Poloniex Is On A Delisting Spree: Who's Next On The Chopping Block?

Don't split up, and don't go to Jeremy's secret a-lair.

Share this article

Circle acquired Poloniex, one of the largest US-based crypto exchanges, in February 2018: and since then the exchange has taken a Friday 13th approach to delisting projects. In fact, the list of -ex’s is getting longer with almost every passing month.

The latest victims of the Poloniex delisting bloodbath (albeit only for US customers) were slashed away last week, and included Augur (REP), Decred (DCR), and Lisk (LSK). Six other projects were also voted off the island – sorry, eliminated from the exchange.

These delistings were made following an SEC statement that Circle says is “…taking an extremely broad view of what crypto assets might be deemed securities.”

Prior to the Circle acquisition, Poloniex had something of a reputation as a “Wild West” crypto exchange within the industry, a result of an aggressive expansion plan that saw Poloniex list dozens of coins.

But according to Nathaniel Popper of The New York Times, the SEC informally told Circle that regulators would not pursue any enforcement on Poloniex’s prior activity – as long as Circle transitioned the company into a regulated exchange after the acquisition.

Jeremy Allaire, the Co-Founder and CEO of Circle, was a guest on Laura Shin’s Unchained podcast last July, and he would not address the rumored informal conversations with the SEC. He did say that, “what’s important for us is that we have really positive, constructive engagement with regulators all the time” and that “we’re going to fully cooperate with them [regulators]”.

Circle later published their Asset Framework to determine which projects they will list on all of their exchanges, including Poloniex; and the same framework guides their delisting decisions as well.

When asked about the Circle Asset Framework, Allaire explained that “listing and delistings and that whole framework is also a priority for us and we’re going to be doing a lot there.”

Poloniex’s delisting policy cites that they remove assets to ensure the exchange meets their high standards – and these delistings clearly have adverse effects on coin holders.

For example, Poloniex announced the REP geofencing for US customers on May 16th, and the coin’s price has dropped 15% since then.

The other delisted coins have performed similarly, and Poloniex has been delisting batches of coins for the last year. For example, Gnosis (GNO) was delisted on October 3rd, 2018 and has been on a downward trajectory ever since (although clearly the trend was in full swing by then).

By analyzing Circle’s Asset Framework we can try to predict the coins that could be next on the executioner’s hit list.

It should be noted that most of these criteria require a subjective analysis – the framework is fairly nebulous, and Circle/Poloniex would likely find that any digital asset falls down on some measure of suitability or other.

The framework breaks the analysis down into five areas:

Fundamentals: Ensuring the project “aligns with the core tenets of the cryptocurrency community”.

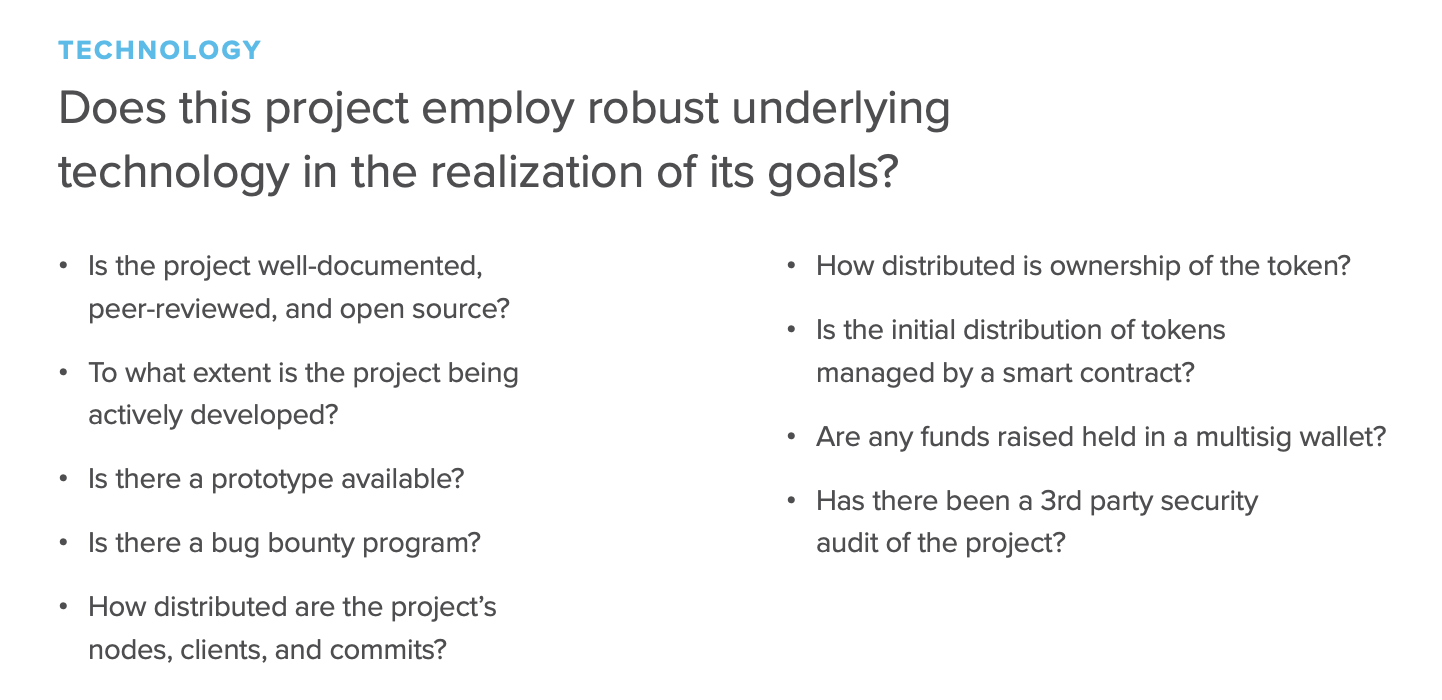

Tech: Ensuring the underlying technology is sound.

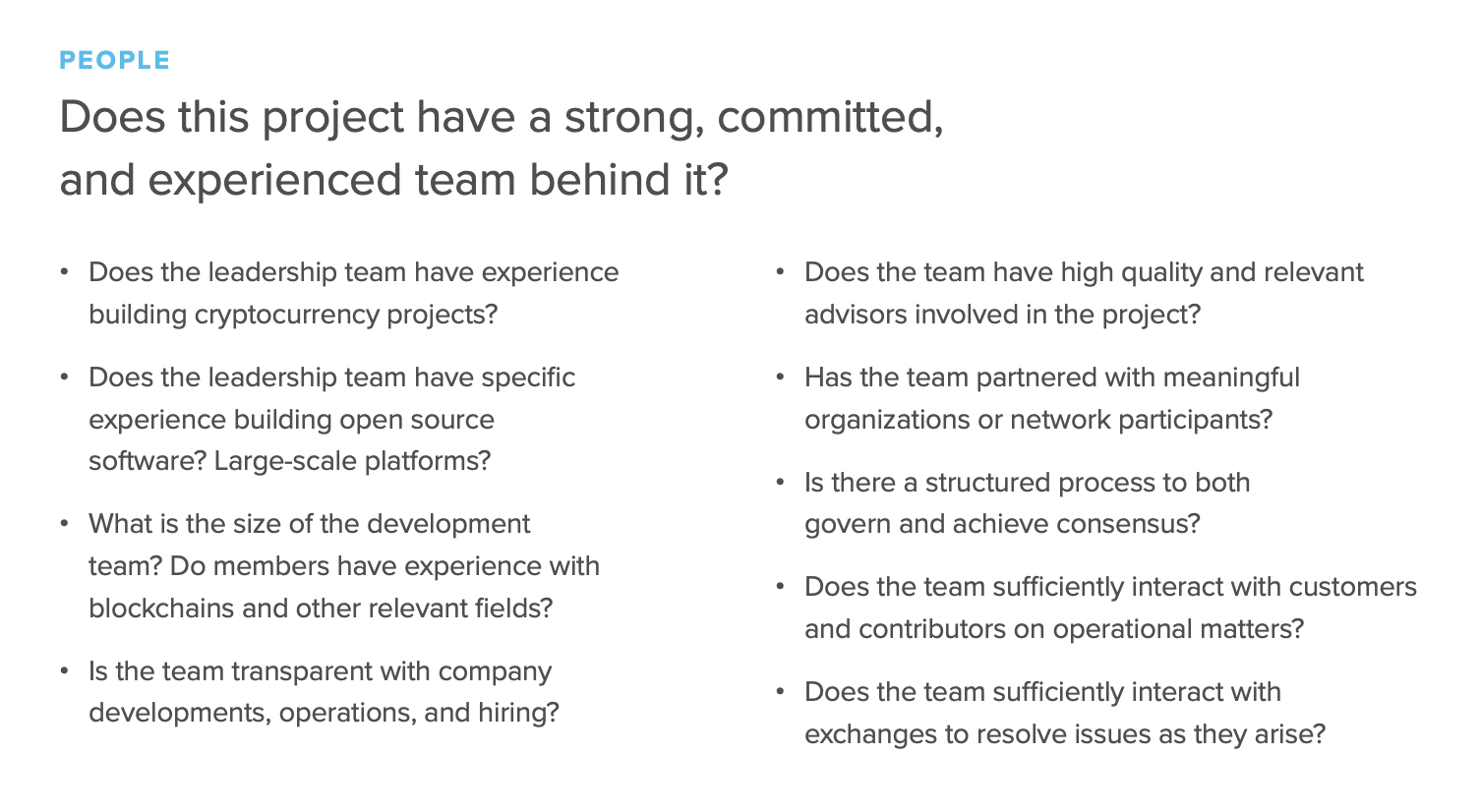

People: Ensuring that the project members are qualified, experienced and strong. It’s good that they look at both transparency of disclosures and partnerships.

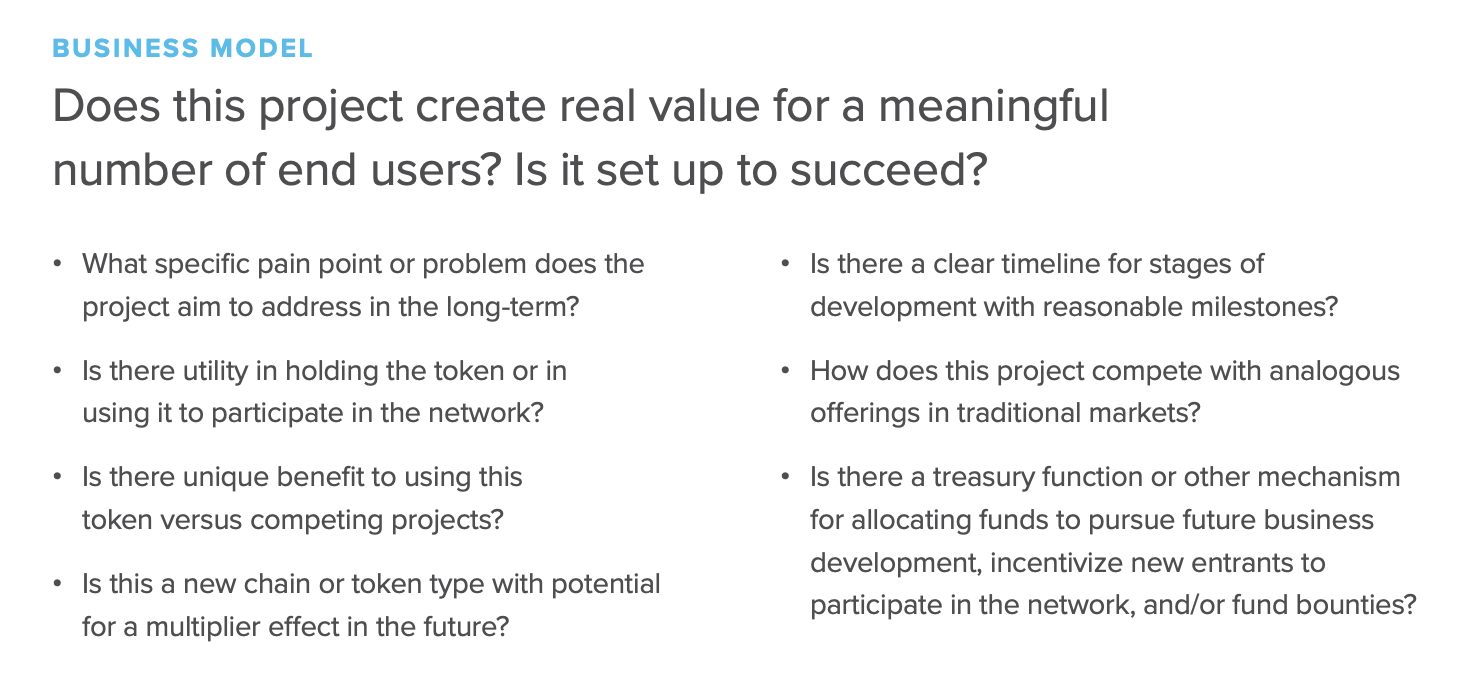

Business Model: This is another subjective measure to see if there is a market-fit for this project.

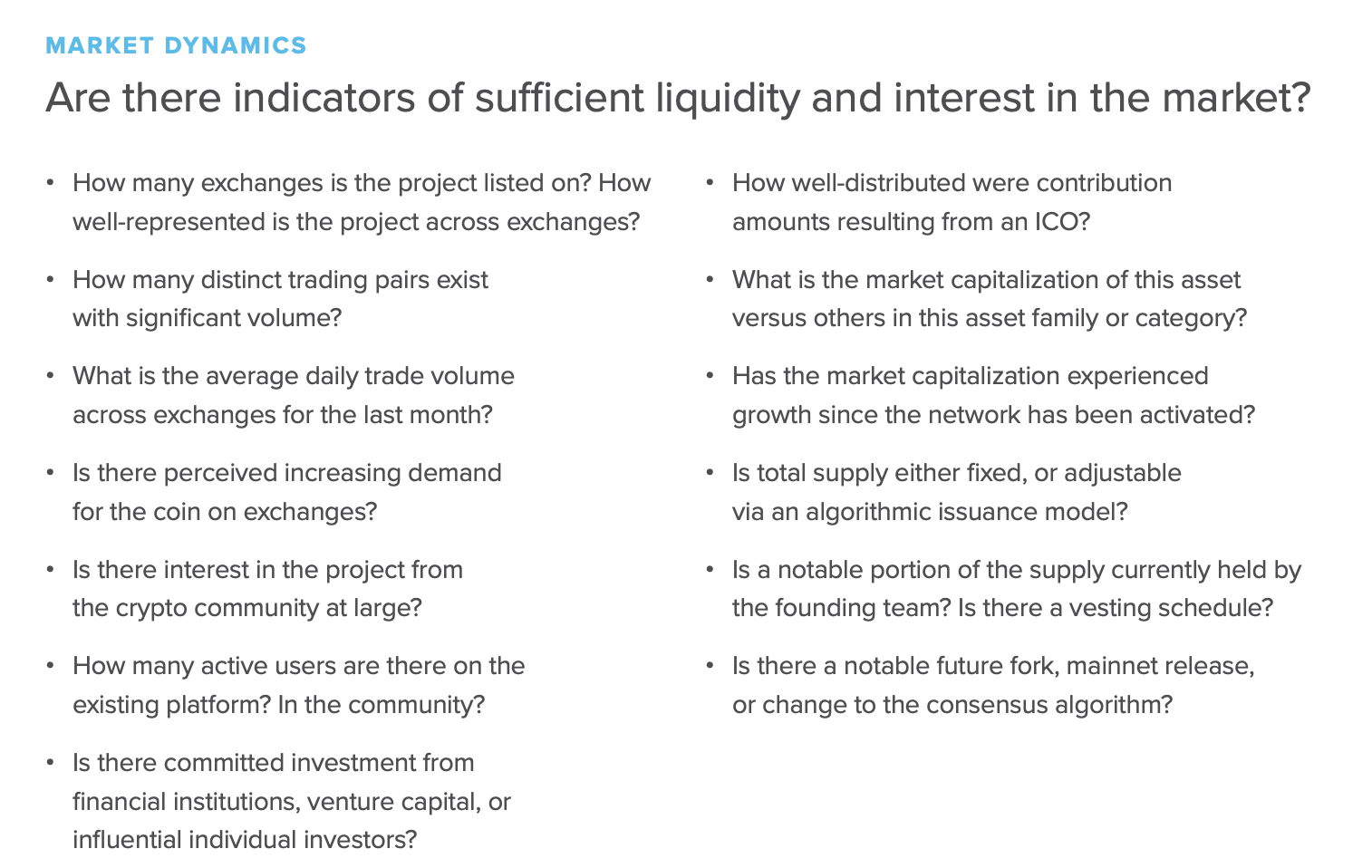

Market Dynamics: It seems likely that this makes up a bulk of the analysis. Circle looks at market interest, volume, trading pairs, and other exchange listings that are available to gauge the interest from the market.

Aside from this framework, the company is likely to make business decisions that govern future delistings. Each coin listed on their exchange requires maintenance. If the assets are not making the company money through trading fees, it makes sense to abandon them.

So which assets are next?

By cross-referencing the Asset Framework with the coins that Poloniex still has listed, we’ve identified four projects that could be at risk of delisting in the future:

1. Vertcoin (VTC): The project had $12k in volume on Poloniex in the last 24 hours, and despite being around since 2014, it seems the market (and its developers) have really lost interest.

2. Primecoin (XPM): The only other exchanges XPM is listed on are CoinEgg, BX Thailand and Bittylicious – not exactly exchanges known for their global commitment to working with regulators. XPM also had an abysmal $7k in volume traded on Poloniex in the last 24 hours.

3. FOAM (FOAM): This is a hot-take, since it was listed on Poloniex in December 2018 after the Circle acquisition, and a blog post was published supporting the fact that FOAM actually did pass their Asset Framework. With that said, the coins trades $13k of volume per day. With Poloniex’s fee structure that means they profit $30 a day on trading fees to have this coin listed… Is that worth the maintenance required? There is also very little public information on the project, which makes it hard to believe that the project meets a high enough standard of public disclosure to remain on the exchange.

4. LBRY Credits (LBC): This coin doesn’t look as “risky” as the others, but it has only had $10k of volume in the last 24 hours and is only listed on two other exchanges – with similar volume traded. With that being said, the developers are active, with above average code commits in the last year, and the project’s ethos of a digital marketplace may fit with the ‘ethos of the crypto community’.

While there are many contenders for delisting, some of which are major tokens with significant volume, the digital assets mentioned above seem to have a better-than-average chance of delisting – at least, from analyzing the published Asset Framework.

With that being said, anybody who’s been in the crypto world for a while knows that logic and analysis don’t always matter – just like the slasher movies, sometimes it’s just being in the wrong place at the wrong time.

Share this article