Decentralizing The Dollar: A Dollar Without a Dollar

Share this article

Stablecoins are in the news today as Tether goes under the microscope once more. In this three-part series Andrew Ancheta casts an eye over three different economic models for stablecoins. Part one dealt with TrueUSD, and in part two of the series he looks at a new algorithmic coin: Kowala and its kUSD.

Once upon a time, I wrote for a website that paid in cryptocurrency. The writing was fun, but the biggest adventure was timing my invoices: every few weeks I’d wait till the market looked like it was in a trough, so I could cash in the maximum amount of ethers for my work.

This is a reality for hundreds of freelancers and crypto-professionals: those of us who take our paychecks in crypto can look forward to lambos or soup-kitchens, but not much in between. Volatility is a huge risk for employers, a bigger risk for employees, and a huge headache for all involved.

We’ve already written a lot about stablecoins, the cryptocurrencies with all the benefits of internet money and the stability of the dollar. Some, like TrueUSD, are designed to distribute the trust and weak points among several actors, but there’s no escaping centralization: those dollars have to be somewhere.

But there’s also a different kind of stablecoin: a kind of token that maintains price stability by math and code, with no actual dollars involved. Unlike explicitly dollar-backed tokens, these cryptocurrencies are not limited by restrictions on money transmission, and they don’t depend on bank accounts.

A Market-Driven Peg?

Among the newest prospects is Kowala’s kUSD, a cryptocurrency pegged to the dollar by a combination of market forces and a smart contract-regulated supply. At least, that’s how it’s supposed to work, according to CEO Eiland Glover.

Instead of an ERC-20 token, Kowala has it’s own separate blockchain: a proof-of-stake Ethereum fork capable of 7,000 transactions per one-second block. Like other POS chains, nodes must put down a deposit of mUSD tokens to participate in the network, which is incentivized by a block reward as well as transaction fees.

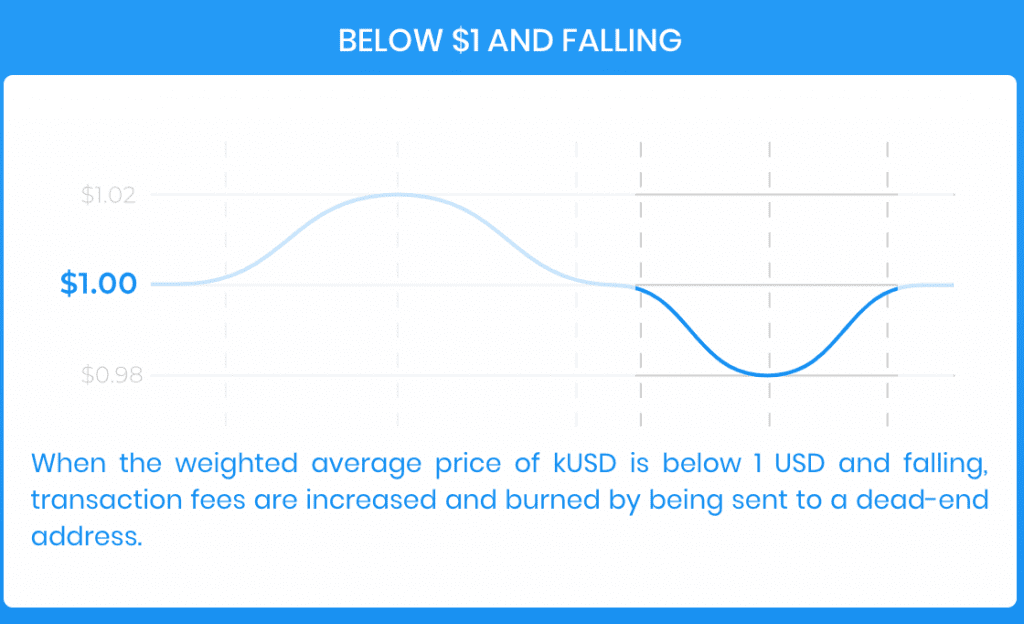

But unlike other blockchains, the block reward is paid out in stablecoins. Kowala “miners” (stakers, actually) are rewarded in kUSD at a variable rate, which is determined by kUSD’s trading volume and exchange rate. When kUSD trades for over a dollar, the blockchain prints money; when kUSD is worth less than a dollar, it burns transaction fees of up to two percent.

The peg also relies on arbitrage to keep prices close to a dollar, Glover says:

It’s not just the miners who have an interest but also other traders in the marketplace who want to take advantage of those slight fluctuations around one US dollar to make money. When they pursue their self interest by trying to make a point or two over the course of a day, they provide stability.

Then there’s the question of calculating the exchange rate, which depends on a network of human-informed oracles. This is calculated by a set of high-stake supernodes, similar to a Masternode network. “They run software on their node that takes market data from different exchanges and they calculate a weighted average of the price and then it delivers that information to the network,” Glover says. “These super nodes can alter that anyway they want but they don’t get their bonus, which is four percent of the block rewards, if they fall outside of an acceptable range.”

Finding Network Effect

There are other difficulties which are incumbent on anyone trying to launch a new blockchain. Unlike the plug-and-play simplicity of launching an ERC-20 or Stellar token, Kowala’s builders needs to program new wallets, exchange functionality and smart contracts—before they can even begin thinking about adoption.

But these are problems which the Kowala team has anticipated. Although they’re still developing a wallet, that project is less urgent now that Kowala has Ledger support—a big deal, considering that Ledger doesn’t even support Tether.

Exchanges are also coming on board, and ExRates and RightBTC have promised to support kUSD from launch. Mr. Glover has also hinted at large partnerships with mobile payment systems in Mexico and abroad, which would allow easy access to kUSD by up to 40 million people.

Learning to Fly

It’s one thing to design a new airfoil, and another thing to test-fly it with a full crew and passengers. Kowala’s team has tested their system in mathematical models and testnets, but it remains to be seen how it will react to real market forces.

You’d be excused for scratching your head, as the system involves quite a few what-ifs. What if Bitmain corners the mining tokens, or if none of the miners sell their block rewards? What if (as today with Tether and TrueUSD) exchange values deviate far from the peg?

Mr. Glover repeatedly uses the word hypothesis to describe the Kowala stability mechanism, and one gets the sense that Kowala is an lab experiment as well as a business proposition. “We hypothesize that those miners are going to act in their medium- and long-term self interest and make those coins available for sale,” Glover says. “The next thing we have to do is prove these hypotheses and find stability, and as it does I think we will gain greater credence.“

There are many other ways the system can go wrong, but you’d be hard-pressed to find one that Kowala hasn’t thought of first. “You have to assume that people are gong to pursue ethical or unethical means to line their pockets,” Glover explains, on the possibility of hacks or trade manipulation. “You have to build into the token economics disincentives for that sort of behavior.”

While there are still plenty of ways for the experiment to go wrong, the Kowala team is confident that they’ve identified all the obvious points of failure. “No one here’s come up with a compelling way that they can attack the systems for their own benefit.” That probably won’t stop the Kowala team from crossing their fingers, though.

And, as exotic as it may seem to have a cryptocurrency that’s self-pegged to the dollar, kUSD already has plenty of competition.

Even if, after today, Tether might not be such a serious part of the equation…

The author has investments in Ethereum and other digital assets.

Share this article