Did Bitcoin Crash Or Dip? Crypto's Trajectory Moving Forward

Monday's dive was unexpected. Would a bitcoin recovery also be a surprise?

Share this article

Given the decline of cryptocurrency markets over the past week, it may be a good time to put things into perspective about the latest dip. While the usual advice to ‘zoom out’ is scant comfort during a bear season, it may be reassuring to note that many of bitcoin’s metrics are still in an upwards trajectory.

Here, we take a look at the relative size of the crypto economy, some technical historical patterns, rising interest among institutional investors, and demographic shifts, all of which suggest a bright future for bitcoin despite the occasional dip.

The Forthcoming Halving

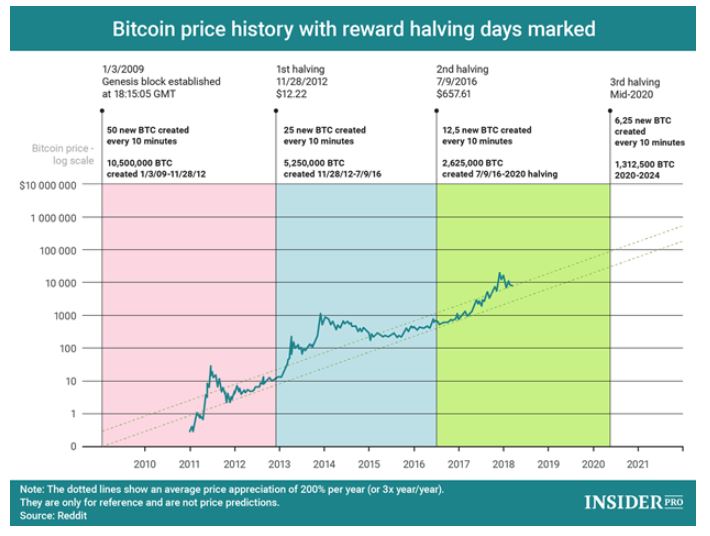

In May 2020, the next bitcoin halving will occur, cutting mining rewards from 12.5 BTC per ten-minute block to 6.25. Historically speaking, bitcoin spiked after the halvings in 2012 and 2016, along with temporary spikes leading up to the events.

One fundamental effect of a halving is to reduce the supply of new coins. Given no change in demand, the price of bitcoin should rise.

‘Should’ never means ‘will,’ but May 2020 will make bitcoins a lot harder to mine. The graph below doesn’t show a substantial impact on price, as much of the halving knowledge is already baked in. But any time there is a cut in the supply of a sought-after asset, prices can rise to reflect a new equilibrium.

It may not happen overnight. But a longer-term perspective is often warranted.

The Dot Com Bubble vs The Bitcoin Pop

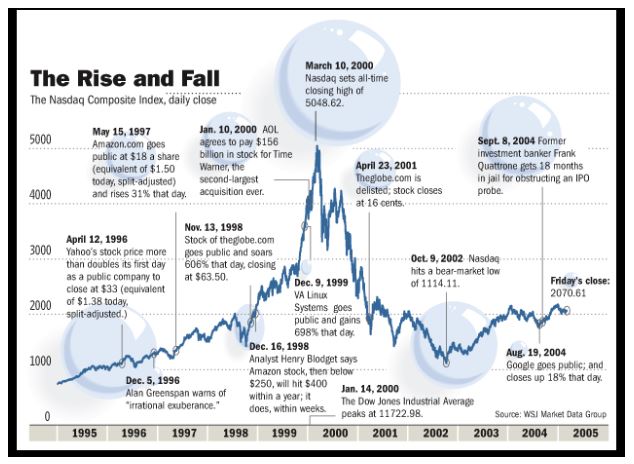

It is interesting to compare the tech bubble and bitcoin. If we are to imagine Dec 2017 – January 2018 as the peak of bitcoin’s biggest bubble, it pales in comparison to the peaks and troughs of the 2001 dot com bubble.

On March 10, 2000, the NASDAQ set an all-time high of around $7 trillion. The current market cap of crypto is about $213 billion, with bitcoin representing just over half of that figure.

The dot com bubble was also very much an American phenomenon, whereas bitcoin reaches the shores of many jurisdictions. The natural conclusion is that if crypto is – or was – in a bubble, it was a relatively weak one.

There are a few other figures worth mentioning to illustrate how early bitcoin and crypto is in its development. The U.S. stock market, at the time bitcoin euphoria popped in January 2018, was worth around $30 trillion. Gold is worth around $8 trillion. Forex trading has a daily value over $5 trillion.

Crypto’s $213 billion market cap reaches nowhere near those kinds of figures. Assuming that Bitcoin may one day function as an alternative to gold, as supporters have long argued, the asset still has a lot of room to grow.

Institutional Investors Are in a Crypto Arms Race

Whether we consider the gradual growth of capital inflows into Grayscale’s funds, of analytics firm The TIE adding institutional clients like hedge funds to its customer base, big-money is becoming increasingly interested in cryptocurrencies as investment vehicles. Even Goldman Sachs considered opening up a bitcoin trading desk (though the company denies that).

The low early interest in Bakkt’s launch dampened bitcoin enthusiasm, but having a physically settled futures market is a big step forward for the industry. For all the institutional interest in crypto, however, the most seismic shift in the sector could be a result of demographic changes.

Millennials… From Vegan Tacos to Bitcoin

A late 2017 survey commission by Blockchain Capital found that millennials prefer cryptocurrencies over the stock market. Twenty-seven percent of millennials surveyed would prefer to receive $1,000 in bitcoin over the same value in stocks. Thirty percent preferred bitcoin over government bonds, 22 percent preferred it over real estate, and 19 percent over gold.

These figures are telling. While 42 percent of millennials described themselves as at least familiar with bitcoin, among those over 65 the same figure was only 15 percent. As millennials become a more substantial component of the economy, they are likely to make cryptocurrency more mainstream.

And with the infrastructure around cryptocurrencies is making them easier to access, that demographic shift could mean significant growth in the use of cryptocurrencies over the next ten to twenty years.

So while the recent bitcoin dip was not pleasant, it needs to be put into perspective of an asset class which still appears to be on the upswing.