Bitcoin, Ethereum, and XRP Attempt Come Back, Aiming for New Yearly Highs

The top three cryptocurrencies by market cap are back in the green as more public companies add Bitcoin to their balance sheets.

Key Takeaways

- Bitcoin is up more than 4% in the past 24 hours, aiming to regain $11,000 as support.

- Ethereum whales continue accumulating despite a massive resistance wall ahead.

- XRP continues benefiting from Ripple's efforts to expand the utility of this token.

Share this article

Bitcoin, Ethereum, and XRP look ready to break out following a month-long stagnation period. But first, these top cryptocurrencies must overcome a few serious hurdles.

Bitcoin Eyes New Yearly Highs

Bitcoin made headlines after Square Inc. announced a $50 million investment into the digital asset. The mobile payment company purchased approximately 4,709 BTC through an over-the-counter platform.

This represents about 1% of its “assets as of the end of the second quarter of 2020.”

The announcement was received with much optimism from crypto enthusiasts who rushed to exchanges to get a piece of the pioneer cryptocurrency. The spike in buying pressure allowed prices to rise by nearly 4%.

Bitcoin went from trading at a low of $10,560 to a high of $10,960 within five hours after the news broke.

The upswing was significant enough to push BTC to its 50-day moving average, which is currently the only barrier preventing it from advancing further. If buy orders continue to pile up and this resistance level breaks, Bitcoin could rise towards new yearly highs.

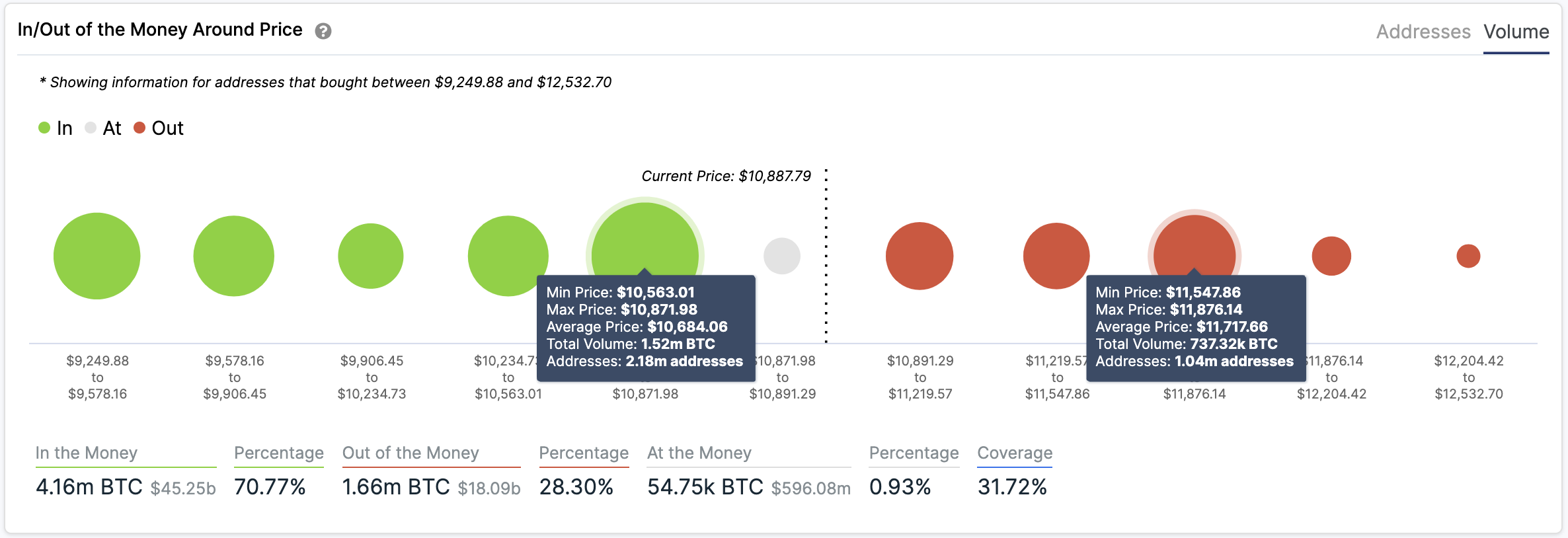

On its way up, the flagship cryptocurrency may find resistance around $11,700 based on IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model.

This on-chain metric reveals that roughly 1 million addresses had previously purchased nearly 740,000 BTC around this price level. Such a critical area of interest might absorb some of the buying pressure as holders within this range will likely exit their underwater positions.

It is worth noting that the same model also shows that Bitcoin sits on top of a massive supply wall, which adds credibility to the optimistic outlook.

Approximately 2.2 million addresses are holding more than 1.5 million BTC between $10,560 and $10,870. As long as this support barrier holds, the odds will favor the bulls.

Ethereum Whales Fill Their Bags

The 100-day moving average has been able to keep Ethereum from depreciating further after the so-called “September Effect” wreaked havoc on its market value.

Each time ETH has dropped to this support level since the beginning of September, it has been rejected, and a significant rebound followed. Now, it seems like history is repeating itself as prices are once again rebounding from this crucial trend-following index.

While the 50-day moving average appears to be the only barrier ahead of the smart contracts giant, IntoTheBlock’s IOMAP puts more emphasis on the $352-$361 range.

Here, more than 841,000 addresses bought nearly 4.4 million ETH. This vital area of interest could put a stop to ETH’s uptrend.

Nonetheless, Santiment’s holder distribution index has recorded a significant spike in the number of Ethereum whales on the network. The behavior analytics firm registered a 3.13% jump over the past three days in the number of addresses holding 100,000 to 1 million ETH.

If the buying spree by large investors continues, Ethereum might be able to slice through the $352-$361 hurdle and aim for new yearly highs since the IOMAP cohorts show no significant resistance ahead.

Given the unpredictability of the cryptocurrency market, investors must pay close attention to the 100-day moving average.

An increase in sell orders that turns this critical support level into resistance may ignite a sell-off. Under such circumstances, Ethereum would likely drop to the 200-day moving average that sits around $270.

XRP Is On the Cusp of a Major Price Movement

Ripple is doing everything in its power to expand the utility of its native altcoin, XRP. Following the backlash that the company faced after resuming the quarterly sale of its token, it vowed to become the Amazon of crypto.

To reach this goal, the company is allegedly working on building a new cryptocurrency exchange on top of the XRP Ledger.

The recent news generated buzz within the crypto community. Data from LunarCRUSH reveals that 70% of more than 10 million social interactions have been bullish about the cross-border remittances token. More importantly, prices have risen over 8% in the past four days as speculation mounts around Ripple’s new platform.

Despite the recent gains posted, XRP sits underneath a critical resistance barrier that may reject its upward price action.

This hurdle is represented by the upper boundary of a descending parallel channel forming since the beginning of August. Failing to break above might result in a steep correction towards the channel’s middle or lower boundary.

But if demand for the international settlement token rises around the current price levels, it may have the strength to break out of this consolidation pattern.

If this were to happen, XRP would likely climb to the next resistance area around $0.30.

The Crypto Market Moves Forward

October kicked off a new wave of fear, uncertainty, and doubt, shaking the broader crypto market.

First, the CFTC charged one of the largest crypto derivatives exchanges in the industry, BitMEX, for violating multiple regulations, including operating an unregulated trading platform. And then, President Donald Trump announced that he and the First Lady had tested positive for COVID-19.

Despite these concerns, Square’s recent announcement has brought hope back to investors.

According to Peter Brandt, more than six public companies are now said to be holding Bitcoin on their balance sheets, which is a positive long-term signal. The trading veteran argues that global corporations are moving some of their assets to crypto could be the catalyst that ignites the next bullish cycle.

Given the increasing buying pressure behind these Bitcoin, Ethereum, and XRP, it could be just a matter of time before resistance gives up, and a new uptrend begins.

Share this article