Ready To Start Mining? Here’s What You Need To Know

Part 1 of a series on everything to know about mining, from ASIC to Zcash

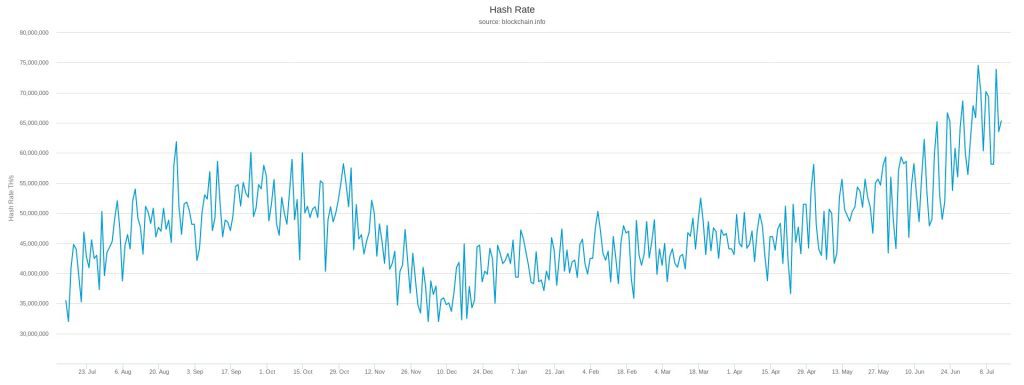

Cryptocurrency prices are back on the rise, and the number of miners is rising with them. In the past couple of months, hashrates have been racing higher, indicating that some large-scale miners may be back in business.

So you might be thinking it’s time to fire up your own rig again, or perhaps order parts and set up your own little mining farm for the first time.

But before you start counting your bitcoins, it’s worth taking the time to understand some of the fundamentals of the cryptocurrency economy. Each cryptocurrency uses a distinct algorithm, which incurs important tradeoffs in centralization, equipment and network security.

Here’s what you need to know about mining equipment:

CPU Mining

If you go waaaay back (about nine years), you would find that older cryptocurrencies were mined with CPUs, the basic processor in any computer. CPUs offered the greatest flexibility, and could perform whatever algorithm was needed to solve mining puzzles for block rewards.

This is generally referred to as “Proof-of-Work,” since the computer must solve a puzzle in order to add transactions to the ledger. It’s kind of like figuring out a combination lock by trial and error, but with a lot of possible combinations.

GPU Mining

Video cards, or Graphics Processing Units (GPUs), offer considerably more power than CPUs due to their ability to perform more calculations in the same amount of time.

But some cards are better at performing certain algorithms than others, depending on the manufacturer or even the specific model. So, GPUs offered more mining power and efficiency, but a little less flexibility.

As miners began building multiple-card rigs, these performance differences became even more apparent. CPUs found it nearly impossible to compete with graphics processors, which caused mining difficulty to ramp up considerably due to their huge advantage in efficiency.

FPGA Mining

The next stage in mining evolution was the introduction of FPGAs (field-programmable gate arrays). These devices are more powerful than video cards, but can be reprogrammed to specifically mine different algorithms quite efficiently — even more efficiently than a GPU.

While they are more powerful than GPUs, they are also a little less flexible, and can be very expensive, although there are some more affordable options available for certain mining solutions. While not as popular as GPUs or ASICs, they have in some cases acted as a happy medium due to their efficiency advantages over GPUs and their flexibility advantages over ASICs.

ASIC Mining

ASICs (application-specific integrated circuits) are the king of the hill when it comes to pure mining power, if the currency for which they are designed is worth mining.

That’s a big IF. ASICs are built for the express purpose of calculating one specific algorithm. They can can only perform one task, but they perform it very well (hence the term ‘application-specific’). ASICs are often many times faster at performing certain calculations than competing GPUs, and they also consume less power per calculation.

For example, the first specialized miner for ZCash was introduced by Bitmain, a leading manufacturer and designer. This dedicated machine could mine at around 10,000 solutions per second, using only 300 watts of power per month, completely outperforming the competition and making Zcash nearly impossible to mine with other devices.

But if ZCash were to change their algorithm, this device would no longer perform any purpose except mining other currencies on the Equihash algorithm. That makes ASICs a risky investment, especially for large-scale operations.

So ASICs can provide a greater pay-off than GPUs, but run the risk of becoming worthless if developers alter the algorithm. That’s what happened to Monero (which regularly forks to prevent ASIC development) and Siacoin, whose developers forked the mining algorithm so that only their devices could be used.

GPUs, on the other hand, offer less risk as they can simply redirect to another currency’s algorithm. They also tend to keep their resale value — when a device is obsolete, you can swap it out of your rig and use it for gaming or mining other coins.

Maintaining Decentralization

Many people think of mining as an easy way to make money, but miners also perform an important function in any PoW cryptocurrency network. A high mining difficulty ensures that transactions cannot be reversed, and having many miners ensures that transactions cannot be censored or controlled.

But mining also comes with tradeoffs, especially with the invention of specialized equipment. ASIC devices, which may take up to a year and millions of dollars to develop, make it impossible for any but the largest players to help maintain the network. The Bitcoin network, for example, is dominated by a small handful of players. Conversely, currencies that are CPU or GPU friendly may appeal to the spirit of decentralization, but are also vulnerable to outside mining power.

While there’s no ‘right’ way to secure a cryptocurrency network, the latest innovations and varieties in equipment should make it clear that mining is not to be taken lightly. We’ll address these issues in further detail in the next installment of this series.