TRON / USD Technical Analysis: Rising Above

Share this article

- TRON has turned bullish over the short-term, with the cryptocurrency breaking above a falling wedge pattern

- The TRX / USD pair’s medium-term outlook remains bullish, with price holding above its 200-day moving average since early January

- Bulls are probing the neckline of a large inverted head and shoulders pattern on the daily time frame

TRON / USD Short-term price analysis

TRON has turned bullish over the short-term, with the cryptocurrency surging above its 200-period moving average on the four-hour time frame and testing levels not seen since January this year.

The four-time frame shows that bulls have moved price above a large descending triangle pattern that the TRX / USD pair had been trapped inside for most of 2019.

Technical indicators on the four-hour time frame have now turned bullish and are pointing to further short-term gains.

TRX / USD H4 Chart (Source: TradingView)

Pattern Watch

Traders should note that the overall upside objective of the descending triangle pattern on the four-hour time frame will take the TRX / USD pair towards the January 27th swing-high.

Relative Strength Index

The Relative Strength Index has once again turned bullish on the four-hour time frame after a brief technical correction.

MACD Indicator

The MACD indicator is rising on the four-hour time frame, with the MACD signal line attempting to cross higher.

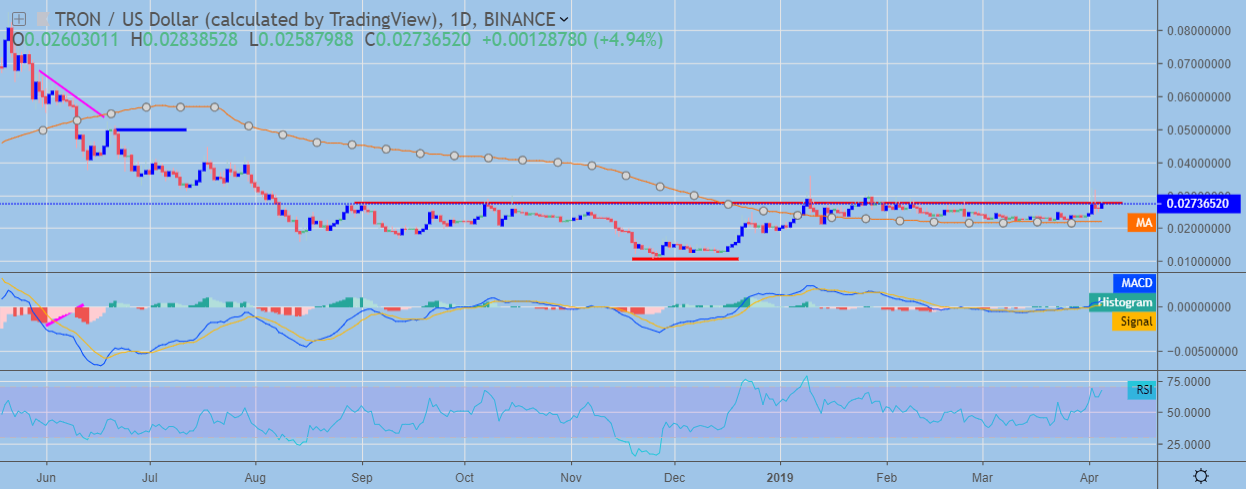

TRON / USD Medium-term price analysis

TRON has a bullish medium-term outlook, with buyers maintaining price above the TRX / USD pair’s trend defining 200-day period moving average for most of the year.

The daily time frame is highlighting growing bullish pressure, with bulls starting to probe the neckline of large inverted head and shoulders pattern with a sizeable upside projection.

Bullish MACD price divergence still remains present on the daily time frame from June of last year. Buyers may try to reverse the divergence if a bullish breakout occurs.

TRX / USD Daily Chart (Source: TradingView)

Pattern Watch

Traders should note that the initial upside target of the bullish inverted head and shoulders pattern on the daily time frame would take the TRX / USD pair towards the June 21st swing-high.

Relative Strength Index

The RSI indicator remains bullish on the daily time frame and continues to steadily rise.

MACD Indicator

The MACD indicator on the daily time frame has turned bullish and is showing scope for further upside.

Conclusion

TRON is steadily advancing above its 200-day moving average, with the bullish triangle breakout on the four-hour time frame highlighting the growing buying demand for the TRX / USD pair.

If bulls can ignite the inverted head and shoulders pattern on the daily time the cryptocurrency could stage an explosive rally towards levels not seen since June 2018.

Check out our quick guide into TRON in our coin guide.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.

Share this article