XRP Prices Jeopardized as Ripple Continues Flooding Market

Ripple put a massive number of tokens into circulation Q2. Now XRP prices may soon suffer the consequences.

Key Takeaways

- Ripple's over-the-counter sales of XRP skyrocketed over 1,760% in Q2 2020

- Many investors seem concerned about the substantial increase in the total number of circulating tokens

- A spike in the selling pressure behind XRP may see it pull back towards $0.28 or even $0.25

Share this article

Ripple revealed that it ramped up its XRP sales last quarter, which may lead to a steep correction based on different fundamental and technical metrics.

XRP Sales Spike

Ripple made headlines after revealing in its “Q2 2020 XRP Markets Report” that it continues to flood the market with more XRP. Although the US-based technology company had dramatically reduced the sale of its tokens in Q1, it appears to be back at it. Ripple sold approximately $32.6 million XRP to institutional investors Q2, a 1760% increase.

According to Ripple, the significant spike in sales is partially due to the growing adoption that the cross-border remittances token have experienced and its integration into different markets.

“The development of liquid and robust markets is key to the success of ODL. The second quarter of 2020 saw numerous integrations that helped contribute to the health of XRP markets,” reads the report.

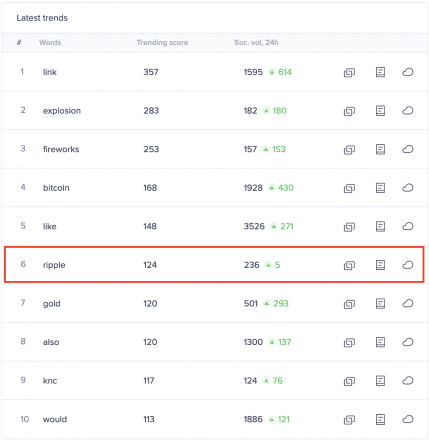

After the report was released, the number of XRP-related mentions on social media exploded. The rising chatter around the international settlements altcoin allowed it to move to the number six spot on Santiment’s Emerging Trends list.

Usually, when market participants pay heightened attention to a cryptocurrency, it leads to a steep correction.

“On average, the moment [cryptocurrencies] show up on the list, the dump begins. In the second week since appearing on the Emerging Trends list, the coins we backtested have, on average, lost a massive 8% of their total price. And this is on a sample of 200 coins,” said Dino Ibisbegovic, head of content and SEO at Santiment.

Bearish Impulse on the Horizon?

The TD sequential indicator adds credence to the bearish outlook. This technical index presented sell signals in the form of green nine candlesticks on both XRP’s 1-day and 12-hour charts. The bearish formations estimate that this cryptocurrency is bound for a one to four daily candlesticks correction before the uptrend resumes.

Although in the recent run-up the TD setup was not entirely accurate at anticipating XRP’s local tops, it still holds a lot of credibility. In early May, for instance, it presented a sell signal that led to 20% nosedive. Therefore, the current pessimistic outlook must be taken seriously.

Based on the Fibonacci retracement indicator, the $0.28 support level holds a lot of significance to XRP’s uptrend. Breaking below this key hurdle could result in a sell-off that pushes this cryptocurrency down to the next areas of interest around the 61.8% and the 50% Fibonacci retracement levels. These support barriers sit at $0.25 and $0.22.

It is worth mentioning that a spike in the buying pressure behind the cross-border remittances token may have the strength to jeopardize the bearish outlook. Under such circumstances, investors must watch out for an upswing above the recent high of $0.33.

Moving past this resistance barrier could see prices rise to a new yearly high of $0.39.

Share this article