Ripple Digital Asset Report: XRP Review And Investment Grade

Share this article

Ripple Digital Asset Report: Introduction

Ripple is a real-time gross settlement system, currency exchange and remittance network originally created by Ripple Labs Inc. in 2012. Ripple aims to connect banks and payment providers via RippleNet to provide more efficient transactions between the global financial institutions.

However, Ripple, the technology company, and XRP, the independent digital asset, are distinctly different. While the company is providing services for financial institutions, XRP can be used as a settlement currency by Ripple’s clients, but doing so is not obligatory.

This leads to one of the main criticisms of Ripple. The fact that it is selling the technologies that do not require the use of XRP ledger. The company is offering special software solutions (xCurrent and xVia) to its customers which have “no use” for the XRP tokens. Indeed, the token still lacks mainstream adoption among Ripple’s clients and this remains the main point of concern for the cryptocurrency.

The second main concern is in regard to the continuing saga over whether Ripple and XRP are truly separate. This will be addressed briefly in this research article, but countless authors have contributed their thoughts on this issue in other arenas.

Nevertheless, Ripple is one of the few companies, out there, that utilizes DLT technology to solve real problems for real customers. The company is taking time to develop network effects among its users, adding about two customers (B2B) per week. With over 200 banking and financial partners connected through RippleNet already.

Such a strong effort for the ecosystem development makes Ripple a strong player in the traditional payments market. However, Ripple needs to further push for adoption of the XRP token in order to maintain its positions in the cryptocurrency space.

Part One: The Business Case

Ripple Market Opportunities

Ripple is evolving as a significant player in the cross-border transaction market. According to the US Treasury, its closest competitor in the traditional market, SWIFT directs the transfers of over $5 trillion worldwide each day. The company has already made a play in that market and is reporting that its customers are using both SWIFT and Ripple.

Ripple, with its XRP token, is also looking to become a source of “on-demand liquidity”. In order to maintain liquidity for international transactions, financial institutions must open Nostro/Vostro accounts in foreign banks. These accounts must be pre-funded in a foreign country’s native currency. According to 2016 McKinsey Global Payments report, this forces financial institutions to lock up around $5 trillion capital that could otherwise be put to work. With XRP as a tool for instant settlement, these resources would be unleashed.

Ripple is also making a play in the global remittance market, which totaled over $680 billion in 2018, increasing over 10% compared to the previous year.

Entering all of the markets above, Ripple is not trying to replace the banking sector. On the contrary, its B2B products are architected to fit within banks’ existing infrastructure, resulting in minimal integration overhead and business disruption.

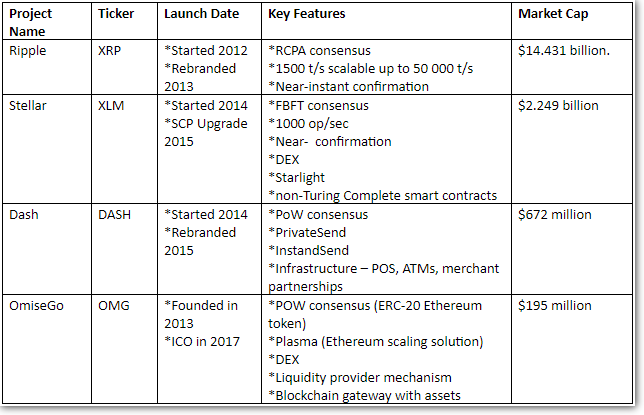

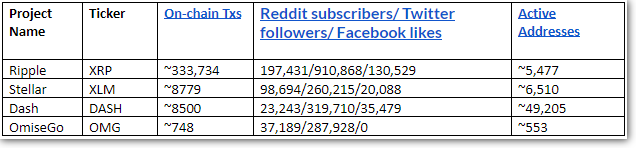

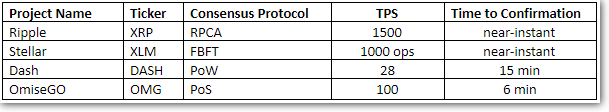

Its competitors in the blockchain space have taken a different path, and provide B2C solutions that aim to replace existing banking infrastructure. Stellar is often considered to as a B2C alternative to Ripple, trying to connect people to low-cost financial services. Dash and OmiseGO are also working on providing solutions for retail customers. Dash is building payment infrastructure, ATMs, SMS payment solution, while OmiseGO wants to provide banking to the unbanked, something both PayPal and Stripe are doing.

Competition in the Blockchain Space

Ripple is not a traditional DLT company, as most of its market growth comes from the traditional space. While Ripple is expanding its partnerships network it can become really successful in providing payment services for financial companies. However, if the company will not increase adoption of the XRP token in the B2B sector, its token holders may see no benefits from such a success, driving the price down.

NVT Comparison

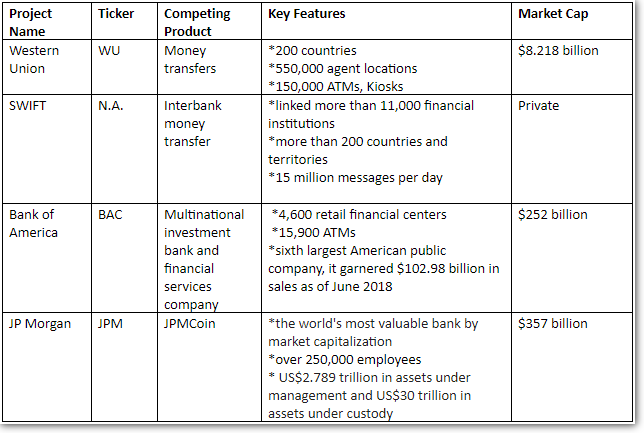

In the traditional space, Ripple is competing with established companies, which have been in the industry for decades.

SWIFT is considered to be the main competitor of Ripple. It is a market leader with over 40 years in the industry. SWIFT provides interbank financial services for over 11,000 financial institutions all over the world. There have been a number of rumors that two companies are going to partner. However, the rumors were not confirmed and currently, two companies are actively competing against each other.

In 2017, SWIFT has launched its GPI payments service which makes interbank payments faster, cheaper and more efficient. SWIFT GPI promises payments within 30 minutes or within 24-hour time. However, Ripple confirms payment within seconds.

SWIFT is also testing its own blockchain technology. Although it is not ready for mainstream adoption, taking into account the SWIFT’s network effects, further improvements in its payment infrastructure can slow down the Ripple’s network growth. This is a significant risk in the long run, since Ripple is already taking away the market share from SWIFT.

With some companies, Ripple has been trying to develop partnerships rather than increase competition. Western Union (WU), for example, has been testing Ripple since the beginning of 2018. However, in the interview with Fortune, WU CEO Hikmet Ersek said that during the 6-month test they have not seen significant cost efficiencies using Ripple. He also noted that it is too early to draw conclusions because their pilot may have been too small. According to Ripple, Western Union sent just 10 payments during the 6-month period, which is far too little to achieve any cost savings.

It is also important to mention, that Western Union filed a cryptocurrency related patent, which may partially explain why the company was not that enthusiastic about testing Ripple, thinking about their own solutions to compete with Ripple.

Large U.S banks are also periodically filing for cryptocurrency-related patents, and waiting to make a move into the industry.

One of the most active banks in this sphere is Bank of America (BofA), the second-largest bank in the United States. BofA has filed more than 50 cryptocurrency related patents since 2014. Although filing patents do not necessarily mean that the company will develop a product, the interest from such a large financial institution indicates that increased adoption of the blockchain technology will drive competition.

JP Morgan has also been working on its blockchain solutions. The company announced JPMCoin which will be used for settling transactions in real-time among clients of the bank’s wholesale business. Currently, JP Morgan clients are using SWIFT and Fedwire to transfer money within the bank.

Competition in the Traditional Space

In the traditional space, Ripple has been successful in introducing innovation to the conservative payment market, competing with the companies that have far greater adoption levels and brand recognition. However, its fast pace of market development initiated the progress for the whole industry, making traditional companies more competitive and technologically relevant. This will further increase the competition in the sector and make it more difficult for the company to acquire new clients.

At the same time, the lack of adoption of XRP token, in the blockchain space, should be one of the main concerns for the company during the next phases of development. Ripple should push for adoption of XRP token among traditional financial companies, lack of progress in this direction, may negatively affect investors perception and its overall market share in the cryptocurrency space..

Ecosystem Development

The XRP Ledger is a decentralized cryptographic ledger powered by a network of peer-to-peer servers. Ripple maintains a distributed ledger which keeps track of all the transactions on the network. Each participant in the network has to choose a set of validators, specifically configured to participate in consensus. There are two types of validators:

- Validators – determine if transactions meet protocol requirements and valid. They are also involved in grouping transactions into ordered units, agreeing on ordering to prevent double spending

- Validators from the Unique Node List (UNLs) – this is a list of trusted validators provided by Ripple. Since anybody can run a validator, UNLs are appointed by Ripple and trusted to not conspire to defraud the network. Ripple assessing a possible UNL against several factors including server topology, uptime, speed, network agreement rate, public attestation, etc.

The Ripple Protocol consensus algorithm (RPCA), is applied every few seconds by all nodes. In order to reach consensus at least 80% of UNLs should agree on the state of the network. If, for example, more than 20% trusted validators are faulty, the network would simply stop making progress. In this scenario, XRP Ledger would require intervention from human participants who can decide whether to reconfigure the validators or simply wait.

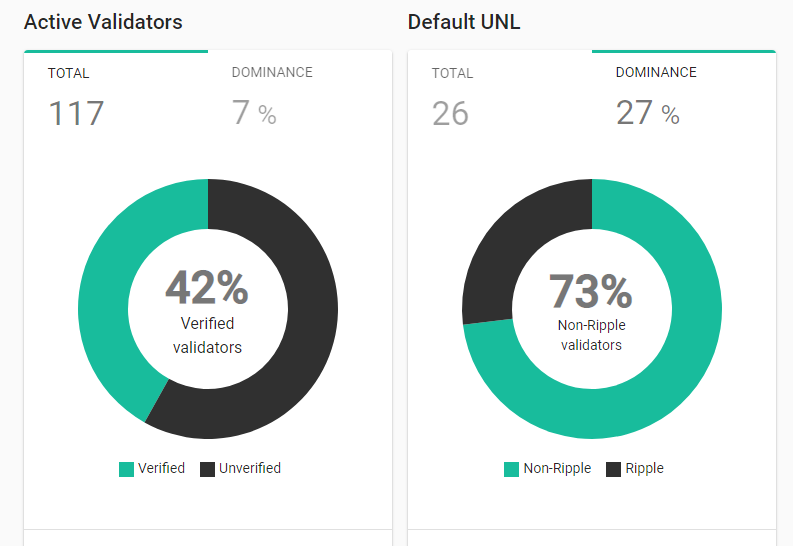

Currently out of 22 default UNLs, 7 are from the Ripple company. Although, Ripple plans to remove itself from the process of choosing trusted validators in the future, at the present time the network remains highly centralized and company dependent.

This dynamic is also present for the developers’ community. In fact, Ripple is a major contributor to the XRP ledger codebase and most of the upgrades and developments are prepared inside the company. There are almost no developers that are working in a decentralized and independent way for the benefit of the network, which makes its existence without Ripple company highly doubtful.

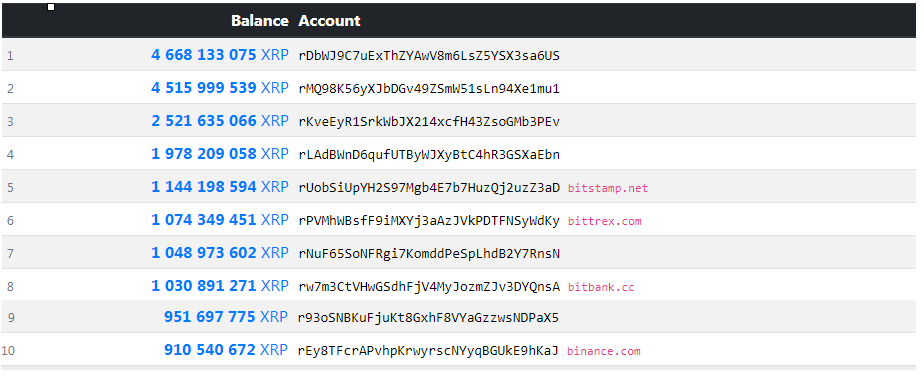

Centralization of funds is also quite high. According to ledger.exposed.com top 10 addresses own nearly 42% of the available XRP supply. Some of the addresses are represented by exchanges, but still, a substantial amount of tokens are in the hands of a few company insiders. This could be an issue in case of governance conflicts.

Moreover, Ripple has already faced selling pressure, from its co-founder and former CTO Jed McCaleb. McCaleb has left the project in 2013 receiving at least 9 billion XRP as part of the funding agreement. McCaleb has signed the agreement with Ripple limiting the daily sales based on a set percentage of the average daily volume. However, according to the WSJ, his sales dramatically spiked in August 2018, from less than 40,000 XRP per day to over 750,000 XRP per day resulting in a strong downward pressure on the token price.

Top-10 Wallet Distribution

Ripple is criticized for the centralization of its network. In fact, centralization can have some benefit as well as drawbacks.

On one hand, the company is working with highly sophisticated financial institutions, so it helps to have a central point of contact for its customers. This makes the customer onboarding process quick and efficient. Additionally, centralized networks are far more scalable and reliable when it comes to upgrades and technical support.

On the other hand, centralization poses different company-related risks. The Ripple company is the only entity that drives adoption for XRP token. At the same time, it owns a substantial amount of XRP tokens and appoints trusted validators. If for some reason the company is going to stop its operations or decides to discontinue its involvement, it is highly doubtful that the XRP ledger would be able to survive.

It is also difficult not to notice the effort of the company towards becoming more decentralized. In fact, Ripple is trying to disassociate itself from the XRP Ledger, stating that “Ripple Labs is not XRP”.

The company is also trying to decentralize the XRP governance process by introducing amendments. Any changes to transaction processing should be approved by 80% of trusted validators. However, giving the fact that trusted validators are approved by the Ripple company, this adds little to decentralization.

The suit claims:

In fact, there is a difference between Ripple investors and investors in XRP. According to Crunchbase, Ripple has raised a total of $ 93.6 mil in funding over 8 rounds from such investors as Standard Chartered, Accenture, CME Group, Andreessen Horowitz, Google Ventures, etc. While Ripple investors are expecting to profit from the company operations and services, retail investors in XRP, for the most part, do not have any use case for the token, not taking into account the speculation part.

Ripple is actually trying to say that XRP was not created by Ripple, instead, it was gifted to the company by some of the open-source developers that created it. However, according to archived version of their website in 2013, there was a statement that “Ripple Labs created 100 billion XRP within the Ripple network”. In addition, there were documents published strongly suggesting that Ripple created XRP.

Such contradictions show that Ripple is actually recognizing the risk of XRP being considered a security and is trying to change the tactic to avoid SEC enforcement action over its token issue. Before we see a clear statement from SEC that XRP is not a security, the risk is present, and in the worst case scenario, it can negatively affect both the underlying asset and the company.

However, this is not the case presently and Ripple is successfully securing partnerships with financial institutions all around the globe. RippleNet is currently connecting 200+ banking and financial partners all over the world. The company is providing services for companies such as PNC Bank (top ten bank in the United States), Standard Chartered (one of the top banks in the United Kingdom), CIMB Group (one of the largest banks in Asia), Kuwait Finance House (one of the leading Islamic bank in the state of Kuwait), etc. In fact, RippleNet currently counts 11 of the world’s top 100 banks by total assets as customers, all of whom are deploying Ripple payment solutions.

Partnerships

Most of Ripple’s clients are using either xCurrent or xVia, the software that enables instant cross-border settlement of payments. With these products, there is no need for the XRP token.

The product that requires XRP token is xRapid. It came out in the fall of 2018 and is currently used by a few companies such as MercuryFX, Cuallix, and Catalyst Corporate Federal Credit Union. MercuryFX is using xRapid in the Europe -Mexico corridor, while Cuallix is using it for the U.S.-Mexico corridor. Corporate Federal Credit Union uses xRapid to develop a new cross-border payment service. Ripple also partnered with U.S. based Bittrex, Mexican Bitso to move between XRP, U.S. dollars, and Mexican pesos.

Moreover, recently, London based Euro Exim Bank has publicly announced that it would use xRapid for cross-border payments, starting Q1 2019. This would be the first bank in the world to utilize xRapid.

The release of xRapid was long awaited by the blockchain community. Ripple advocates believe that “today xCurrent tomorrow xRapid”. However, the company still has to prove that xRapid solution is viable and has the potential to become popular among current and future clients.

xRapid is not the only product that is supposed to increase the adoption of the XRP token. Facing critique that the token has no retail use-cases, in 2018, Ripple introduced Xpring, which should incentivize projects that will form the ecosystem around the XRP Ledger. Ripple will incubate these projects and support them with a mixture of investments and grants. Ripple has hired Ethan Beard, former director of Facebook’s developer network, to serve as Senior Vice President, to lead Xpring and Ripple’s developer program.

Xpring has already offered support to a few projects which will utilize XRP as a currency in their ecosystems. Omni will integrate XRP as a currency into Omni’s marketplace. Coil utilizes interledger protocol and allows XRP donations to different content creators.

Creating Xpring, Ripple is trying to play the role of a VC fund. However, the supported projects are still in the early days of their development, and their long term sustainability and positive effect on XRP adoption are still questionable. The whole move towards retail use-cases can be seen as an attempt to disprove the perception that the XRP token is useless for retail actors.

Still, the larger portion of the crypto-community around the project is speculating on the price, hoping that the company will be successful in promoting XRP token for cross-border transactions.

At the same time, compared to Stellar, despite a large number of followers Ripple has a relatively small number of active addresses. This could be explained by the fact that Ripple is a B2B solution, which can be expected to have fewer clients with larger volumes.

It is also reasonable to notice that XRP active accounts holders are almost 40 times more active than XLM account holders, which may be a sign of network tests by the financial institutions.

Community Involvement Comparison

Ripple has been successfully developing its ecosystem in the traditional markets. The project attracted a lot of attention in the blockchain space, making XRP one of the top 3 cryptocurrencies available for investors. The project needs to make another step in order to connect traditional markets via xRapid. Given the amount of speculation in the market about the viability of xRapid solution, further delay and lack of adoption could have a negative impact, on both XRP Ledger and on Ripple Labs.

Token Economics

The Ripple native currency, XRP, primarily can be used by banks as a source of on-demand liquidity. XRP is utilized as a settlement currency in Ripple’s product xRapid.

Settlement instrument – as a settlement currency XRP can potentially free capital/liquidity that is locked in Nostro/Vostro accounts. Ripple has already connected more than 200 financial institutions via RippleNet, where most of the transactions are settled through USD and EUR, with the development of xRapid, some fraction of RippleNet payments can be settled with XRP. This could boost the adoption of XRP token by institutions.

Ripple released xRapid in the fall of 2018, and it plans to target payment corridors that are inefficient but have fairly high volume, such as USD>MXN or EUR>INR. Ripple likely won’t target biggest corridors like USD>EUR early since they’re already efficient.

Currency traders often have small profit margins, so even a small incentive to place good EUR<>XRP and XRP<>INR offers can beat what banks are getting now through the correspondent banking system.

Cross–currency – Ripple can be used as a medium of exchange. Binance uses XRP as a base trading instrument, for TRX/XRP and XZC/XRP pairs.

Speculation – XRP is traded on many of the popular crypto-exchanges.

Reserve requirement – Ripple also requires its users to maintain reserve requirements. To submit transactions, an address must hold a minimum of 20 XRP in the shared global ledger. To fund a new address, you must send enough XRP to meet the reserve requirement. This is done to protect the network from growing excessively large as the result of spam or malicious usage.

Fees – current fee for a standard transaction is 0.00001 XRP ($0.00000369). Fees sometimes increase due to higher than usual load.

Current Transaction Cost in XRP = base_fee_xrp × load_factor, where base_fee_xrp = 0.00001 XRP, load_factor – is determined by the highest of the individual server’s load factor, cluster’s load factor, and the overall network’s load factor.

The transactional fees are not used to pay anyone, they exist in order to protect the network from spam. XRP fees are irrevocably destroyed which decreases the overall supply of tokens. However, with such low fees, the deflationary effect is absent. For example, SWIFT processes up to 24 million transactions per day, with such transaction volume Ripple would burn around 87600 tokens per year, which is a negligibly small number comparing to the total number of 100 bln. tokens.

At the same time network maintainers (validators) are not incentivized for their work. The company is trying to decentralize itself, and since it owns most of the tokens, it does not want to be seen as “paying for the validators services”. Nevertheless, with no incentives from the network, validators could discontinue their operations, if Ripple does not succeed with XRP adoption in the long run.

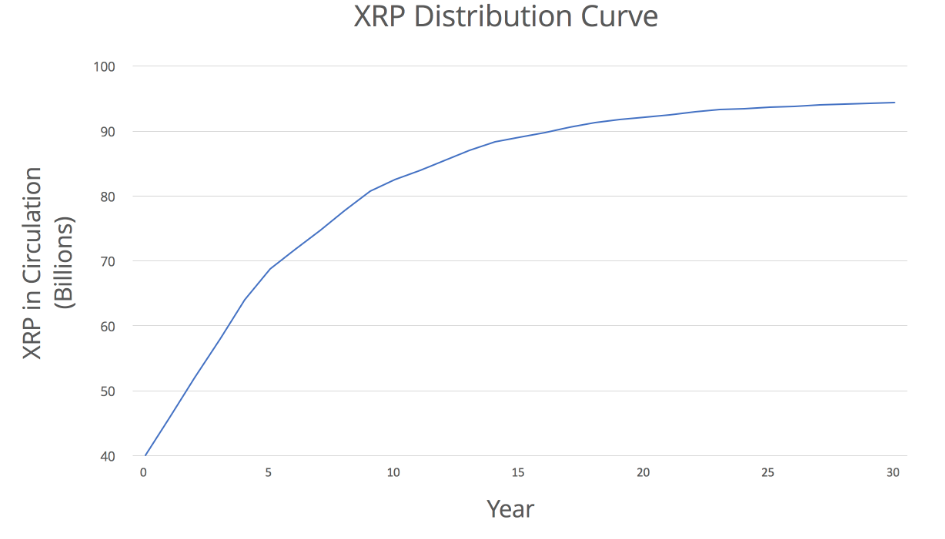

The total supply of XRP has been capped at 100 billion. Of these, 40.7 bln XRP are currently distributed, 8.3 mln were burned as fees 6.7 bln held by Ripple, and 52.5 bln is placed in escrow.

The number of tokens that are going to be sold during each quarter is entirely controlled by the company, which gives the opportunity to finance nearly any business incentive that would benefit the network.

XRP Distribution Curve

The concerns arise regarding the fact that Ripple company controls almost 60% of the available tokens and is selling them to retail investors who do not have a utility use case for them.

There is an ongoing debate on whether Ripple should be considered a security. In fact, the company is facing several Class-Action Lawsuits regarding this issue.

Although, as already mentioned above, the speculations will continue, and the company should try to come up with a better tactic than simply denying any connection with XRP ledger.

This makes the whole token economics questionable due to the fact that the company is using retail investors’ money to fund its non-crypto activities, while the clients who are supposed to use XRP as settlement currency are still just entering the adoption phase.

Lead Team

Brad Garlinghouse – Brad is the CEO of Ripple Labs. Prior to Ripple, Brad served as the CEO of file collaboration service Hightail. Brad was also the President of Consumer Applications at AOL and held various executive positions at Yahoo! from 2003 to 2009.

Chris Larsen – Chris is Executive Chairman of Ripple’s board of directors, former CEO and co-founder of Ripple. Prior to Ripple, he co-founded online mortgage lender E-Loan, and the first peer-to-peer lending marketplace Prosper Marketplace. On January 4, 2018, Forbes estimated Larsen’s worth at $59 billion on paper.

David Schwartz – David is the CTO of Ripple Labs. He is one of the original architects of the Ripple consensus network. In the past, David developed encrypted cloud storage and enterprise messaging systems for organizations like CNN and the National Security Agency (NSA).

Ripple has established and well rounded leading team. The company was able to hire executives from various backgrounds and well-known companies such as Facebook, Yahoo!, AOL, Mastercard, Citibank, Bloomberg, CNBC, Yelp, IBM, etc.

Currently, the company has more than 200 employees with offices in San Francisco, New York, London, Sydney, India, Singapore, and Luxembourg.

However, during the early stages of its development Ripple has also been through a few governance conflicts. One of the co-founders of the company, Jed McCaleb, left Ripple, having “different vision” for the project and founded Stellar.

At the same time, in 2014, the early investor Jesse Powell was not happy with the fact the founders Jed McCaleb and Chris Larsen allocated themselves 20% of all XRP tokens:

“In my view, the two stole company assets when they took the XRP without approval of the early investors, and without sharing the allocation amongst the other shareholders.”

Although the founders’ tokens were not returned to the company, McCaleb committed to donating 2 bln. XRP to charity, while Larsen created a foundation to distribute 7 billion XRP to the underbanked and financially underserved people.

As was discussed above, such a great centralization of tokens in the hands of co-founders caries risk of selloffs in case of conflicts between founders and investors, which is not beneficial for any distributed ledger.

Having quite a long history for a cryptocurrency startup, Ripple was able to form a very professional team of individuals that have been driving adoption of the company’s products. However, its centralized structure continues to remain a concern for the blockchain community.

Part Two: The Technology Case

Underlying Technology

Ripple currently offers three main products to its customers: xCurrent, xVia, and xRapid. All of the products are interconnected and designed to increase the speed and lower the cost of cross-border transactions made by financial institutions.

xCurrent – is a software solution that enables banks to instantly settle cross-border payments with end-to-end tracking. xCurrent, banks message each other in real-time to confirm payment details prior to initiating the transaction and to confirm delivery once it settles. The product is architected to fit within a bank’s existing infrastructure, resulting in minimal integration overhead and business disruption which makes it popular among many financial institutions.

xCurrent is built around an open, neutral protocol, Interledger Protocol (ILP), which enables interoperation between different ledgers and networks, it connects ledgers from two different banks and removes intermediaries and central authorities from the system.

The usual process of cross-border transfers involves connectors, which do not have a standardized model for communication, making the transfer process more expensive and time-consuming.

xVia – is for corporates, payment providers and banks who want to send payments across various networks using a standard interface. xVia’s simple API requires no software installation and enables users to seamlessly send payments globally with transparency into the payment status.

xRapid – uses XRP token as a bridge currency, allowing payment providers and banks to process faster cross-border transactions to emerging markets.

XRP token is a digital asset of XRP ledger, a decentralized cryptographic ledger powered by a network of peer-to-peer servers.

Anyone can run their own Ripple server (validator) that follows the network and keeps a complete copy of the XRP Ledger. However, not every server can participate in consensus. In fact, each server maintains a unique node list, which contains trusted servers specifically chosen by Ripple company.

Currently, there are 117 active servers (validators) and 22 servers from the Unique Nodes List. Ripple is trying to decentralize the ledger by including more non-Ripple servers in the UNL, which are maintained by different trusted organizations. For example, there are two servers maintained by educational institutions: the University of Kansas and the University of California, Berkeley.

The Ripple Protocol consensus algorithm (RPCA), is applied every few seconds by all nodes, in order to maintain the correctness and agreement of the network. The consensus is only achieved if 80% of the UNL server agrees with it.

The RPCA proceeds in rounds. In each round:

- In the beginning, servers take all valid transactions that have not already been applied, since the previous consensus, and make them public in the form of a list known as the “candidate set”

- Each server then amalgamates the candidate sets of all servers on its UNL, and votes on the veracity of all transactions

- Transactions that receive more than a minimum percentage of “yes” votes are passed to the next round, if the transaction does not receive enough votes, it will either be discarded or included in the candidate set for the beginning of the consensus process on the next ledger

- The final round of consensus requires a minimum percentage of 80% of a server’s UNL agreeing on a transaction. All transactions that meet this requirement are applied to the ledger, and that ledger is closed.

Ripple is pointing out that it would be really hard to attack its DLT network since it would be really difficult to compromise 80% of UNLs which are located in different geographical locations. Still, the company acts as a central point of failure for the network because it is the main entity that is building infrastructure for the adoption of the XRP token.

Scalability Comparison

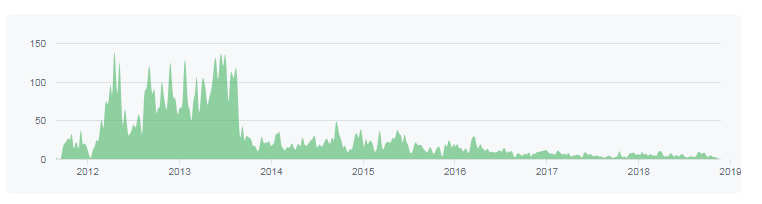

The GitHub activity has mostly been steady (under 20 commits per month). Major developments for the project were completed in 2012-2014. After that, there has been a steady decrease in the number of commits. In 2018, there were less than 300 commits for the whole year, from about 20 contributors. Such a low number of commits indicates that outside developers are not interested in the ledger, while Ripple developers do not see that there is a need for major improvements in the current state of the network.

The company is also far ahead from a technological point from its competition. Technologies behind Ripple allows banks to transfer money within seconds, on average, 3.6 seconds, while SWIFT transfers money in 1-3 days. If Ripple will be able to successfully adopt instant settlements with XRP, SWIFT’s market share would start diminishing at a faster pace.

From a technological standpoint Ripple has built working products for their customers. However, from a maximalist perspective, the ledger is not decentralized enough and entirely dependent on Ripple company. Nevertheless, the adoption of XRP token is connected to the development of RippleNet. It is too early to make conclusions, and we need to give a chance for broad adoption to materialize.

Roadmap

Ripple does not have a roadmap listed anywhere on the website. In fact, Ripple Labs is a private company, and it is trying to keep its plans private, revealing some of the information during formal interviews or press releases.

2019 will be the first year when the company will have three commercial products available for its customers: xCurrent, xVia, and xRapid.

The company is currently singing about two production contracts a week and plans to expand the usage of xRapid. However, xRapid is still in the early stage of commercial implementation. In order for it to become fully adopted, banks have to significantly change their liquidity management processes, which will not happen overnight.

Ripple is planning to continue to expand its operations in Southeast Asia and the Middle East where the corresponding banking system hasn’t been as effective in serving customers.

Part Three: The Investment Case

Token Performance

Ripple (XRP) is a top-3 crypto project based on market cap. Due to the steep drop off in the price of Ethereum, XRP was able to reach the second place on Coinmarketcap. However, its second place position is not that stable, giving the periodic high spikes in the Ethereum token price. The price of XRP token also followed the overall direction of the market during 2018 and fell more than 90% from its ATH. In terms of 24-hour volume, XRP holds the 5th place on the chart with over $500,000,000 daily volume.

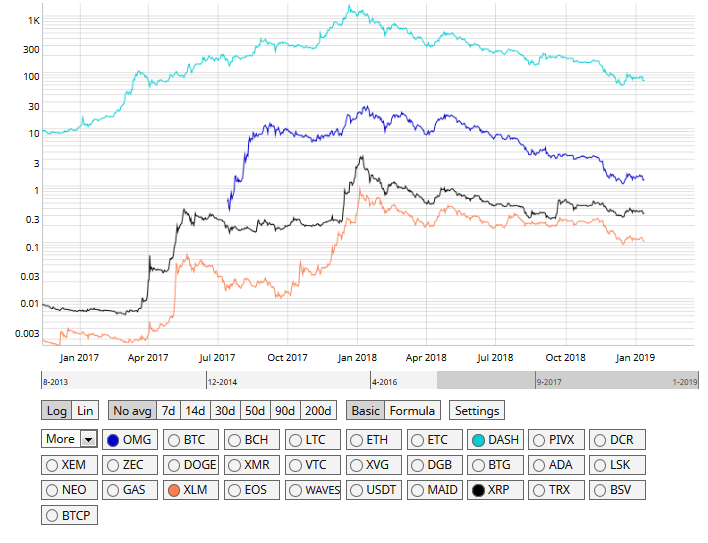

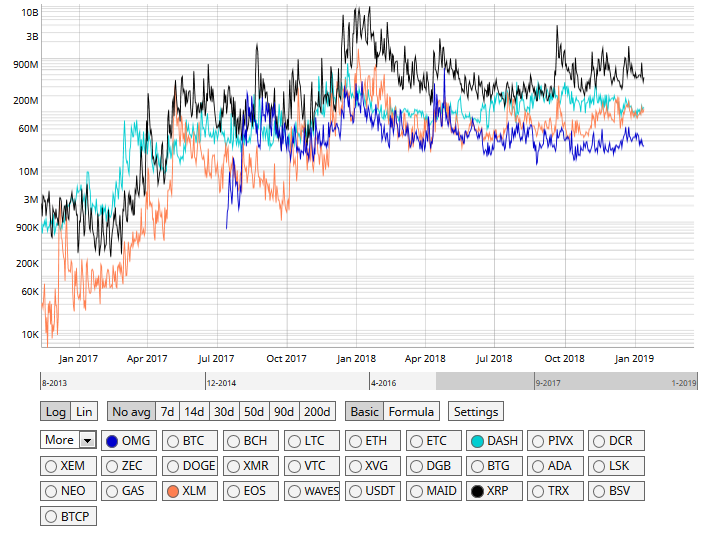

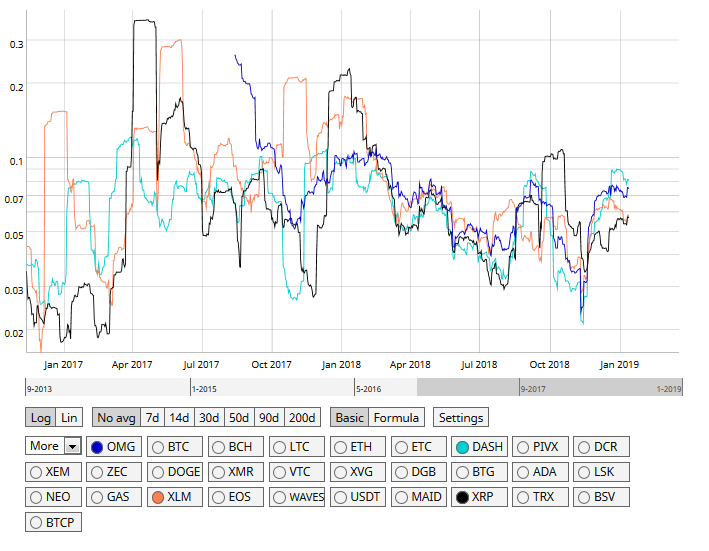

Price Comparison

XRP / Stellar / DASH / OmiseGo / Price Comparison

Compared to its rivals XRP price chart follows a similar pattern. However, in Q4 2018, XRP grew 100% during a few days, following the announcement of its latest product xRapid. This indicates that the community is ready to accumulate the token if it sees further adoption of xRapid. This adds volatility to the token, which is a negative factor for it as a cross-currency.

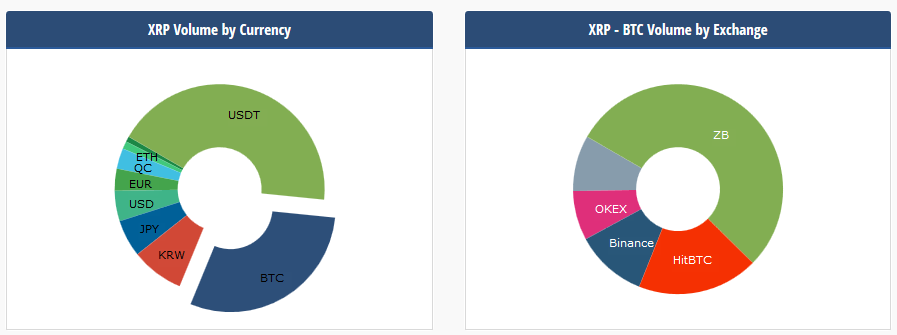

XRP trading is dominated by XRP/USDT, XRP/BTC, and XRP/KRW markets. The fact that XRP/fiat pairs are dominating is encouraging, given that Ripple is trying to make a play in the financial services sector.

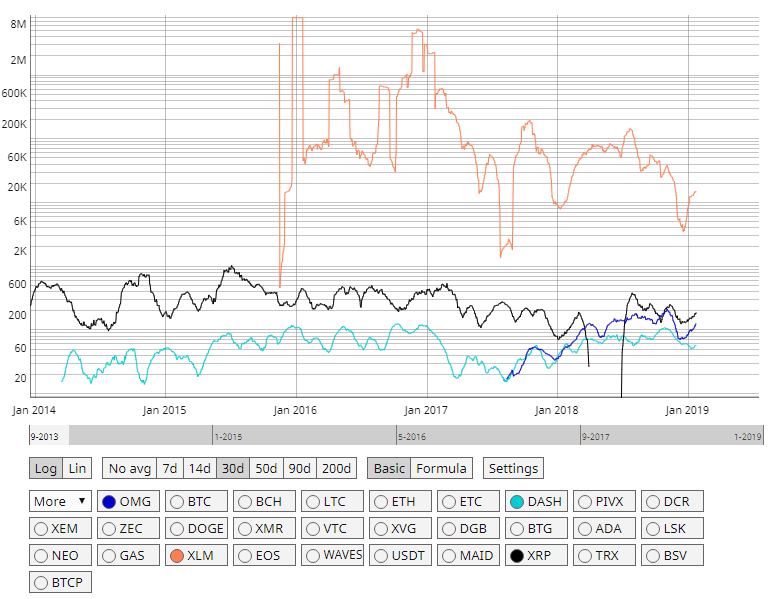

Trading Volume Comparison

XRP’s 30-day volatility has largely followed a downtrend over the past year with the spike in November 2018. However, comparing to other coins recent volatility is much lower. Given the fact that there is high degree of sell-off in the market, Ripple holding its positions, indicates strong support from the community.

30-Day Volatility

Technical Analysis

Ripple / USD Short-term price analysis

In the short-term, Ripple is bullish following the cryptocurrencies recent rally above the $0.3500 resistance level. Despite the recent pullback in the XRP / USD pair encouraging signs are starting to emerge over the short-term horizon.

The cryptocurrency is creating bullish higher highs and lower lows, with buyers recently forcing price above the January 14th trading higher, which was a significant near-term price high.

The other key development over the short-term is the emergence of a bullish inverted head and shoulders pattern. If the bullish pattern broke to the upside, it would take the XRP / USD towards the $0.4200 area.

Key technical support is found at the cryptocurrencies 200-period moving average on the four-hour time frame, with the psychological $0.3000 level offering the last line defense against strong bearish attacks.

XRP / USD H4 Chart (Source: TradingView)

The MACD indicator has turned bearish across the four-hour time frame, which is largely consistent with the recent decline from the $0.3500 level. The Relative Strength Index is coming under bearish pressure and is starting trade below the neutral line.

The trading action around the inverted head and shoulders pattern is likely to remain the dominant theme over the short-term. If the bullish pattern were to be negated, we could easily see the XRP / USD pair falling below the pair’s 2018 trading low.

Ripple / USD Medium-term price analysis

Ripple currently has a bearish medium-term outlook, with the cryptocurrency trading well below its key 200-day moving average and towards the lower end of a triangle pattern on the daily time frame. The XRP / USD pair has underperformed other popular cryptocurrencies during the most recent crypto market rally, with Ripple sliding back into third place in terms of overall market capitalization.

Key technical support for the XRP / USD pair below the triangle pattern is currently found at the important former swing-lows, at $0.2850 and $0.2500. It is certainly worth noting that a sustained break under the $0.2500 level would put Ripple under significant technical pressure, with the $0.1700 to $0.1800 levels offering the strongest form of support below.

XRP / USD Daily Chart (Source: TradingView)

The MACD indicator on the daily time is currently flat and providing no clear trading signal on the daily time frame. While the RSI Indicator on the mentioned time frame remains weak and is struggling to move back into positive territory.

The triangle continues to dominate the trading over the medium-term horizon, with XRP / USD bulls so far failing to stage a sustained break below the pattern.

Ripple / USD Long-term price analysis

Ripple is bearish over the longer-term with the popular cryptocurrency currently treading water around $0.3000 level. The weekly time frame shows the XRP / USD pair trading inside of a large descending price channel, with the upper end of the channel located slightly above the $0.5000 level.

Any upside rallies in the XRP / USD pair are currently being capped by the cryptocurrencies 20-week moving average, with is located just above the $0.3700 level. Technical indicators appear overstretched on the weekly time frame and show signs that the XRP / USD may be due for an upside correction if the 2018 trading low holds firm over the coming weeks.

XRP / USD Weekly Chart (Source: TradingView)

The MACD indicator on the weekly time frame is currently flatlined and providing no clear trading signal. However, the Stochastic Indicator is extremely oversold on the weekly time frame; a strong counter move higher against the prevailing bear trend could occur if the indicator starts to correct from oversold territory.

The ascending price channel remains absolutely key on the weekly time frame; as long as price continues to trade within the region defined by the channel, traders should expect the overall long-term trend to remain bearish.

From a technical perspective XRP is showing bullish signs in the short-term, which should not be ignored, especially given the recent recovery in the broader cryptocurrency market.

The daily time is highlighting the urgent need for bulls to rally the cryptocurrency away from the $0.3000 level, given that the XRP / USD pair still trades perilously close to the worst levels of 2018. Longer-term indicators are trading in oversold conditions, which may signal a counter rally towards the top-end of the descending price channel if the 20-week moving average and the December 24th swing high can be taken out.

It should also be noted that since listing on Coinbase Pro on 25th February 2019, the value of XRP increased as expected, demonstrating gains of approximately 10% in the hours following listing.

Share this article

Trending News