Why Didn’t Bitcoin React Like a Safe Haven Asset to Coronavirus Fears?

As coronavirus fears mount, Bitcoin's safe haven credentials come under question

Fears that the novel coronavirus originating in Wuhan, China could grow into a pandemic has not translated into a flight to Bitcoin. Is the OG crypto really a safe haven asset?

Coronavirus Fears Cause Global Sell-Off

The spread of COVID-19 to hotspots in Italy, Iran, and South Korea has led to a sell-off of risk assets worldwide and a flight to gold.

The Dow was down almost 900 points on Feb. 25, following similar falls the day before. The S&P 500 closed over 3% lower.

Markets in Japan, the UK, and Australia have all plunged early this week as fears heighten that the spread of COVID-19 could end in a pandemic with the resultant economic impact. Gold reached seven-year highs on Monday, as the traditional safe haven asset benefited from the flight from risk-on assets.

That flight has not driven Bitcoin prices up, however.

Bitcoin is down for the week from over $10,000 to around $9,150 at press time, according to CoinMarketCap.

The Safe Haven Narrative

Bitcoin’s credentials as a hedge against risk have long been debated. Proponents of the narrative have pointed to recent price activity that suggests investors liken digital gold to its precious metal namesake.

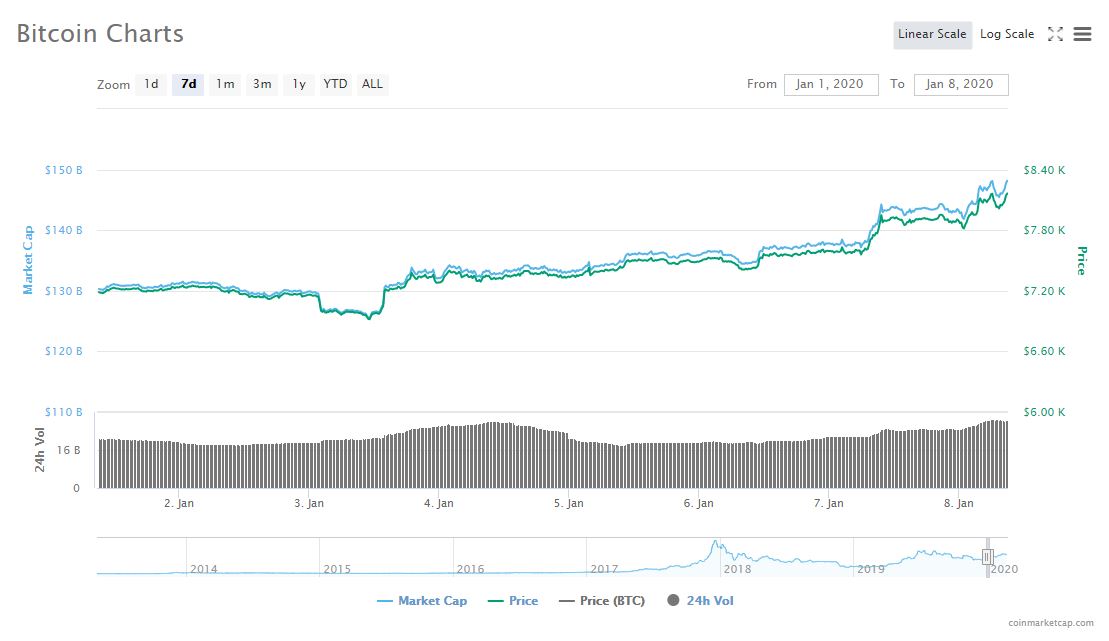

In early January, a U.S. airstrike in Baghdad killed the head of Iran’s elite Quds Force, Qassem Soleimani. Iran retaliated with missile strikes against Iraqi bases housing American troops on Jan. 8.

With the world braced for a prolonged escalation of tensions, Bitcoin soared from under $7,000 to almost $8,500 for the week.

In mid-2019, as trade tensions between the U.S. and China threatened to boil over into a full-blown trade war, demand for Bitcoin, especially among Chinese investors fearing a devaluing of the Yuan, rose. From the May announcement by the Trump administration of a rise in tariffs on Chinese imports to August, BTC skyrocketed by over 100%.

Bitcoin was also trading for a premium in Argentina and Hong Kong, as investors sought refuge from hyperinflation and fears of geopolitical risk, respectively. Rayne Steinberg, Los Angeles-based crypto hedge fund Arca’s CEO told Bloomberg:

“Bitcoin is becoming the asset of last resort in areas of extreme currency devaluation and political uncertainty. In the last week alone, Bitcoin is up approximately 50% against the Argentine peso and trading at a significant premium on local exchanges. And they are not alone, joining the ranks of Venezuela, Hong Kong and Turkey who have also experienced similar shocks.”

Doubts Emerge Over Bitcoin as a Safe Haven Asset

As a global sell-off of equities points to investor fears over coronavirus fallout, Bitcoin is experiencing price activity that correlates with risk-on assets, not gold. The supposed safe haven asset story has not played out in response to the risks COVID-19 poses to the global economy.

As Mati Greenspan from Quantum Economics told Crypto Briefing:

“At this point in time, Bitcoin is trading very much inline with the stock markets and generally behaving like a risk-asset. Bitcoin is often used as a hedge against inflation, governments, and central banks. As coronavirus has yet to affect those things, there’s little reason to see it as a safe haven for now.”

Greenspan’s assessment is in line with the pattern that appears to be playing out, given the lack of response from Bitcoin to the worsening of the coronavirus outbreak.

While the crypto asset benefited from flights from hyperinflation and political turmoil – driven by government actions – it hasn’t received a boost from the uncertainty caused by the growing threat of a pandemic.

Does The Color of The Swan Hold the Key?

Notorious crypto skeptic, Nouriel Roubini, has argued that there are several crises that could threaten to derail the global economy.

Identifying simmering tensions between the U.S. and Iran and China, real-world costs of climate change, and the impact novel coronavirus could have on the Chinese – and therefore the global – economy, the economics professor has voiced concerns about a “white swan” event in the making.

A black swan event, a term made popular by Nassim Nicholas Taleb, is a wholly unknown and unpredictable event with potentially severe ramifications. Roubini is more concerned about white swan events, which are similarly significant, but which are entirely forecastable.

As the economist argued last week:

“Beyond the usual economic and policy risks that most financial analysts worry about, a number of potentially seismic white swans are visible on the horizon this year. Any of them could trigger severe economic, financial, political and geopolitical disturbances unlike anything since the 2008 crisis.”

The On-Again, Off-Again Safe Haven Asset?

Price history has demonstrated that the narrative that Bitcoin is a gold-like safe haven asset lacks the nuance to be predictive. Bitcoin has responded in line with gold and other safe haven harbors to certain events, but not others.

Commentators like Greenspan have identified that Bitcoin is attractive as a hedge asset when the risk is created by governments and poor economic policies.

While the economic impact of coronavirus could be severe, it is decoupled from the direct threat of government malfeasance or incompetence. That suggests Bitcoin could continue to be negatively affected by growing health concerns.

Drop gold? Not yet.

Earn with Nexo

Earn with Nexo