Decentralizing The Dollar: True USD Distributed Asset Token

Share this article

Stablecoins: what are they, why do we need them, how do they work? In this three-part series Andrew Ancheta casts an eye over three different economic models for stablecoins. Part one deals with the decentralized version of the current market leader, and examines how TrueUSD (TUSD) attempts to hurdle one of the highest barriers to adoption for cryptocurrency.

If you’re a regular reader, you’ve probably spent some time chewing your nails about Tether, the Schrödinger’s stablecoin holding up the crypto market like a crooked Jenga piece. More than a year after alarms started ringing, there still isn’t any sign of a collapse, but that hasn’t stopped anyone from holding their breath.

If you’re a new reader, here’s a recap: Tether.to, the ‘Central Bank of Cryptocurrency’, issues a token that’s backed by dollars “in” a bank. Except that you can’t redeem tethers for dollars, and there has never been an audit. A one-off “report” on the company’s finances has not stopped rumors about the solvency of Noble Bank, where Tether keeps some of its accounts.

Withdrawals are temporarily suspended….for the last year or so. Since then, there have been several new tries at fixing the Tether model. Circle has one, which will be used on Poloniex. The Winklevoss twins have their dollar coin for the Gemini exchange, with monthly inspections by third-party accountants. And the Paxos recently introduced to the OTC ItBit exchange. Some are even backed by gold or other metals.

But none of these really offers a variation from the centralized model—you still have to trust a third someone, whether Circle or Gemini. And, while the safeguards make it easier to sleep with your money in stablecoins, there’s nothing really stopping those companies from playing Federal Reserve with the token printer. At best, they’ve just provided a better Tether.

Decentralizing Fiat

This underlines the central problem of stablecoins: it’s easy to have a distributed virtual currency, but it’s not so simple to attach those currencies to tangible, fixed commodities.

If you want a stablecoin to follow the crypto values of decentralization and trustlessness, you’re going to need a bit more than a bank account.

There’s one approach that’s not truly Trustless, but it requires a lot less Trust: TrustToken, which designed the TrueUSD: a dollar-backed stablecoin that does not rely on the probity of any single actor or party.

An Asset-backed Token Without Trust….Almost

“We don’t want any single points of failure,” says Tory Reiss, TrustToken’s Head of Corporate Development.

Instead of relying on a single bank or company, the dollars behind TrueUSD are stored in separate escrow funds outside of the company’s control. Like other stablecoins, the tokens are backed by dollars in the bank; but unlike any of the others, no single party has control over the balance sheet.

“Every single dollar that’s held in our fiduciary partners’ accounts today is under a signed contract that says it’s held for the beneficial ownership of the tokenholders,” Reiss told Crypto Briefing in an exclusive interview.

“Legally, we as a company could not withdraw those funds, we can’t access it, we can’t print TrueUSD, the companies that are our trust partners will prevent us from doing that.“

As a result, the TrueUSD removes some of the counterparty risks associated with Tether and other Stablecoins. If one bank can’t or won’t live up to their obligations, you can redeem TrueUSD from a different one; if you don’t like one escrow partner, you can get TUSD from a different one.

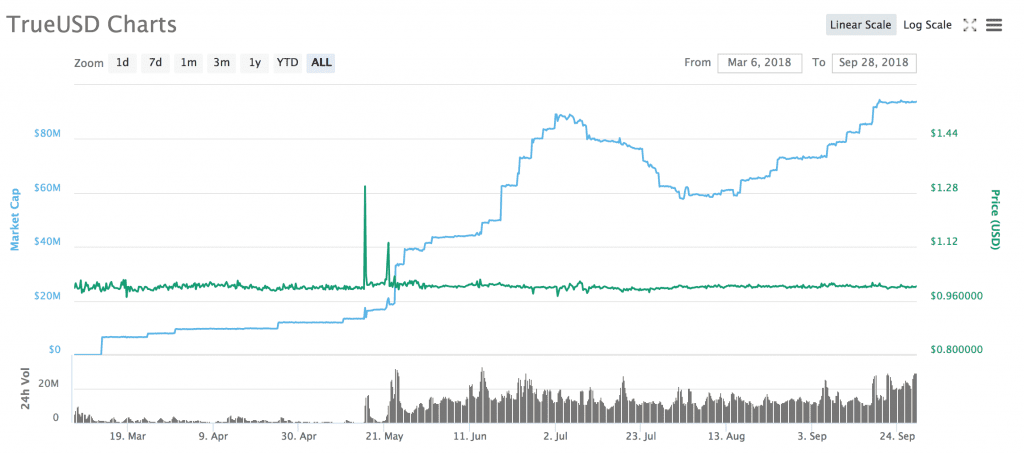

Although the market capitalization is pushing $120 million, the “distributed network” is still limited to two banks and two trust partners.

That makes TrueUSD a bit more resilient than the average Tether or Gemini Dollar, Reiss explains, and the company has plans to distribute their network further. “We’re also on boarding with European banks, Asian banks, and additional North American banks and trust companies,” he says. Even if the government cracked down on Crypto, the dollars in escrow would still belong to the token hodlers.

The Trouble With Stablecoins

There’s not a lot of profit in stablecoins, and companies don’t launch tokens for free. That’s why stable coins like Tether are usually issued by exchanges— everyone wants to control fiat’s gateway to crypto.

This ends up being counterproductive: instead of one universal dollar, we end up bartering between incompatible, dollar-pegged crypto-pesos.

TrueUSD, on the other hand, is exchange-agnostic, a property to which Reiss attributes its relative success. “We are not associated or controlled by any one exchange, and that reduces the possibility of manipulation,” Reiss says, a fact which has allowed entry to 17 exchanges so far.

And, unlike certain other dollar-backed stablecoins we can name, the occasional drops in TrueUSD’s market cap show that people are actively cashing out.

TrustToken does not expect TUSD to moon; rather, the token is part of the company’s long-term strategy which will eventually see tokenized equity, real estate and other assets:

These tokenized currencies are critical for our tokenized securities strategy. You need a way to receive dividends in your crypto wallet and we can now use TrueUSD to issue those dividends in a stable currency. Many other companies are having to issue dividends in Ethereum.

Almost Resistant

The result of those carefully-balanced incentives is something almost, but not quite, censorship-resistant. While there are still counterparty risks, it would take the collaboration of several different parties to break the system.

TrustToken is a registered money service provider, and like any other token sale has KYC and AML requirements for those who try to trade fiat for TUSD. It can also freeze tokens, a property shared with the Gemini Dollar and many other ERC-20 tokens. “If the authorities came to us and say we know that this address is a known bad actor,” Reiss explains, “We can actually freeze their funds and see a history of all their transactions in one place and we can provide that to the appropriate authorities.”

That’s not likely to satisfy crypto-purists, but there’s no getting around those legal and banking regulations. And, as Mr. Reiss makes clear, you need to follow those laws if you want your stablecoin to be backed by real dollars.

Part 2: A dollar-backed stablecoin with no dollars behind it.

The author is invested in digital assets, but not in TUSD.

Share this article