SBF jail photos surface, former inmate says he is 'more gangster' than 6ix9ine

Share this article

A photo of a scruffy Sam Bankman-Fried in jail shows the fallen FTX CEO is getting used to life behind bars. According to a former inmate, SBF is keeping a low profile and earning some street cred for not ‘snitching’ on anyone.

Meanwhile, on the more serious side of things: an Oxford economist believes economic predictions will get better when quantum computing calculations are applied, though the complex theory remains a tough sell. The same economist correctly predicted that crypto will go mainstream. And now we’re here.

The launch of Ethereum spot ETFs might consolidate power among fewer giant validators, says an analysis by S&P Global, but diversification could help. Regulated custodians may replace Lido for storing staked ETH from US institutions, but increased reliance on an industry giant like Coinbase is said to have associated risks.

Today’s Newsletter

- SBF jail photos surface, former inmate says he is ‘more gangster’ than 6ix9ine

- Oxford economist who predicted crypto going mainstream says ‘quantum economics’ is next

- Ethereum spot ETFs may intensify validator concentration risk, says S&P Global

a

Markets

|

Data powered by CoinGecko.

|

a

Top Stories

REGULATION

SBF jail photos surface, former inmate says he is ‘more gangster’ than 6ix9ine

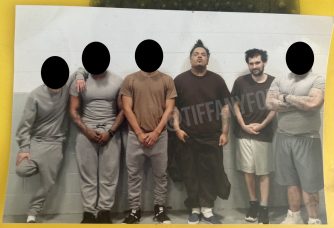

The former CEO of FTX, Sam Bankman-Fried, has grown a beard and lost weight in jail, according to a photo published by crypto reporter Tiffany Fong. The photo, taken at the Metropolitan Detention Center in Brooklyn on December 17, presents a rare glimpse into the fallen crypto billionaire’s life after FTX collapsed under fraud allegations and he was denied bail. According to a recently released interview with a former inmate known as G Lock, Bankman-Fried has kept a low profile behind bars and remains well-liked.

Bankman-Fried faces over 100 years in prison when he is sentenced on March 28 for charges of fraud and money laundering. G Lock contends that SBF has more street cred than rapper 6ix9ine because he has not betrayed any partners in crime even under pressure, according to Fong’s reporting. However, other inmates have reportedly teased Bankman-Fried about his intimate history with FTX co-founder Caroline Ellison, who has pleaded guilty to fraud and turned witness for the prosecution.[cryptobriefing]

TECHNOLOGY

Oxford economist who predicted crypto going mainstream says ‘quantum economics’ is next

David Orrell, an Oxford-trained economist, believes that classical economic models are too simplistic to accurately predict real world financial outcomes. According to an interview with The Quantum Insider, Orrell argues that the complex uncertainties of economics require “quantum” math models, like those used in physics, with a range of potential states. Orrell contends that the binary on/off calculations used in classical economics fail to capture the intricacies of financial systems.

Orrell has written books on the concept of quantum economics and started a scientific journal to promote research into this field. He maintains that the key obstacle is awareness, though he has previously demonstrated foresight, such as when Orrell predicted the rise of cryptocurrencies back in 2018. Ultimately, the economist clarifies that he uses the term “quantum” to refer to the mathematical calculus underpinning economic models, rather than implications about subatomic particles or quantum computing hardware. [cointelegraph]

ETHEREUM

Ethereum spot ETFs may intensify validator concentration risk, says S&P Global

The approval of spot Ethereum ETFs could increase concentration among the validators who secure the Ethereum network, warns an analysis by S&P Global. While simple spot ETFs that just hold Ether would have no effect, those that provide staking rewards could shift power if they attract major inflows. ETFs may prefer regulated custodians for staking over dominant firm Lido, which controls nearly 33% of staked ETH currently.

However, the research identifies potential new risks if ETF custodians like crypto exchange Coinbase come to dominate staking. As Coinbase already custodies several Bitcoin ETFs, increased Ethereum exposure could consolidate too much control in one firm, increasing vulnerability. Still, the overall impact remains uncertain – ETF issuers could also choose to diversify their validator selections, spreading out risk rather than substituting one concentration threat for another. [cryptobriefing]

a

Other News

a

Trending

Nexo is giving out 10 BTC in rewards until the Bitcoin halving.

Vince

Share this article