Stellar Eyes New Bull Target Following Brief Consolidation

Stellar continues to regain lost ground despite uncertainty among market participants.

Key Takeaways

- Stellar continues to consolidate within a descending parallel channel.

- The most recent upswing looks promising as XLM tries to slice through a crucial resistance wall.

- Turning the $0.32 level into support could see it rise by nearly 40%.

Share this article

Stellar has seen its price increase by nearly 48% in the past 24 hours. Multiple technical indicators suggest that XLM could be bound for further gains if it manages to break above a critical resistance barrier.

Consolidating Within a Narrow Range

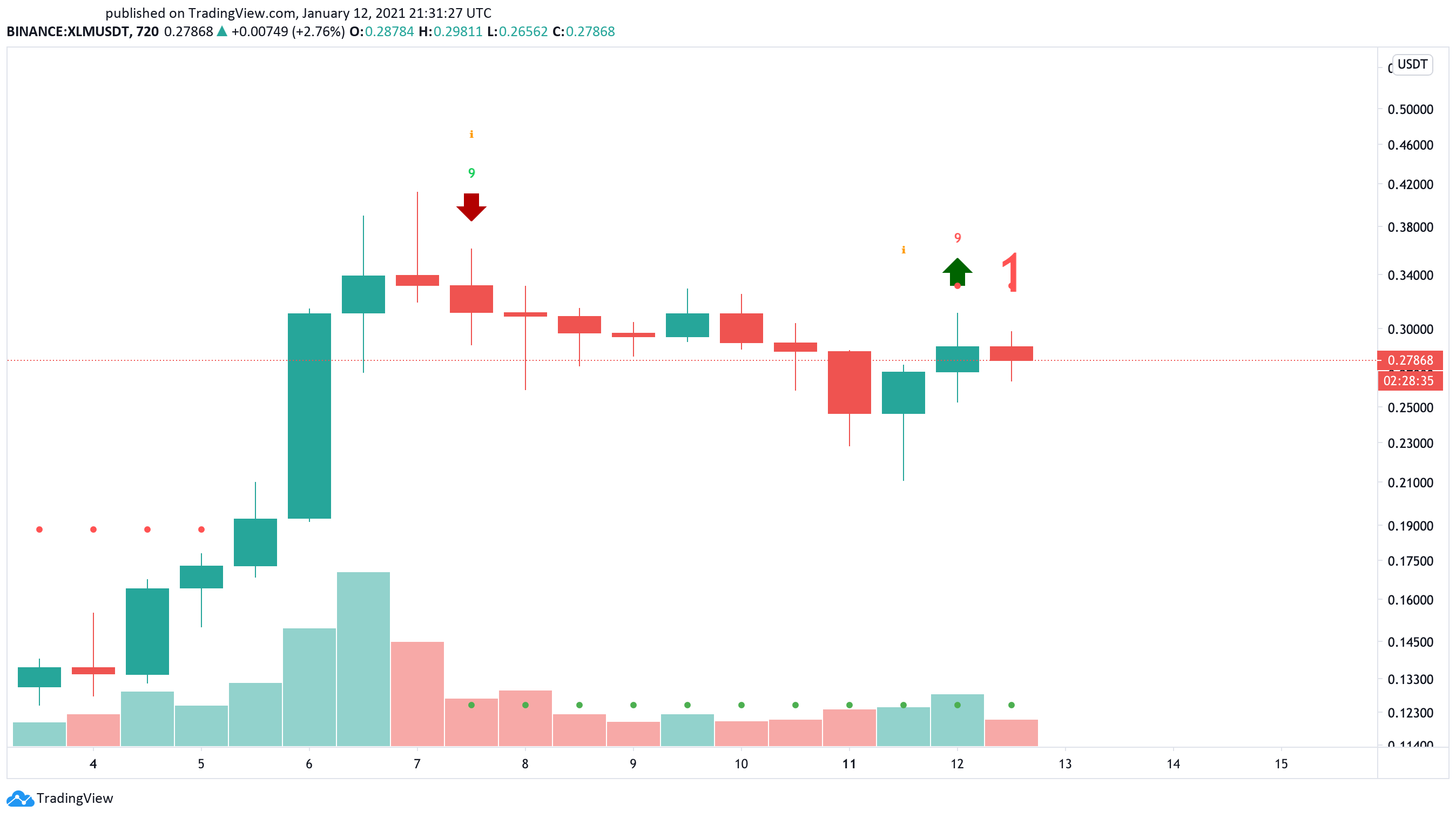

Stellar’s price action has been contained within a descending parallel channel over the past week.

Each time XLM has risen to this technical formation’s upper boundary, it gets rejected and retraces to the pattern’s lower edge. From this point, it tends to rebound, which is consistent with the characteristics of a parallel channel.

Following the retest on Jan. 11 of the channel’s lower trendline, Stellar’s price rebounded towards the upper trendline and has been hovering around this resistance level since then.

Stellar Primed for Bullish Breakout

Now, the Tom Demark (TD) Sequential index suggests that the ninth-largest cryptocurrency by market capitalization is poised to break out of consolidation and advance further.

This technical index presented a buy signal in the form of a red nine candlestick on XLM’s 12-hour chart. The bullish formation forecasts a one to four 12-hour candlestick upswing or the beginning of a new upward countdown.

A spike in buying pressure behind this cryptocurrency may help validate the optimistic outlook.

By breaking through the overhead resistance at $0.32, Stellar could see its price surge by more than 40% to hit a target of $0.40.

Given the high levels of volatility in the cryptocurrency market, the bearish outlook cannot be taken out of the question.

If XLM fails to move past the $0.32 resistance barrier, rejection may occur. Under such circumstances, this altcoin might drop to find support around the channel’s lower boundary at $0.20.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article