Yield Farmers on Compound Are Destroying This Stablecoin

DAI's peg proves to be fragile once again.

Lucrative DAI yields on Compound have caused the stablecoin’s peg to break once again. MakerDAO governance is scurrying to find a solution and restore equilibrium to DAI.

Hard and Soft Pegs

Despite ferocious growth, there has been no shortage of problems for MakerDAO and its stablecoin DAI over the last year.

Black Thursday forced the Maker Foundation to issue more MKR, the platform’s governance token, to erase the protocol’s deficit. The March crash also created a premium on DAI, making it slightly more expensive than the U.S. dollar to which it was pegged.

Maker’s governance has since twisted and turned to ensure the protocol’s resilience.

Despite its best efforts, however, DAI’s peg is under threat, and this time it’s because of yield farmers.

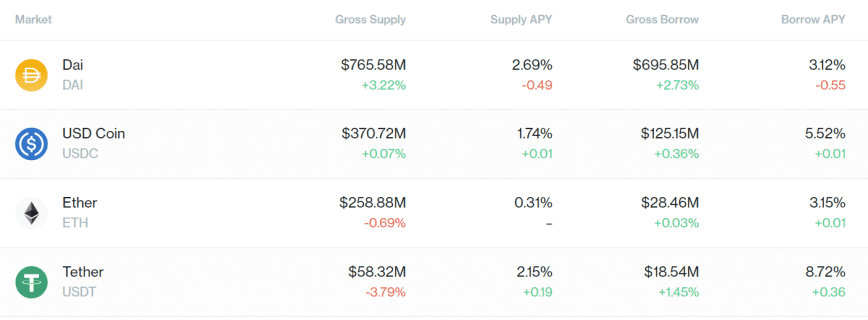

After Compound pushed a proposal to change the parameters for allocating COMP rewards to each asset’s lenders and borrowers, DAI and USDC shot to the top of the list with the highest amount of COMP allocated. As markets often do, the incentive was immediately pounced on.

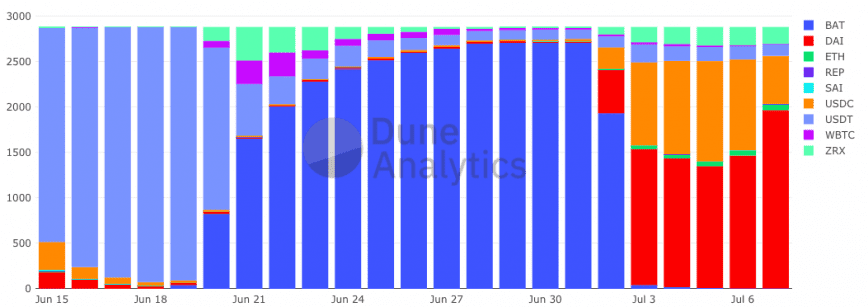

At the time of writing, there is $765 million of DAI in Compound whereas the market cap of DAI is a mere $187.5 million. This is due to circular lending and borrowing i.e. supply DAI, borrow DAI against it, supply the borrowed DAI back the pool, and so on.

MakerDAO increased its debt ceiling so the system could cater to the growing demand for DAI. The ETH debt ceiling is currently at 88.55% utilization and WBTC is at 100% utilization, implying that DeFi users are minting DAI against strong cryptoassets.

The lack of DAI in the open market, however, means that DAI’s peg is at risk, as there is only demand and not much supply.

Ordinarily, high demand and low supply is good for a token – but not for a stablecoin. As the name suggests, the value proposition of a stablecoin is a stable price. An off-peg stablecoin makes transacting and exchanging assets much less efficient.

Unlike USDC, DAI doesn’t have a hard peg to $1, as it cannot be redeemed by anyone for $1 with a central entity. DAI can only be redeemed for $1 by Vault owners. DAI’s peg stabilization falls entirely upon the shoulders of the market, making it difficult to restore equilibrium.

MakerDAO’s governance branch is currently discussing a way to align incentives between stabilizing DAI’s peg and profitability.

According to Cyrus Younessi, the Head of Risk for Maker, the project is trying to expand DAI’s supply so much that it dilutes COMP yields and creates a new incentive for Vault owners to sell DAI in the market to pocket the premium.

This was the outcome Maker relied on when DAI broke it’s peg post-Black Thursday too, which eventually kicked in after months of the stablecoin trading at a premium.