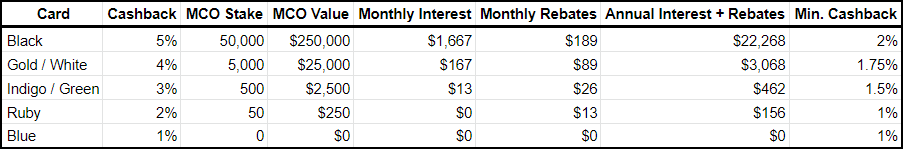

Although MCO Cards do not have annual fees, they do require that holders are comfortable making a significant investment in cryptocurrency.

There is a non-trivial amount of risk associated with holding the MCO needed to unlock these cards. Using the Indigo/Green tier as an example, staking 500 MCO requires an investment of about $2,500 in cryptocurrency. These tokens could be worth $1,500 to $3,500 at the end of the staking period, based on historic data in the last year.

Though, some of this risk is offset by the high interest rates offered on the MCO stake needed to unlock the cards. Funds that are staked automatically earn 6% for the 500 MCO tier and 8% for the 5,000 and 50,000 MCO tiers, deposited directly to the card holder’s Crypto.com wallet.

As shown in the table above, instead of paying an annual fee card holders are actually rewarded with interest ranging from $150 to over $20,000 per year, on top of monthly rebates and excluding potential savings from cashback.

It should be noted, however, that if the MCO stake is withdrawn from the card after the six month period, then holders will not be eligible for rebates and will only receive the “Minimum Cashback” rate, shown in the table above.

Another potential issue in our experience testing the service is that customer service may be slow to respond at times. Though there is a customer chat built directly into the Crypto.com app that “typically replies in a few hours,” it took customer service more than 24 hours to get back to our inquiries.

Should You Get the MCO Visa Card?

The MCO Visa Card offers competitive cashback and attractive perks at every level—and not just for Bitcoin fans.

Despite the sometimes dicey reputation of the cryptocurrency industry, Crypto.com as a company appears to be a well-trusted and regulated financial services provider. As a result, their cards offer similar guarantees to traditional debit and credit cards.

For those looking to avoid credit card debt while getting cashback rewards, then the Midnight Blue and Ruby Steel MCO cards could be a great choice. For those looking for some of the best cashback rates available and can afford to invest $2,500 in cryptocurrency, then the Royal Indigo or Jade Green MCO cards are a sound way to earn extra rewards.

For those with substantial cryptocurrency investments, then the extra interest and higher deposit limits with the Icy White and Frosted Rose Gold cards could be interesting. Finally, high-net-worth individuals who live and breathe cryptocurrency may find the Obsidian Black MCO card appealing.

In all, Crypto.com seems to have a card for everyone, even for those who aren’t interested in Bitcoin. Sign-up today using this link and get $50 after unlocking the Ruby Steel card or higher.

Disclosure: Crypto.com is a sponsor of Crypto Briefing. We received a free Royal Indigo card for testing purposes.

Share this article