Decentralizing the Dollar: Crypto-Collateralized Stablecoins

Share this article

Decentralizing The Dollar is a three-part series on stablecoins, each addressing one of the three key methods postulated for tying a stable cryptocurrency to a fiat currency. In Part One, we examined how TrueUSD might rectify the flaws in Tether; in Part Two we looked at Kowala, and algorithmic stablecoins; and in Part Three we’ll look at crypto-collateralized coins.

Keeping track of the different stablecoins is a bit like learning the names and habitats of all the dinosaurs. There are tokens backed by dollars, euros, gold or silver, or even by pure code. There are also different stability systems for each major blockchain, and some have their own chains.

There are also stable coins whose value is collateralized by other digital assets. Volatile cryptocurrencies might seem like an odd anchor, but that hasn’t stopped several tokens from stabilizing their value with a combination of crypto-collateral and governance to limit their price movements.

Some, like BitShares USD and Maker’s DAI token, can be considered relatively successful at hedging against market volatility. Others, like NuBits, provide a cautionary tale.

Maker/ Dai: Volatility Fenced In

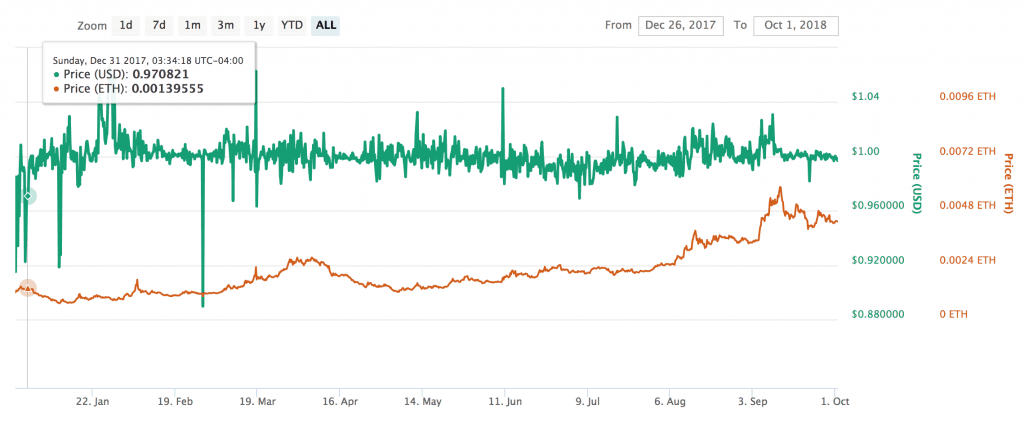

If you wanted an example of clever programmers innovating away the market’s problems, you couldn’t do much better than MakerDAO, a system of smart contracts which keeps the native DAI token stable. Using a combination of price feeds and clever code, MakerDAO has kept the value of the Dai token reasonably close to a dollar.

Each dollar-pegged DAI token represents a loan from a Collateralized Debt Position, a smart contract bank which stores ethers in exchange for Dai. Since each loan requires more collateral than the value of the tokens it issues, Dai hodlers are protected from all but the wildest swings of the crypto market.

It’s those wild swings that make things interesting. In order to insure that each DAI is backed by at least a dollar of ether, each CDP is coded to sell off its collateral before its balance reaches zero.

But how does a smart contract “know” the value of Ethereum? That’s the role of the MakerDAO, an oracle that maintains the price of Dai through the old-fashioned method of smart contract voting.

Maker voters can collect fees on Dai trades, but that right comes with a cost. Maker tokens “function as the buyer of last resort,” according to an explainer on Maker’s website. “Should the collateral in the system not be enough to cover the amount of Dai in existence, MKR is created and sold onto the open market in order to raise the additional collateral.”

Although it’s not the most intuitive or popular stablecoin, Dai has kept its peg fairly well and is still making progress. MakerDAO has recently announced a partnership that to allow Dai payments on the Ink Protocol, a decentralized payment platform on the Ethereum blockchain. “To achieve mainstream adoption as a method of payment, a cryptocurrency needs to be an effective medium of exchange and store of value,” said Gee-Hwan Chuang, co-founder and chief executive officer of Ink Protocol. “Dai addresses both of these needs flawlessly.”

If Dai works, where’s the adoption?

That’s an important question, especially as new and more complex stable coins prepare to enter the market. If algorithmically-decentralized stable coins like Basis and Kowala are to make any headway in the crypto market, they’ll have to figure out why Dai isn’t getting traction.

Even though the shortcomings of Tether and other centralized tokens are well-known, that may still beat the uncertainty of relying on algorithms for value. “If you’re a business you’re not going to be issuing payments to another business in an algorithmic stablecoin,” explains TrustToken’s Tory Reiss. “It doesn’t make sense, its too much risk. No CFO would want that on their balance sheet. You do want to do it in USD.”

Mr. Reiss, whose employers issue the TrueUSD stablecoin, is not an impartial observer, but he raises a salient point. Even if a smart-contract algorithm makes sense “when you think about it,” the fact that it requires thought at all adds an unwelcome element of uncertainty to supposedly stable tokens.

“An essential part of the ecosystem”

One frequently hears stable coins described as essential parts of the “cryptocurrency ecosystem,” as if they were pollinating bees or moths instead of lines of code.

When developers describe software in terms of “ecosystems” they are tacitly acknowledging that crypto-markets share some of the complexity of biological systems. And, as any kid who’s seen Jurassic Park can tell you, living systems (and markets) have inherent instabilities.

Centralized stablecoins, like Tether, may not tick all of the boxes of a cypherpunk manifesto, but as long as they have enough actual dollars they should be immune to the doubts that used to drive banks insolvent.

Algorithm-backed tokens may be more aesthetically pleasing, and they foreclose the need to abide by fiat currency regulations. But, to the extent that they rely on intersubjective perceptions to maintain their stability peg, they also leave the door open for self-fulfilling attacks.

The author has investments in several digital tokens.

Share this article