Tron Plagiarism: Are Investors Prepared For Lawsuits?

Share this article

Copying someone’s work and replicating it without permission or attribution is theft.

This is a common law theme around the world, and it has resulted in some spectacular legal cases over the years.

Robin Thicke paid $7.3 million to the family of Marvin Gaye after ‘Blurred Lines’ was found to cross them.

Uber reluctantly tipped Google’s Waymo $245 million to settle a case regarding the theft of trade secrets.

And Facebook… Ripple… Theranos… Tesla… all hit with investor lawsuits this year.

Investors are no longer prepared to sit back and let the companies in which they place their trust abuse or misuse that trust.

And then there’s Tron.

Tron, the $2.8 billion dollar project which is becoming best-known for plagiarizing from other crypto projects, has been caught plagiarizing from other crypto projects. Again.

The latest instance of code-copying was revealed in a report by Digital Asset Research, which recently discovered in Tron’s codebase “several instances of code that was copied verbatim or slightly modified from EthereumJ” without appropriate reference.

And it’s not just a question of missing a few quotation marks. As DAR explains, the latest case of plagiarism casts serious doubt on the ability of Tron’s developers to independently solve complex coding problems—which are certain to appear in a project of this size.

The biggest headline is that people are still surprised.

We’ve already seen this episode. It’s a rerun.

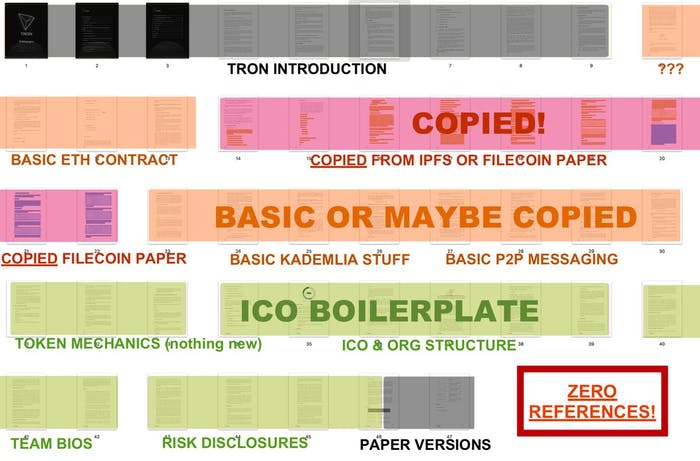

Tron has a well-established history of uninvited borrowing—a pattern that pretty much started on day one, when Tron’s white paper mysteriously included several unattributed pages from the designs of Filecoin and the Interplanetary File System.

At the time, Founder Justin Sun deflected the blame to Tron’s volunteer translators. Yet eight consecutive pages were translated into near-exact copies of other white papers. And the “translator” excuse did not seem to explain the fact that the Chinese version was plagiarized as well.

And that wasn’t the only thing they borrowed; shortly after the white paper scandal emerged, several bits of Ethereum code were found in Tron’s Github, again without attribution.

So what’s different now?

Borrowing someone else’s notes is one thing, but the latest revelation raises serious doubts over the Tron team’s ability to deliver the kinds of code solutions a giant blockchain network will need.

“EthereumJ is known to be unreliable and has issues like memory leakage,” DAR wrote in a press release. “Moreover, the Tron Virtual Machine is a direct copy of the Ethereum Virtual Machine, but with changes that may increase the network’s attack surface. ….the TRON network will likely be exposed to unique technical risks following its mainnet launch because the project is combining technologies originally developed for different system architectures.”

“The problem is when you repurpose code originally developed for a completely different system architecture, and don’t have enough time to fully test it,” DAR’s Lucas Nuzzi told CCN.

And this leads to one of the biggest questions about the Tron project.

What if it just doesn’t work?

What does history teach us about companies like Tron?

Tron has been a cryptocurrency punchline in the community for a long time, partly due to what some critics consider a virtual ‘cult-of-personality’ around its flamboyant founder.

“Justin Sun announces new secret project for July 30th” declared one breathless crypto media outlet today. Sun himself has declared June 25th “Independence Day” and is bigging up his brand all day.

Independence day is upon us!

Amazing treats for all fans are here!

— Justin Sun (@jukstinsuntron) June 25, 2018

The Tron founder has a well-established pattern of hyping his projects, and injecting his effusive personality into the gaps seemingly left by the business plan or the team’s coding prowess. Some might even claim he’s papering over the cracks.

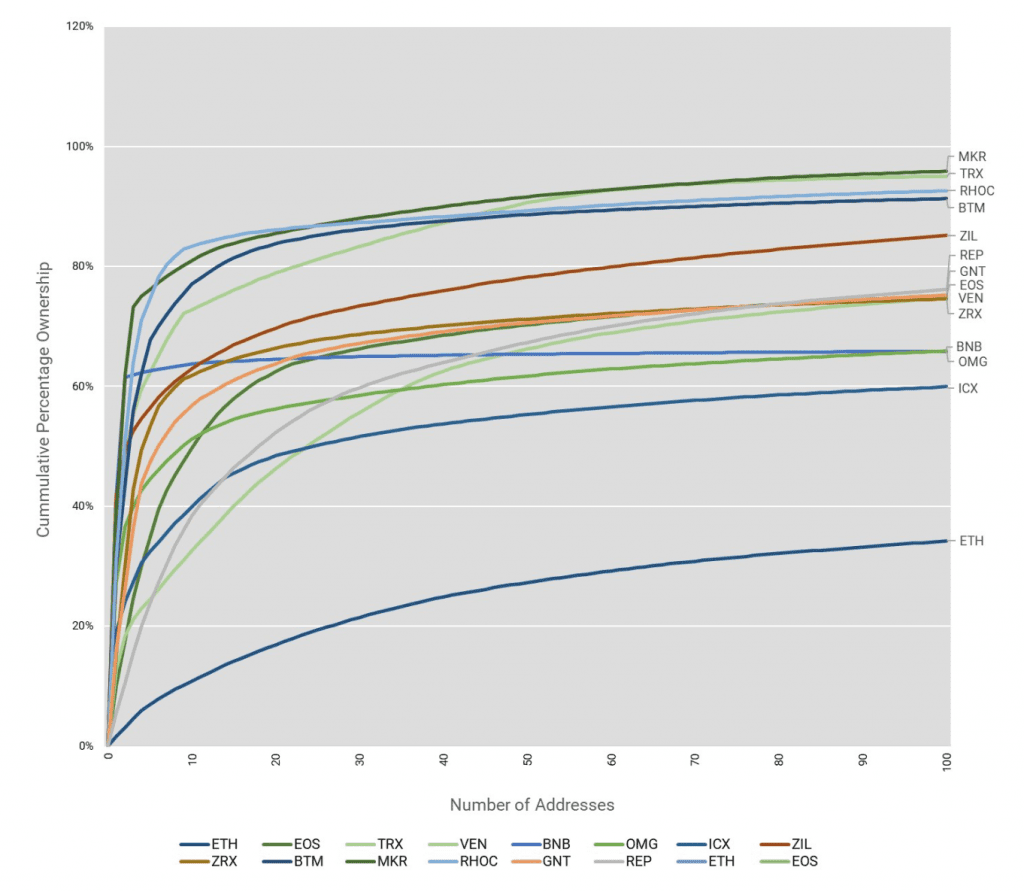

And it has worked – despite the plagiarism, the project still has an almost $3 billion dollar market cap, 50 percent of which belongs to only three addresses, as shown below.

So What If Tron’s Technology Fails Investors?

Although this is really only pertinent to U.S. investors, Hester Pierce of the SEC has spoken on the difference between tokens and securities. She has said that a security can be defined as an “investment in a common enterprise with the expectation of profits solely through the efforts of another” and although Ethereum and Bitcoin appear to have been spared, other tokens and currencies may yet feel that heat of regulation breathing down their necks.

And this is important for Tron, because if it IS a security, then certain other rules and regulations that pertain to securities could come into play – notably that a security can be sued in a class action, something that Ripple is already seeing.

If Ripple can be sued for alleged economic mismanagement of their complex ecosystem, it’s not a stretch to imagine that Tron will suffer a significantly stronger backlash if provable plagiarism and a potentially non-functioning product are conjoined in a lawsuit.

And the argument that Tron is non-domiciled in the US may hold no water either, if exchanges on which it is traded are also found to be within the remit of the SEC: Kevin LaCroix, an insurance liability expert, describes the risk thus: “If foreign companies choose to trade their securities on U.S. exchanges, these transactions fall squarely within prong one of Morrison (“transactions in securities listed on domestic exchanges”) and thus remain subject to U.S. securities laws.”

TRON is traded on Bittrex, which is a US cryptocurrency exchange.

Right now, the status of secondary exchange investors in TRX may lead to jurisdictional questions, but the overarching theme of cryptocurrency regulation over the past few months has been clear: more, not less. More protections for investors, not less. More accountability for founders, not less.

Returning to Lucas Nuzzi once more:

“Vulnerabilities that were not applicable to the original system are now applicable to new one. Plagiarism is bad, but the concern here relates to the unknown vulnerabilities that may arise when you combine all of these modules together, on steroids.”

We can only hope, for the sake of Tron and its investors, that their coders know what they’re doing with that borrowed Virtual Machine.

The author is invested in Ethereum.

This article was co-written with Jon Rice, who is also invested in Ethereum.

Share this article