OneLedger ICO Review And OLT Token Analysis

Share this article

OneLedger ICO Overview

The OneLedger ICO and OLT Token are offering a protocol to facilitate enterprise integration of blockchain technology. Through a combination of business modularization tools, integration APIs and interoperable architecture, OneLedger is designed to make the process of onboarding blockchain technology more viable and efficient for enterprises.

OneLedger present the protocol as a seamless path to enterprise use of distributed ledger technologies for myriad business applications such as supply chain/inventory management, accounting and digitization of assets.

OneLedger ICO Value Proposition

OneLedger is a three-layer consensus protocol designed to provide efficient integration of different blockchain applications for enterprise use. OneLedger allows users to create business applications via the OneLedger business portal, which communicates with the protocol via an API gateway. The business portal enables users with any level of blockchain experience to map their business module onto the blockchain, generate chaincode through modules created by developers and label the process throughout its design.

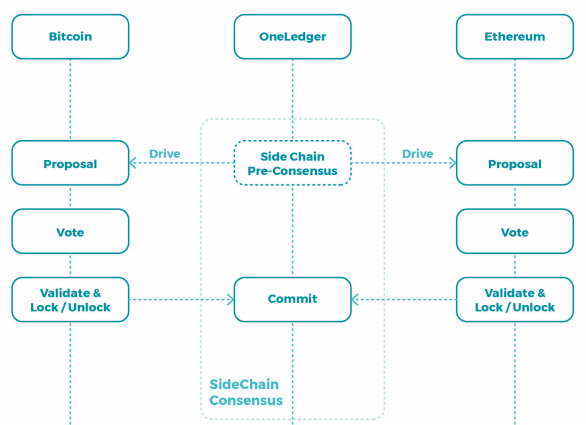

Interaction between enterprise applications with private or public blockchains occurs through the use of side chains. Below is a breakdown of the three layers of consensus underlying the protocol:

Role Consensus- The first layer utilizes a “role-based” consensus protocol tied to the digital identity of business participants, with each role linked to an individual node. Contracts generated by this layer define the roles and their respective behaviours.

The contract generated by this layer will be generated again as one that is executable on a selected public blockchains such as Ethereum. Through their defined key and digital signature, users are linked to their role in the business, enabling transparency and traceability of anyone who writes information on the blockchain.

Channel Consensus (i.e. Side Chain Consensus) – Side Chain Consensus allows for the execution of interactions (transaction or business actions) between roles. When new block data is recorded, Byzantine Fault Tolerant Partial Synchronization is utilized within the channel among all participants.

The Side Chain Consensus will require all participants to vote and consensus is reached when more than ⅔ of voters have reached agreement. When consensus is achieved, the written block data is broadcasted to all nodes in the channel and stored. Side Chain Consensus also helps initiate transfers between public chains.

Public Consensus – When a transfer between public chains is requested, the pre-consensus step is conducted on the sidechain, with a pre-consensus block sending a proposal to the public chain. The proposal is then voted on by validators of the public chain to lock or unlock assets from the public chain.

If the proposal is returned successfully from both public chains, the pre-consensus block is committed. Once ⅔ of the sidechain nodes commit this block, it is finalized on OneLedger.

Diagram Illustrating Transfer Between Public Chains from White Paper

OneLedger Token (OLT) serves several purposes within the OneLedger ecosystem. Firstly, users will pay a network fee to nodes as they use One Ledger protocol. Network supporters who run nodes will receive OLT in exchange.

Initially, anyone will be able to run a node. As the ecosystem develops, staking may be required to further guarantee the quality of the network. Users can also spend OLT in a marketplace to purchase new business modules and plugins made by developers. OLT will initially be issued as an ERC-20 token.

OneLedger ICO Team

David Cao is the Founder and CEO of OneLedger. David has a substantial track record as a developer and technical consultant with over 20 years of experience according to his LinkedIn. He is currently Chairman of the Canada China Blockchain Professional Association and from 2012-2017 served as Lead Commerce Consultant with Xerox.

Alex Todd serves as CTA of OneLedger. Alex has extensive experience as an entrepreneur. He is the Founder and CEO of a blockchain-enabled social credit rating system called Trust 2 Pay. He is also former CTO of PRESTO, a company that integrated Ontario’s transit fare system.

The Lead Engineer of the OneLedger ICO is Stephen Li. Stephen has over 15 years of experience as a developer since 2002. He has held positions with the likes of IBM and Morgan Stanley over his career, most recently with the latter as a full-stack web developer.

CEO of Polymath, Trevor Koverko, has joined the advisory team of OneLedger.

More information on the team and advisors can be found here.

OneLedger ICO Strengths and Opportunities

The product concept offered by the OneLedger ICO is very business friendly in terms of both usability. OneLedger intends to construct a service-side interface, otherwise referred to as the business portal, for users with any level of blockchain experience to build workflows and map business modules on the blockchain.

OneLedger will also leverage their API to encourage developers to create an ecosystem of plugins for specific business use cases. Developers will be able to make plugins available for enterprises on the OneLedger marketplace, where they can earn OLT in exchange.

To further take advantage of the potential that blockchain interoperability holds for enterprises, OneLedger are developing an SDK specifically for deploying Dapps across multiple platforms.

Instead of coding multiple smart contracts, the SDK will allow for developers to create a master smart contract, specifying the smart contract written in each language of choice for deployment on the desired set of protocols. Developers will have the ability to launch Dapps on multiple platforms at once via this master smart contract feature.

OneLedger ICO Weaknesses and Threats

Interoperability is focal point of blockchain infrastructure projects at the moment. With the plethora of protocols that offer similar promises to OneLedger in terms of scalability and interoperability, competition is considerably high.

According to the roadmap, the scheduled release date for the mainnet will be sometime in 2019. By that point, there is a chance the OneLedger ICO will have to contend with a market where enterprise adoption of competing protocols is already well underway.

The question of OneLedger API integration with existing ERP systems is not addressed clearly in the white paper. Most blockchain projects targeting enterprise clients offer a means to directly integrate existing ERP systems with distributed ledger technology, allowing for a more streamlined transition.

On page 11 of the white paper, reference is made to a “Connector” as part of the OneLedger Business Application Development Kit, which allows for integration between the protocol and centralized commercial networks. To what extent this Connector is compatible with existing ERP systems is critical for determining how OneLedger stands up to any competitor with a blockchain/ERP agnostic framework.

The OneLedger ICO team has little to show in terms of actual product development and has yet to release an MVP.

The adoption of a product targeting enterprise clients will invariably require a substantial period of piloting and scaling, which will not occur to any significant degree until after the final product actually exists and has proven both functional and viable.

The capability of the team to deliver such a promising product will be easier to assess once an MVP has been made available to the public. To monitor product development, OneLedger has created a Github, which is available here.

The Verdict on OneLedger ICO

With little product development to show and the absence of any significant indicators on the business front, OneLedger remains a highly speculative project at the moment. Still, the OneLedger team and concept merit attention and we will continue to monitor the progress of this ICO.

To discuss further, join 1850+ crypto enthusiasts in our Telegram chat.

We have rated hundreds of projects to unearth ICOs in which members of our team intend to invest.

We won’t often go into further depth on projects that we don’t consider as candidates for our investments after the initial rating process, which is why you will usually see our stamp on our detailed ICO reviews – they are the best we have found. However, on occasion, we might also rate a well-hyped project that does not meet our personal investing criteria.

The Crypto Briefing Top 10 stamp is awarded to ICO projects that we rate in the top 10% of all projects.

ONELEDGER ICO REVIEW SCORES

SUMMARY

The OneLedger ICO (OLT Token) merits a second look mainly because the team is clearly accomplished and experienced. However, no matter how scalable and interoperable their solution might be, the fact that there is little existing development – and plans for mainnet extend well into 2019 – means that the competition, including the recently-reviewed Unibright ICO, has an advantage in developing blockchain integration solutions for the business enterprise. Not to mention the fact that megatechs such as IBM and Oracle are surely examining this market themselves.

Founding Team……………………….8.4

Product…………………………………..4.0

Token Utility…………………………..9.2

Market…………………………………..8.5

Competition…………………………..4.4

Timing……………………………………5.1

Progress To Date……………………3.6

Community Support & Hype…..7.2

Price & Token Distribution……..6.8

Communication……………………..7.6

FINAL SCORE……………………….6.8

UPSIDES

- Product concept is well designed and addresses important future demand

- Significant hype and fast growing community

DOWNSIDES

- Very little if any product development to date

- Long roadmap leaves ample time for competitors to scale

Today’s Date: 3/29/18

Project Name: OneLedger

Token Symbol: OLT

Website: https://oneledger.io

White Paper: OneLedger White Paper

Crowdsale Hard Cap: $15 million USD

Total Supply: 100 million OLT

Token Distribution: 35% to contributors, 25% to community reserve, 15% to team and advisors, 15% to marketing and long term partners, 10% to company reserve

Price per Token: 1 OLT= $0.52 USD

Maximum Market Cap (at crowdsale price): $52 million USD

Accepted Payments: ETH

Countries Excluded: US, Canada, China, South Korea

Bonus Structure: N/A

Presale Terms: Over

Whitelist: TBA

Important Dates: TBA

Expected Token Release: TBA

Additional Information: https://t.me/oneledger

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article