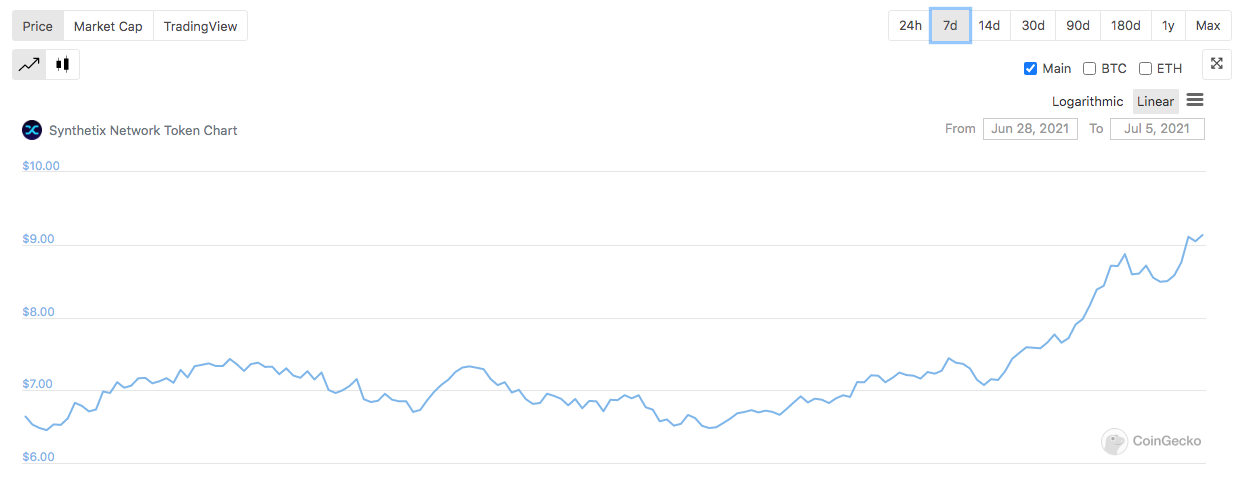

Synthetix Surges 22% as Ethereum DeFi Tokens Rise

DeFi appears to be making a gradual recovery from the recent market crash, with Synthetix currently leading the pack. It’s up 21.9% in the last 24 hours.

Share this article

Synthetix is soaring.

Synthetix Leads DeFi Gains

Synthetix closed the weekend in bullish mode after rising 21.9% Sunday through Monday.

The DeFi protocol’s SNX token is currently trading at $9.17 according to CoinGecko, which puts the project’s market cap at around $1.45 billion.

Synthetix is part of a cluster of projects that form Ethereum’s fast-growing DeFi ecosystem. It allows users to mint synthetics of various types of assets, including fiat currencies, gold, and stocks like Tesla. SNX plays a crucial role in the protocol as it can be staked to mint the synthetic assets, which are known as “Synths.”

The project was among the first Ethereum staples that plans to launch on Layer 2—a framework built on top of the Ethereum base chain to help the network scale. It ran on Optimism’s testnet when it launched last year and enabled staking on the Optimistic Rollup solution in April. Uniswap is also planning to go live on Optimism sometime after it goes live on mainnet this summer.

The jump for Synthetix comes as enthusiasm returns to the broader DeFi ecosystem. As Synthetix rose by 44% in the last week, Balancer increased by 53.2%, Aave by 35.9%, and Maker by 29.2%. The biggest gainer of the DeFi blue chips, Compound, rose 64.6% after announcing that it would launch a Treasury Account offering a guaranteed 4% yield.

Ethereum, which acts as the security layer for the leading DeFi projects, has also seen positive price action in the last week rising 15.3%, which may explain the pickup in DeFi.

When the market suffered from its biggest crash in over a year on May 19, many DeFi tokens were among the hardest hit. Although many are still trading well off their record highs, it seems that the market is starting to show renewed interest in the space.

Disclosure: At the time of writing, the author of this feature owned ETH, ETH2X-FLI, SNX, and AAVE. They also had exposure to BAL, UNI, COMP, and MKR in a cryptocurrency index.

Share this article