Terra Climbs to New Highs Becoming the Second-Largest DeFi Network

The network has surpassed $18 billion worth of assets locked in DeFi protocols, as the LUNA token soars to new all-time highs.

Key Takeaways

- Terra has become the second-largest DeFi network, overtaking Binance Smart Chain.

- The network's native LUNA token has also reached a new all-time high of $84.92.

- LUNA's price appreciation, together with new DeFi protocols on Terra have helped the network reach the number two spot.

Share this article

Terra has overtaken Binance Smart Chain in total value locked, becoming the second-largest DeFi network behind Ethereum.

Terra Takes Second Rank

DeFi on Terra is booming.

The network surpassed Binance Smart Chain in total value locked in DeFi protocols over the weekend, as its native LUNA token climbed to new all-time highs.

Currently, Terra hosts over $18 billion worth of assets across its 13 DeFi protocols. A combination of increasing prices and liquidity from new protocols has propelled the total value locked on the network to the number two spot behind Ethereum.

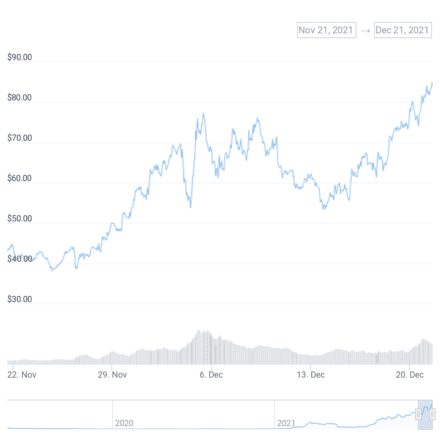

Since breaking past its prior all-time high at the end of November, Terra’s LUNA token has soared, recovering quickly while the rest of the market dipped. Today, LUNA shot to a new all-time high of $84.92, putting it up more than 85% over the past month.

The diminishing supply of LUNA tokens on the market is likely pushing the price of LUNA higher. For example, the Terra community voted to burn around 10% of the LUNA token supply worth approximately $4 billion in October.

Additionally, the increasing demand for UST, Terra’s native, algorithmically-pegged stablecoin, also affects LUNA’s price. UST can be minted by burning $1 worth of LUNA in exchange, decreasing the LUNA supply as more stablecoins are produced.

While LUNA’s price appreciation has helped Terra become the second-largest DeFi network, the launch of new protocols has also attracted more liquidity. Astroport, a new decentralized exchange launching on Terra, has brought more money into the ecosystem with its highly-anticipated “lockdrop.”

Users who lock up their liquidity in the protocol will receive ASTRO token airdrops depending on the amount of time they lock up their assets for. So far, over $1.1 billion worth of assets have been committed to Astroport in this way, with more than half of that value consisting of LUNA tokens, further reducing the liquid supply on the market.

While the total value locked on Terra has increased significantly, other Layer 1 chains have lagged. For example, Binance Smart Chain has failed to break past its previous all-time high total value locked of $31.6 billion achieved in May.

While other Layer 1s such as Avalanche and Solana have experienced steady growth, they have been unable to keep pace with Terra over the past month.

Disclosure: At the time of writing this feature, the author owned LUNA and several other cryptocurrencies.

Share this article