Two Years Later, Is Bitcoin Cash Living Up To Its Promises?

Low fees might not be enough.

Today marks the second anniversary of the User-Activated Hard Fork, which split the Bitcoin community into two competing currencies. While there have been many forks since then, none have been as successful or long-lived as Bitcoin Cash (BCH).

The split occurred because a number of miners and developers believed that Bitcoin’s core developers had abandoned the idea of peer-to-peer electronic cash. That fork underwent its own fork – a highly contentious one – with the creation of Satoshi’s Vision (BSV).

Both projects shared the goal of using larger blocks to raise Bitcoin’s transaction limit, without the complicated development required for solutions like SegWit. Their vision was for bitcoin to be used as a medium of exchange. After two years, we can now see how that vision played out.

The Three Features of Money

One of the key objections to Bitcoin (Core, if you like) is that it has failed to perform the functions of money. Money is defined as a medium of exchange, a store of value, and a unit of account. With relatively high transaction fees and sluggishly slow transactons, Bitcoin fails as a medium of exchange, and therefore as money.

At least, that’s what Roger Ver seems to believe, and when it comes to transaction fees his project is a success. As explained on Ver’s website, Bitcoin.com, “the Bitcoin Cash upgrade made Bitcoin usable as cash again. Transaction fees are low, transaction times fast, and most importantly the Bitcoin Cash community is united in the original vision of Bitcoin as cash for the world.”

Meanwhile, Bitcoin SV has doubled down on big blocks, raising their block size to 2GB in last week’s Quasar upgrade.

But cheap transactions may not be enough for a successful currency. Given the failure of Bitcoin Cash to supplant BTC, there may be a fourth feature of money that Ver and Wright have both overlooked.

It’s Not The Size Of The Block, But The Action In The Transactions

Bigger blocks do make for faster transactions, but that may come at the price of increasing centralization.

Each node needs to store the entire transaction history of their blockchain. With ledgers growing larger and faster, the hardware and bandwidth requirements to run a full node can quickly grow out of reach of anyone except a handful of increasingly powerful operators.

That’s why bigger blocks make for more centralized chains. The controversial fork in August 2017 showed that Roger Ver and his allies were ready to take that risk in order to increase transaction speeds and reduce fees.

But neither fork is close to replacing Bitcoin as a medium of exchange, as Coin Metrics has reported. After conducting research to compare the medium of exchange characteristics of BTC, BCH, and BSV, they found:

Core Remains King

Bitcoin transaction fees continue to trend higher, averaging between $1 and $3, while Bitcoin Cash fees are close to zero. But there’s a downside to those excessively low fees, especially as miners begin to rely on them as block rewards fall. Network security could be compromised on low-fee Proof of Work networks if miners aren’t adequately incentivized to secure the chain.

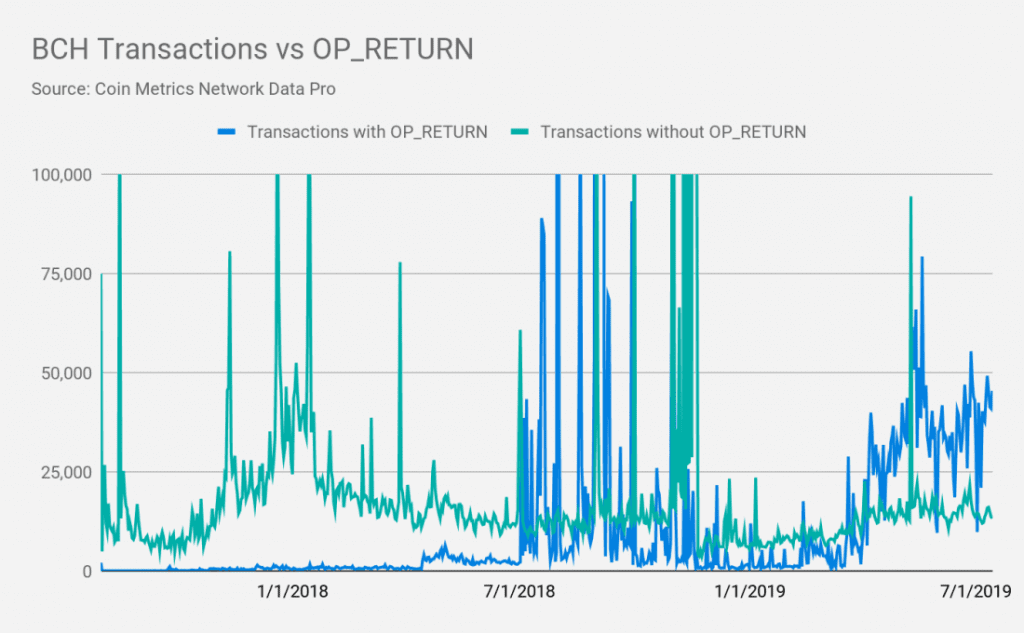

Bitcoin also continues to lead the forks in terms of transaction count, and this lead is more pronounced when OP_RETURN messages are excluded. These are transactions or parts of transactions that simply store data on ledgers, and do not transfer value.

“As of July 1st, over 67% of daily BCH transaction include an OP_RETURN,” CoinMetrics found, compared to 25% for BTC transactions. For BSV, the figure was even higher: 94%.

And while value transfer figures on BCH are climbing, they are dwarfed by those on the Bitcoin network. According to Coin Metrics’ report:

Estimates of active addresses also demonstrate that the BTC network is being used by a lot more people than either of the forks. Daily active BTC addresses averaged between 600,000 and 1,000,000 in 2019, with BCH and BSV remaining below 100,000 and 50,000, respectively.

The Fourth Property of Digital Currencies

One might argue that cryptocurrency as money has a fourth component: decentralization. Unlike fiat currency, digital currencies can exist without the approval of any central issuer or authority.

Decentralization is more than just a technological way of doing things. It is also an ethos, a belief system, and a goal unto itself. A decentralized internet is the only way the IoT is going to manage the billions of ‘things’ that will connect to the internet in the not-too-distant future. Decentralization is also at the heart of the resistance movement against censorship and data monopolies.

Placing Trust in Trustlessness

Most of Bitcoin’s defectors would bristle at the suggestion of using a currency created by an single entity. But the very public spat and resultant hash war between Roger Ver and Craig Wright revealed two blockchain projects that are very much driven by the personalities of wealthy individuals.

To the extent that Bitcoin Cash is ‘led’ by Ver and BSV by a lawsuit-dangling Australian, it’s hard to see how either can produce a ‘leaderless’ cryptocurrency.

Meanwhile, the rest of the crypto-community appears to have spoken. People are more prepared to accept higher fees and smaller blocks – or block size growth that is more sluggish – than cheaper chains with more visible leadership.

Earn with Nexo

Earn with Nexo