Do High Bitcoin Fees Drive Prices Higher?

Does Bitcoin really want "mass adoption"?

Share this article

Although mass adoption has long been regarded as an important component of Bitcoin demand, its relatively high fees and more periodic usage may actually drive prices up, according to economic theory.

2020 Bitcoin Prices Soaring

2020 has seen the best start to the year for Bitcoin prices in 7 years. At press time, BTC is trading at around $10,300 according to CoinMarketCap, up from $7,200 on New Year’s Day.

The price performance of both Bitcoin itself and the wider crypto market has been attributed to a number of factors. Some point to expectations of price pressure after the May block reward halving. Others cite strong and growing institutional demand. Esteemed analyst Mati Greenspan recently suggested expansionary monetary policy worldwide has contributed to creating a bubble in the market.

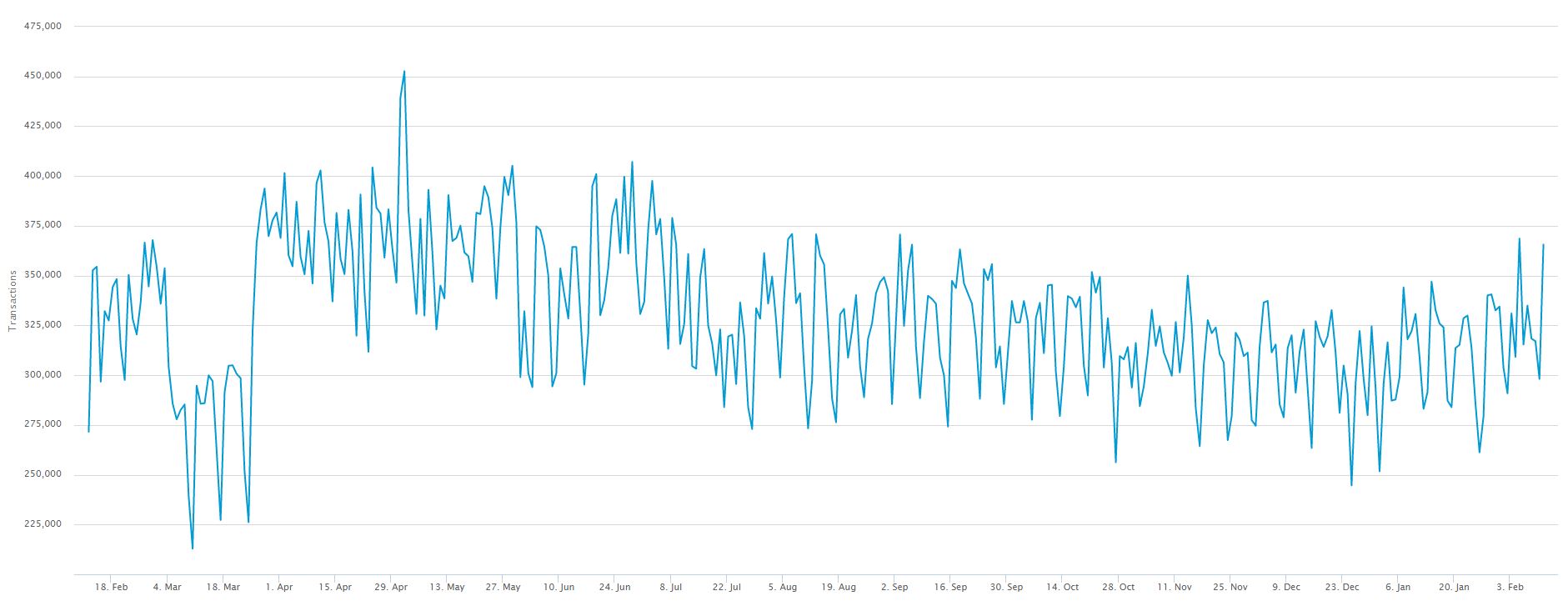

Certainly, mainstream adoption has not been a factor in Bitcoin’s price activity. To the extent the adoption of Bitcoin can be measured by transaction numbers between New Year’s and today, Blockchain.com data confirms that 2020 has not seen any significant uptick.

Fisher’s Equation of Exchange

In 1911, Yale University economist Irving Fisher posited that:

“Other things remaining unchanged, as the quantity of money in circulation increases, the price level also increases in direct proportion and the value of money decreases and vice versa”.

His assertion was neatly captured in the equation MV = PT, where M is nominal money supply, V is the velocity of money, P is the price level of goods and services, and T is the amount of goods and services.

Fisher’s equation has supply as the amount of money in circulation multiplied by how often it changes hands, and demand as the market value of goods and services that money is transacted for.

Applying this to token economics, Joseph C Wang formed a valuation model for Bitcoin that has been widely applied in token design. Using Fisher’s equation as the foundation, Wang’s equation is expressed as MV = PQ.

To account for the particular characteristics of Bitcoin, all values are defined in fiat terms, with Q representing the index of real expenditures (value transferred across the network).

P is always 1, given the application of a fiat valuation to all quantities. M is the amount of Bitcoin in circulation multiplied by its price: BTC market cap.

The implications are clear and mimic those of Fisher: higher velocity of money leads to lower values. In crypto terms, the more often a token changes hands, the lower its price in fiat terms. Specifically, Wang found that:

“… the value of bitcoin is determined largely by the willingness of Bitcoin holders to save Bitcoin and not by its transactional use. This model therefore predicts that increased use of Bitcoin will not cause its value to rise, but that the value of Bitcoin in terms of fiat currency will be almost solely determined by the willingness of Bitcoin holders to pull Bitcoin out of circulation.”

Velocity of Money Theory Puts a Dent in Ripple’s Argument

Ripple CEO Brad Garlinghouse told a panel audience at the World Economic Forum in Davos in 2019 that “the long term value of any digital asset will be derived from the utility that it delivers.”

His statement was a parting shot at Bitcoin and the implicit promotion of XRP, a cryptocurrency that is more scalable and faster and cheaper to transact with. Bitcoin advocates might suggest that Bitcoin utility will rise over time as developments are gradually implemented.

Square’s recent patent for second layer payment technology and Dorsey’s well-established belief in Bitcoin as money for the Internet could represent a significant step in that direction.

But Does Velocity Actually Destroy Crypto Value?

The velocity of money argument put forward in cryptocurrency circles has been strongly criticized. As Coin Metrics’ most recent State of the Network piece identified, the model has been accused of incorrectly treating V as exogenous to the model.

Other criticisms question the validity of applying fiat values to P and Q. If a theory about money is applicable to a cryptocurrency, contorting one side of the equation to value it in another form of money is fraught with danger.

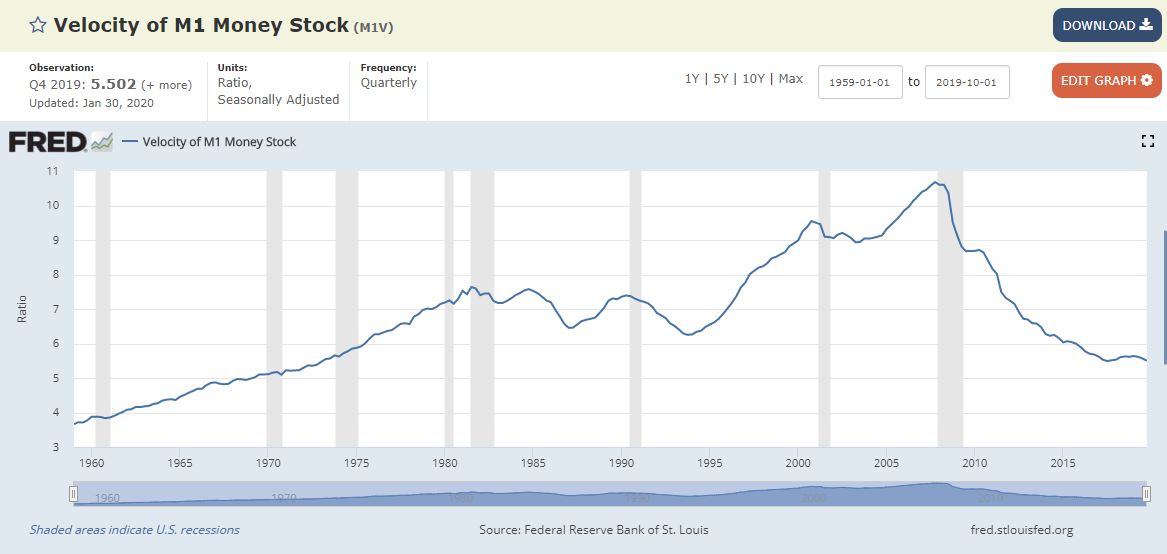

In the original thesis proposed by Fisher, V was assumed to be relatively constant. The number of times a unit of currency is used in a given period of time has historically tended to be steady. As the following graph shows, while money velocity in the U.S. spiked upward leading into the GFC, it has proven fairly constant for a number of decades.

Caution would be warranted when attempting to predict changes to crypto valuations in light of changes to its velocity. Virtual currencies remain too nascent to obey valuation laws derived from a formula developed in an environment when certain variables were assumed to be fixed (and proven to have been historically steady). The repurposing of the quantity theory of money for Bitcoin is risky.

However, the velocity of money theory has been widely applied in the sector. If an increase in Bitcoin velocity poses a threat to its price, those seeking the mainstream adoption of the original crypto might be well advised to be careful what they wish for.