Bitcoin and Ultra High Net Worth Individuals

Bitcoin could create one-third of all UHNWIs in the world: if it hits $1 million

Share this article

If Bitcoin were to hit $1 million, anyone with at least 30 BTC would instantly become an ultra-high net worth individual (UHNWI). That would make BTC the single largest driver of UHNWIs.

Ultra-High Net Worth Individuals

A UHNWI is someone with at least $30 million in disposal assets, net of liabilities.

As of late last year, according to a Wealth-X report, there were 265,490 UHNWIs with a combined wealth of $32 trillion. That figure is expected to climb to just under 300,000 people by 2021.

If Bitcoin were to hit the magical million-dollar mark, anyone holding 30 BTC would become a UHNWI.

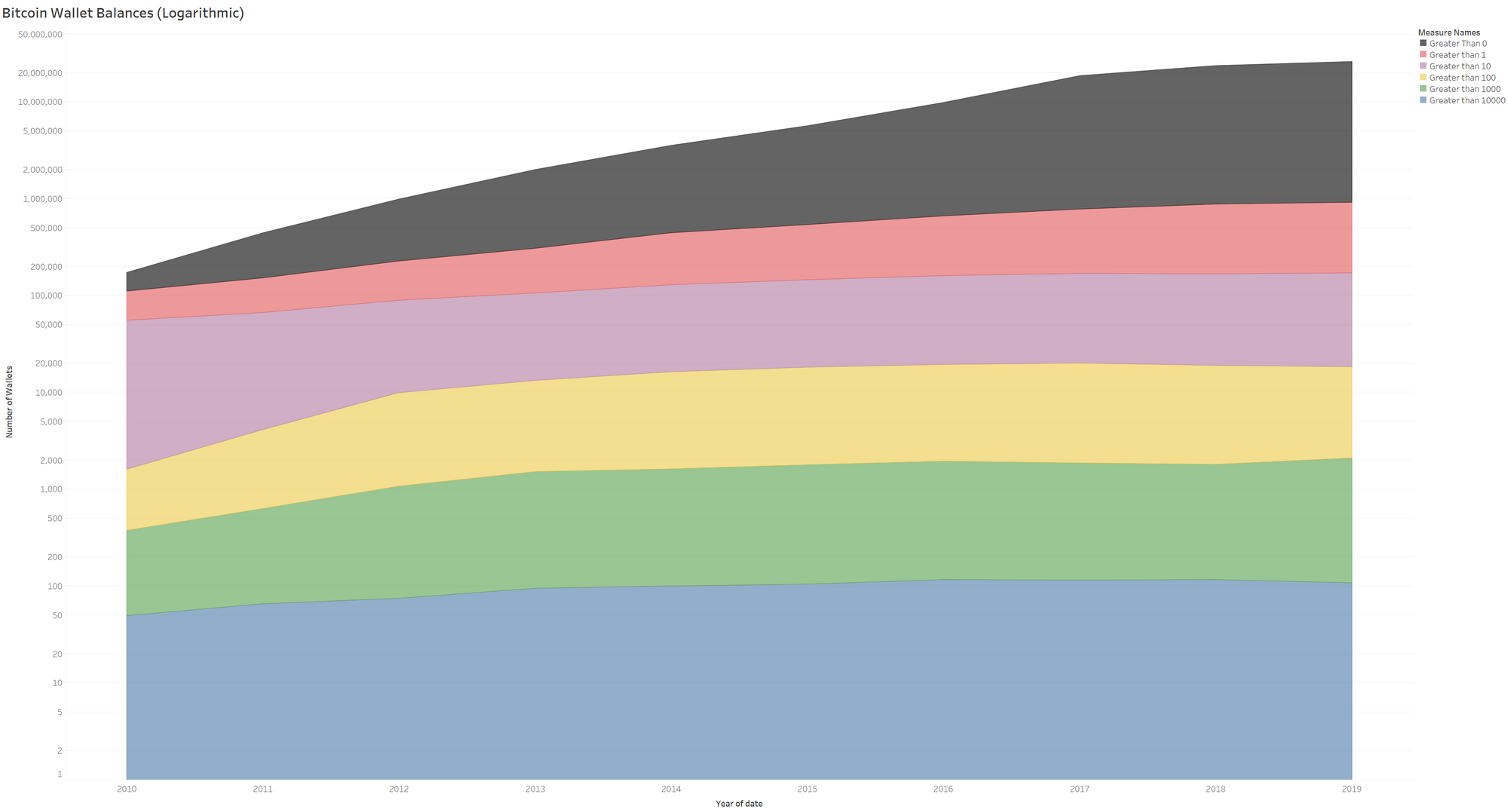

According to a recent analysis by Decentralised.co, as of Dec. 5, over 28 million addresses held more than 0 Bitcoin. 130 held more than 10,000 BTC. Crucially, there are over 152,000 Bitcoin wallets with more than 10 Bitcoin.

Of those, around 90,000 hold less than 100. Put otherwise, more than 10 but less than 100.

A Hypothesis about a $1 Million Bitcoin Price

As a thought experiment, assume that the average holdings of those who own between 10 and 100 Bitcoin are 30 BTC.

It then follows that if Bitcoin were to hit $1 million, the average holder among the 152,000 would become UHNWIs.

This is roughly in line with Tuur Demeester’s recent thought-starter, although he defines UHNWIs as those with at least $50 million in net assets.

If the Bitcoin price rises to over $1M, that would give ~100k bitcoiners "Ultra High Net Worth Individual" status (+$50M). With worldwide UHNWIs projected at only ~200k by 2022, this means the Bitcoin 1% could by then make up 30-50% of the world's financial elites. #Disruption pic.twitter.com/luM5ZYT24q

— Tuur Demeester (@TuurDemeester) June 19, 2018

Under the assumptions above, if Bitcoin hit the improbable $1 million next year, 152,000 newly minted UHNWIs would join the anticipated 300,000 mentioned above.

Critically, Bitcoin ultra-high net worth individuals would represent a third of the world’s uber-rich.

Traditional Paths to Becoming a UHNWI

Ultra-high net worth individuals have tended to coalesce around ten cities that, combined, are home to almost 20% of the world’s richest.

Hong Kong, New York, and Singapore, along with the countries of Luxembourg and Switzerland, have the greatest density of UHNWIs per person. Hong Kong easily tops that list with one UHNWI per 1,364 people.

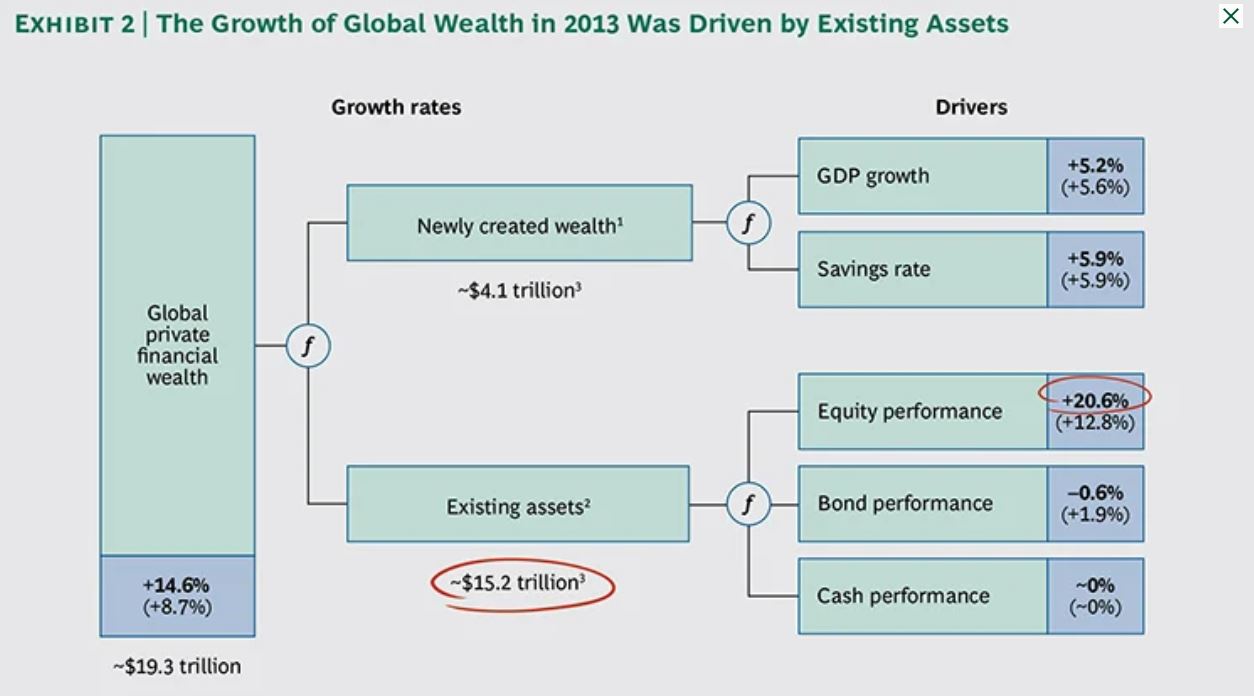

Boston Consulting Group found in 2013 that the primary driver of wealth was “returns on existing assets.” Existing assets contributed about $15 trillion to private wealth, with newly created assets contributing around one-quarter of that.

While a million-dollar Bitcoin price tag would result in a dramatic shift in the makeup of the ultra-high net worth club, Forbes’ 2019 rich list reported that five of the ten richest people in the world all made their fortunes in the technology industry.

They include the two wealthiest individuals in Jeff Bezos and Bill Gates. Larry Ellison, Mark Zuckerberg, and Larry Page fill out the top five in tech billionaires.

In fact, 18 of the richest hundred people in the world have technology backgrounds. Fashion and retail have an equal number of moguls in the top 100. In finance, that number is ten.

The energy sector contributes only six people to the world’s richest 100.

In other words, while new cryptocurrency wealth would have an outsized impact on the number of UHNWIs, technology has already revolutionized the way wealth is created.

Will Bitcoin Increase UHNWI Individuals by One-Third?

Bitcoin has created newly minted millionaires and billionaires, with many of them remaining anonymous.

According to BitInfoCharts, there are over 14,000 addresses with balances between 100 and 1,000 Bitcoin. A further 2,003 BTC addresses have between 1,000 and 10,000 Bitcoin, and 102 addresses hold between 10,000 to 100,000 BTC.

Three wallets hold amounts exceeding 100,000 BTC and under one million. It must be remembered that the largest Bitcoin wallets are commingled assets sitting at exchanges.

According to Glassnode Insights, entities that held 100,000 or more BTC were all exchanges: Coinbase (983,800 BTC), Huobi (369,100 BTC), Binance (240,700 BTC), Bitfinex (214,600 BTC), Bitstamp (165,400 BTC), Kraken (132,100 BTC), and Bittrex (118,100 BTC).

Those entities accounted for around 13% of Bitcoin’s circulating supply.

Whale addresses aside, the 152,000 addresses with balances anywhere between 10 and 100 BTC will create a subset of Bitcoin millionaires were Bitcoin to reach the $1 million mark. The impact would be felt as widely as cryptocurrencies are currently being used and held.

For that to happen, of course, Bitcoin would have to go on a parabolic price surge from now to the end of 2021. But parabolic price movements aren’t exactly unprecedented.

As an asset class, Bitcoin returned over nine million percent in returns from July 2010 to the end of the decade. The S&P 500 tripled and gold rose by 25% in the same period.

With cryptocurrency, history has proven that anything, from brutal bear market slides to upward surges, is possible.

And as the new decade dawns, from the gradual movement of institutional money into the space, Jack Dorsey’s endeavors to make Bitcoin spendable, and the looming supply shock of the third halving, the future is filled with endless possibilities.

Share this article